Strong pricing for industrial assets, and balance sheet management, drives upsurge in corporate asset sales - Knight Frank

Contact

Strong pricing for industrial assets, and balance sheet management, drives upsurge in corporate asset sales - Knight Frank

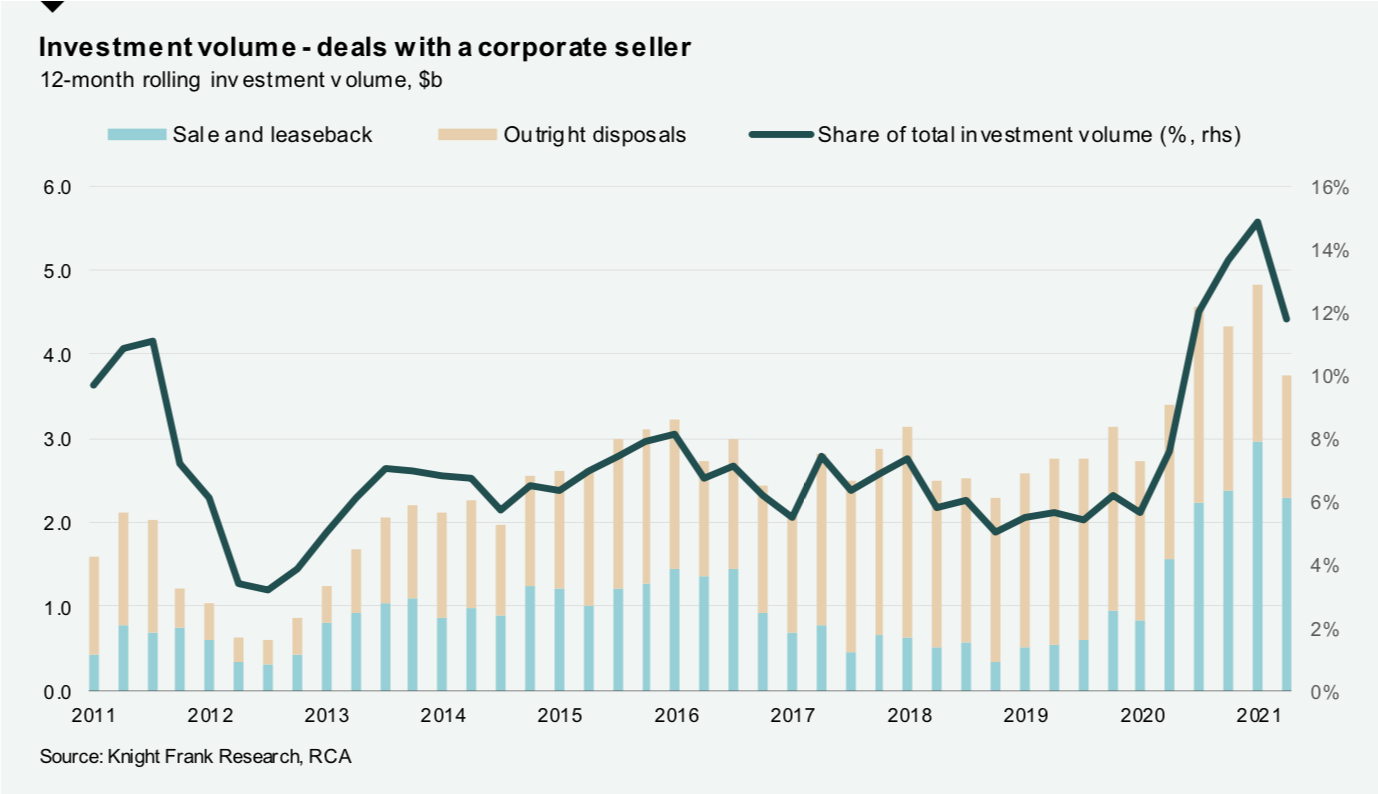

Over the past year, deals involving a corporate seller have increased signifcantly in the share of total commercial investment volume in Australia. The increase has predominately been driven by ‘sale and leaseback’ deals as corporates look to rebalance and repair their balance sheets in the wake of the pandemic, and take advantage of historically low yields.

While most commercial buildings are owned by private and institutional real estate investors, many businesses also have longstanding property holdings that have been acquired and often developed for their operations. However, over the past year many corporates have been inclined to sell down their real estate holdings. As a result, the quantum of investment deals involving a corporate seller has increased markedly since the onset of the pandemic, which is striking given that overall market turnover has been well down.

Over the year to June 2021, there have been $3.7 billion of corporate asset sales accounting for 11.8% of total investment volume, compared to 5.7% over the 12 months to March 2020 prior to the pandemic. The increase has been largely driven by ‘sale and leaseack’ deals rather than outright disposals, which implies that businesses are not selling their property holdings because they are no longer required, but rather to free up capital for other uses. ‘Sale and leaseback’ deals accounted for 61% of deals with corporate seller over the year to June 2021, up from 46% a year ealier, and the highest level since Q1 2013.

