A healthy boost to cash flow for office owners and tenants - BMT

Contact

A healthy boost to cash flow for office owners and tenants - BMT

The office sector has proven surprisingly resilient over the course of the COVID-19 pandemic. In early 2020, the sector saw widespread changes to the physical locations in which people were working, with most office staff shifting to working from home arrangements.

The office sector has proven surprisingly resilient over the course of the COVID-19 pandemic. In early 2020, the sector saw widespread changes to the physical locations in which people were working, with most office staff shifting to working from home arrangements.

With the expectation that a large share of employees would continue to make use of these arrangements, many were left wondering how COVID-19 would change demand for office space in the longer term.

As we enter the third year of the pandemic, working from home arrangements are still in place for many organisations. It is logical to think that demand for office space would decline and remain at levels lower than pre-pandemic. And while there certainly was an initial sharp fall, it is interesting to observe that demand is rebounding, with many businesses and governments choosing to hold onto their office space and in some cases, lease even more.

According to the Property Council of Australia, at the end of December 2021 Sydney’s CBD towers were 23% occupied, but 91% leased and Melbourne’s CBD towers were only 12% occupied in December, but 88% leased.

In December Ken Morrison, Chief Executive of Property Council of Australia, said “While aggregate vacancy levels have risen slightly from 11.9 per cent to 12.1 per cent, the driver of this has been new supply of office space, not a drop in demand. The reality is that most CBD businesses continue to see the office as integral to their future, and that is reflected in the increased demand for office space over the past six months.”

The fact is that most organisations don’t know how post-covid life will play out. Clearly, social distancing will have an impact on office layouts. But many organisations seem to be increasing their office footprint to meet growth in staff numbers and accommodate for larger collaborative workspaces.

It appears that most large firms are planning to adopt a hybrid model of work, where employees have the option of working remotely for part of each week, where the amount of office space required will depend on ‘peak’ usage, rather than average usage across the week.

So, while the long-term demand for office space is unknown, one thing that can be relied upon is the lucrative depreciation deductions available on office buildings and fit outs.

Depreciation case study: CBD office

‘Business A’ is classed as a medium-sized business entity. They have office space occupying a partial floor of a Sydney office tower. The space was originally fitted out and occupied in 2018 (prior to the COVID-19 pandemic) and is now going to be expanded to accommodate larger collaborative workspaces, social distancing and future growth in head count.

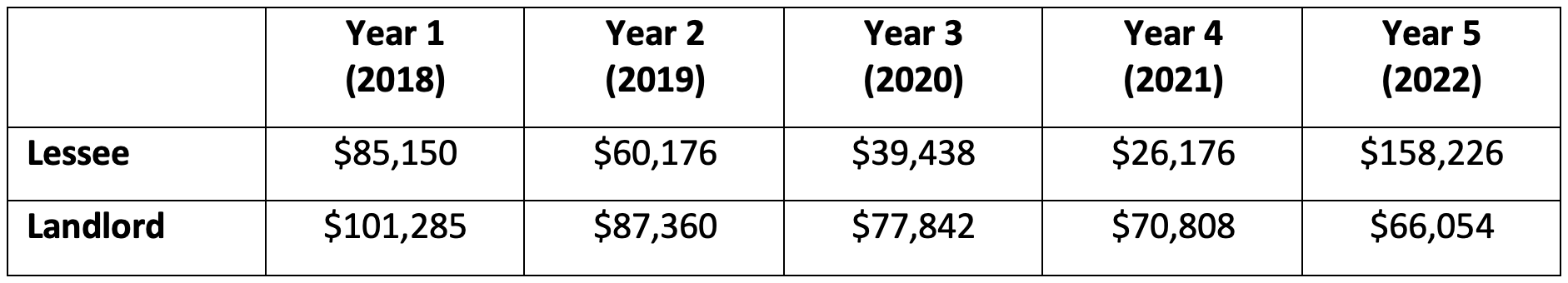

The following table demonstrates the depreciation deductions available for the owner of the property (landlord) and the business operating from it (the lessee).

These deductions provide a healthy boost to cash flow for both Business A (the lessee) and the landlord. Note the large boost in deductions for Business A in year five, which takes into account the instant asset write-off for some of the new fit out.

Tax depreciation schedules are key to claiming the maximum depreciation deductions. A BMT Tax Depreciation Schedule applies all industry-specific legislation to ensure commercial depreciation deductions are claimed to their full potential and compliantly.

BMT also applies current business incentives including the backing business investment and temporary full expensing depending on the business size, to ensure every cent is claimed.

BMT Tax Depreciation has optimised its commercial process to ensure both owners and tenants claim the most deductions possible. To learn more about commercial depreciation of offices, call BMT today on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

Similar to this:

How can scrapping affect your business? - BMT

Commercial owners and tenants can maximise cash in time for their spring clean - BMT

Why it’s not too late for commercial investors and businesses to claim thousands - BMT