WA’s Time to Shine Report - Colliers

Contact

WA’s Time to Shine Report - Colliers

Colliers has released its latest research industry report covering the strength of the WA economy and highlighting the top 10 reasons to invest in WA.

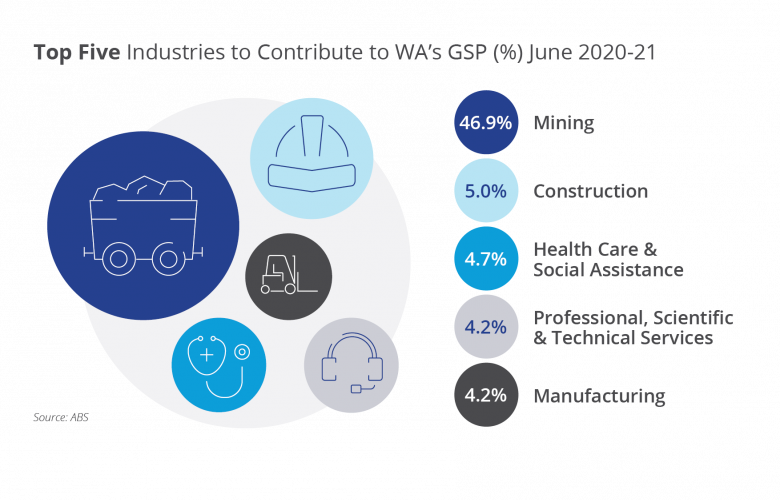

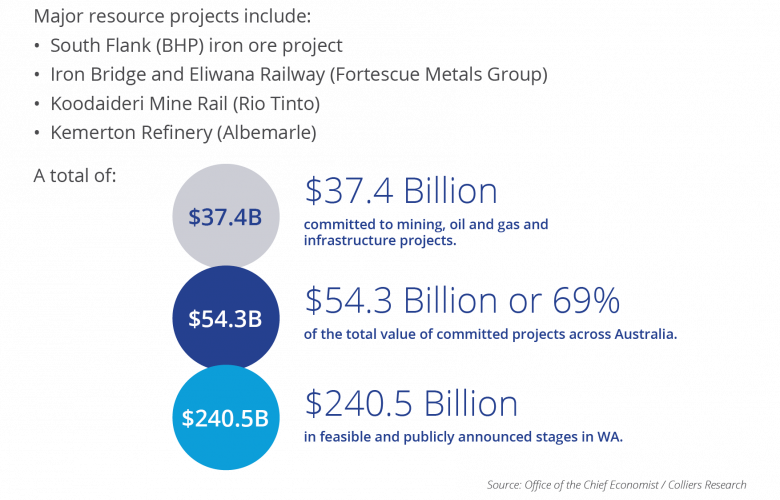

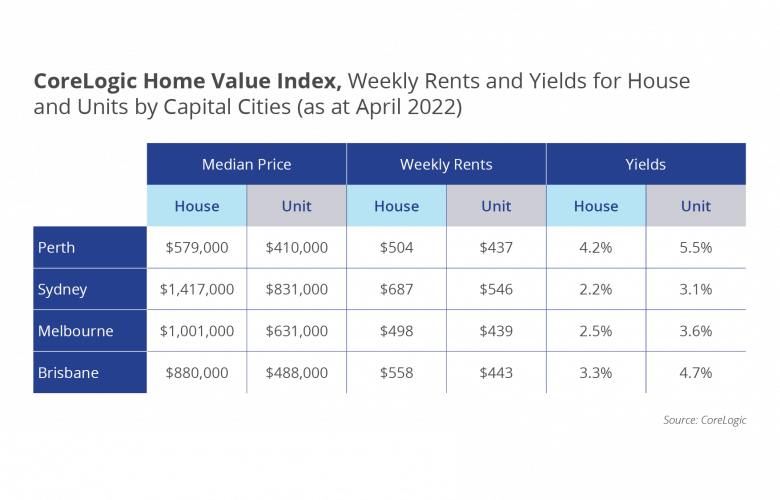

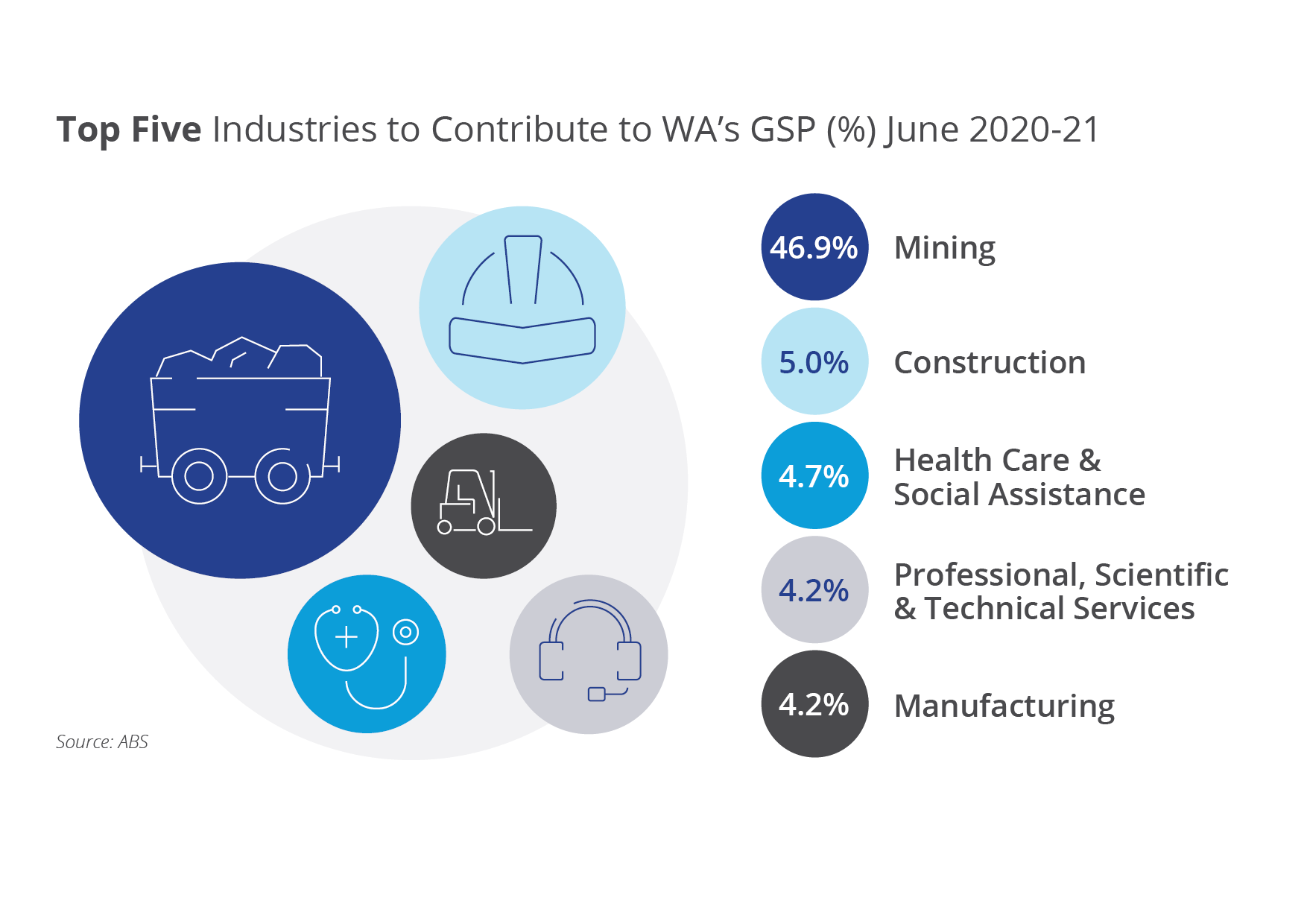

Colliers has released its latest research industry report covering the strength of the WA economy and highlighting the top 10 reasons to invest in WA. Over the last two years, the Western Australian economy has shifted gears and has outpaced the rest of Australia in its economic recovery over the course of the pandemic. WA is becoming a significant investment destination for global capital, known for its diverse natural landscapes, climate and unique lifestyle. Anchored by a robust resource sector that is currently fuelling a global recovery, the economy is underpinned by flourishing industries. These are just some of the major drawcards for investors, residents, workers and visitors.

The report explains several key areas of focus including WA being an international hub for resource production and mining, growing demand for commercial office space, growth in the industrial and logistics sector, rising investment in international education and an emerging focus on agriculture, to name a few. The State is undergoing a resurgence on the back of significant growth and infrastructure investment.

Research Manager for Colliers WA, Yashwini Halai said the report reinforces WA’s resilience and key industries that are of focus in the current market. “Despite the challenges faced over the past two years due to the pandemic, WA has shown resilience and is the strongest economy in the country. Population growth is expected to increase incrementally over the coming years, we currently have the lowest unemployment rate in the country at 3.1% and with significant infrastructure investment, there is a lot of opportunity in Perth. ”