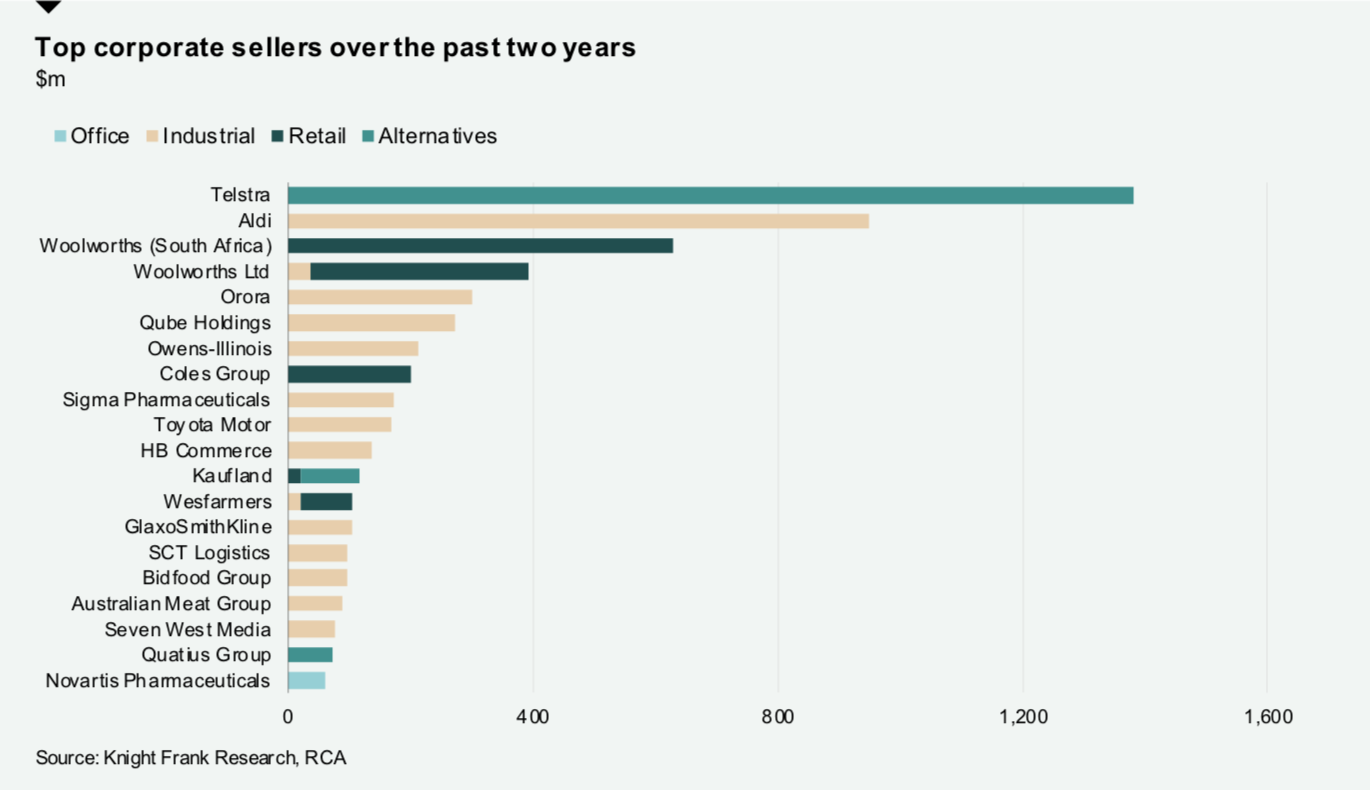

By sector, industrial, retail, and alternatives (data centres) assets have accounted for a large share of deals involving a corporate seller , underpinned by a number of large deals including:

- Telstra’s ‘sale and leaseback’ of its data centre in Clayton in Melbourne to Centuria Industrial REIT for $416.7 million in August 2020, and the disposal of the Pitt Street Exchange in Sydney to Charter Hall Long WALE REIT for $281.5 million.

- Aldi’s disposal of four disbtribution centres to Charter Hall and Allianz Real Estate for $648 million in June 2020, and a further two distribution centres to the same buyers for $281.5 million in December 2020.

- The sale of the David Jones store on Elizabeth Street in the Sydney CBD by Woolworths (South Africa) to Charter Hall for $510 million in December 2020.

Qube Holdings’ pending disposal of the Moorebank Logisitics Park in Sydney to Logos for $1.65 billion will further boost investment volume upon settlement.

Rise in corporate sales driven by balance sheet mangement and low yields

There are two principal drivers for the rise in companies selling property holdings (especially through ‘sale and leaseback’ deals) over the past year.

Firstly, it reflects the desire to support corporate balance sheets and rebalance asset holdings amidst the pandemic.

For some companies, trading conditions over the past year have presented a serious challenge to cash flow and this has motivated the desire to shore up balance sheets via asset sales.

For other companies, there was no material threat to cash flow but asset sales have been pursued to free up capital to deploy opportunisitcally as they reassess their business models and reconfigure their operations in the wake of pandemic-related disruption.

