Make convenience retail convenient for your investment portfolio - BMT

Contact

Make convenience retail convenient for your investment portfolio - BMT

With $493 million worth of transactions in 2020, service stations have proven to be a lucrative industry according to BMT Tax Depreciation.

Everyone is busy, and a hustling lifestyle requires easy access to everyday essentials. This is where convenience retail comes in. This sector is currently booming, with recent reports announcing that the Australian convenience industry is worth $8.4 billion.

The convenience retail sector encompasses service stations, fast food outlets, grocery shops and on-the-go food stores. These outlets collectively offer busy consumers everything they need – accessibility, efficiency and proximity.

The profitability and demand of the convenience retail sub-sector is luring commercial investors. Recent deals in the sector include a $3.7 million sale of a fast food outlet in regional NSW and a $10 million sale of a Lithgow service station, just to name a few.

Investing in property within the industry

Strong demand for convenience means investors often have the choice of offering lengthy leases that provide stable cash flow. This, along with potential capital growth, means the convenience sector could be the next sound move for a commercial investor.

Convenience retail is a large and diverse sector. To better understand the intricacies, pure size and tax deductions available from this investment option, let’s deep dive into one of the biggest players, service stations.

Under the microscope: Service station investments

With $493 million worth of transactions in 2020, service stations have proven to be a lucrative industry.

There are now more than 6,000 service stations across Australia, and approximately 789 vehicles per 1,000 people. These numbers suggest demand for service stations won’t be going away anytime soon, providing longevity to investor portfolios.

For service station owners, there is the added benefit of claiming depreciation. Depreciation is the natural wear and tear of property and assets. It’s an advantageous tax deduction exclusively available to income-producing property owners and can be claimed under two categories:

- Capital works deductions are claimed on the property’s structure and fixed assets. For a service station, this could include the driveway/carparks, walls, doors, windows and the underground fuel storage tanks.

- Plant and equipment depreciation can be claimed on the property’s easily removable and mechanical assets. What a service station owner can claim depends on what they own (versus what the business tenant owns). Some common examples include hot water systems, air-conditioning units and floor coverings.

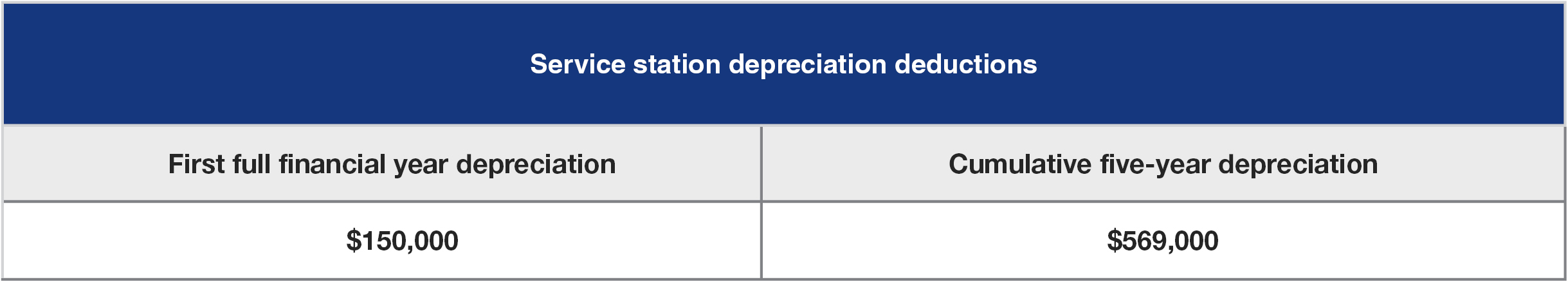

The following table demonstrates just how much depreciation a commercial investor can claim from an average-sized service station investment.

In the first five years of ownership, the commercial investor has the potential to claim $569,000 in depreciation deductions on the property’s structure and the assets they own.

Depreciation can be claimed across all commercial industries – from convenience, hospitality, to construction and manufacturing. But the key step for any commercial owner or tenant is to have a tax depreciation schedule prepared by a specialist quantity surveyor, such as BMT Tax Depreciation.

BMT has been specialising in the tax depreciation industry for over twenty years. Over this time, they have become the industry’s leader and prepared more than 700,000 tax depreciation schedules Australia-wide.

The team ensures commercial and residential investors alike claim maximum depreciation deductions through specialised schedules.

To learn more about BMT and the comprehensive commercial services they offer, contact them on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

This is a sponsored feature article.

Similar to this:

Depreciation for commercial mixed-use developments - BMT