Over the past 6 months we’ve seen the Perth office market improve significantly with workers coming back into the city. Over 72,000sqm of office space is projected to come into the market by 2024 across Premium and A Grade buildings highlighting the current confidence major developers have in deploying capital to Perth.

Colliers National Leasing Director, Jemma Hutchinson said, “Perth CBD is growing up and building out Elizabeth Quay, which will help transform it into the buzzing, vibrant precinct it has the potential to be,” says Colliers’ Jemma Hutchinson. “Mooted developments are on the rise with a number of projects closer to fruition, as demand soars across the CBD for good quality office space.”

Retail sales have increased by 10% YoY in April 2022, with Headline Clothing (21.5%), Pharmaceuticals (19.5%) and Electronics (18.7%) ranking as the top three retail categories (ABS).

Colliers State Chief Executive Western Australia, Richard Cash said “there’s a 50 to 100 basis point advantage for purchasers who look west for their shopping centre investments. We are expecting in excess of $1bn of shopping centre investment activity for 2022. With the borders now open, we are seeing strong interest from South East Asian clients looking to act on opportunities presented.”

Investment volumes for industrial and logistics assets in Perth were at their highest level on record during 2021 with approximately $1.9 billion trading up from $170 million in 2020. The outlook for demand in 2022 is favourable with the continued expansion of key industries including transport and logistics, retail trade and manufacturing where commercial property investors are looking for warehouses and larger storage facilities.

Mr Cash said “WA has a strong value proposition which investors now have untapped access to. Investors who are are looking to WA for their next purchase are providing great feedback and have expressed confidence in the outlook of the WA economy. For the remainder of 2022, Colliers are anticipating increasing sale volumes across all sectors within the WA property market, continuing the momentum and appeal to all forms of investor groups.”