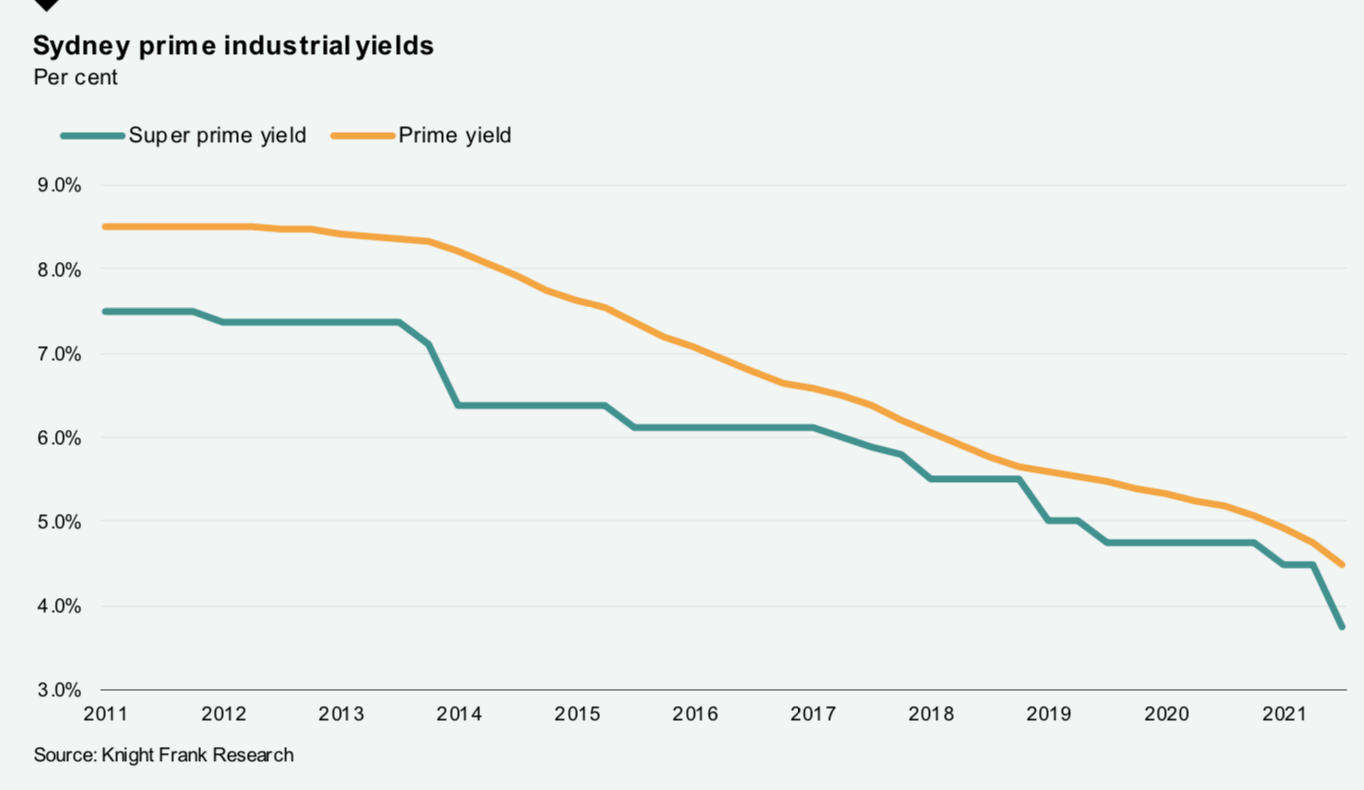

Secondly, companies have also sought to take advantage of historically low yields on many commercial property assets which have resulted in rising values and hence the scope to realise substantial capital gains on long-standing property holdings.

With the notable exception of ther retail sector, property yields have generally continued to drift lower over the past few years consistent with the shift downward in interest rates since mid-2019. Yield compression has been particularly pronounced in the industrial sector, with demand for logistics assets boosted by the acceleration of growth in e-commerce and the trend towards online shopping. The growth of the sector has spurred the development of larger and more sophisticated buildings with long leased income streams and yields for these types of assets are now now moving below 4.0% in Sydney and Melbourne.

Companies have taken advantage of this environment to sell (and often lease back) assets, with the industrial and logistics sector accounting for 48% of deals with a corporate seller over the year to June 2021.

Looking ahead, the economic recovery currently underway, which to date has been stronger than anticipated, should continue to ease the pressure on corporate balance sheets . At one level this will reduce the impetus for companies to monetise their property assets. Indeed, the share of deals with a corporate seller has moderated a little from its recent peak of 14.9% of total investment volume recorded over the year to March 2021, although it remains high by historical standards.

However, the prolonged low interest rate environment in Australia and globally, and the likelihood that this will continue indefinitely, will ensure yields remain low.Related to this, intense competition for property assets, including from major global investors with a low cost of capital and commensurately low target returns, will continue to drive strong pricing, particularly for industrial and logistics assets and alternative assets such as data centres, and this will continue to motivate corporate property holders to take advantage through asset sales.

Similar tho this:

Two agents join Knight Frank Perth to meet growing activity

Demand high for strong core office assets in Adelaide CBD despite COVID-19 - Knight Frank report