Top 5 predictions for the small (sub $2 million) commercial market

Contact

Top 5 predictions for the small (sub $2 million) commercial market

Vanessa Rader, Head of Research for Ray White Commercial says the strong turnover levels recorded over the last few years for the sub $2 million segment can be attributed to availability of finance and low interest rates, however, as market conditions change, the outlook may be different?

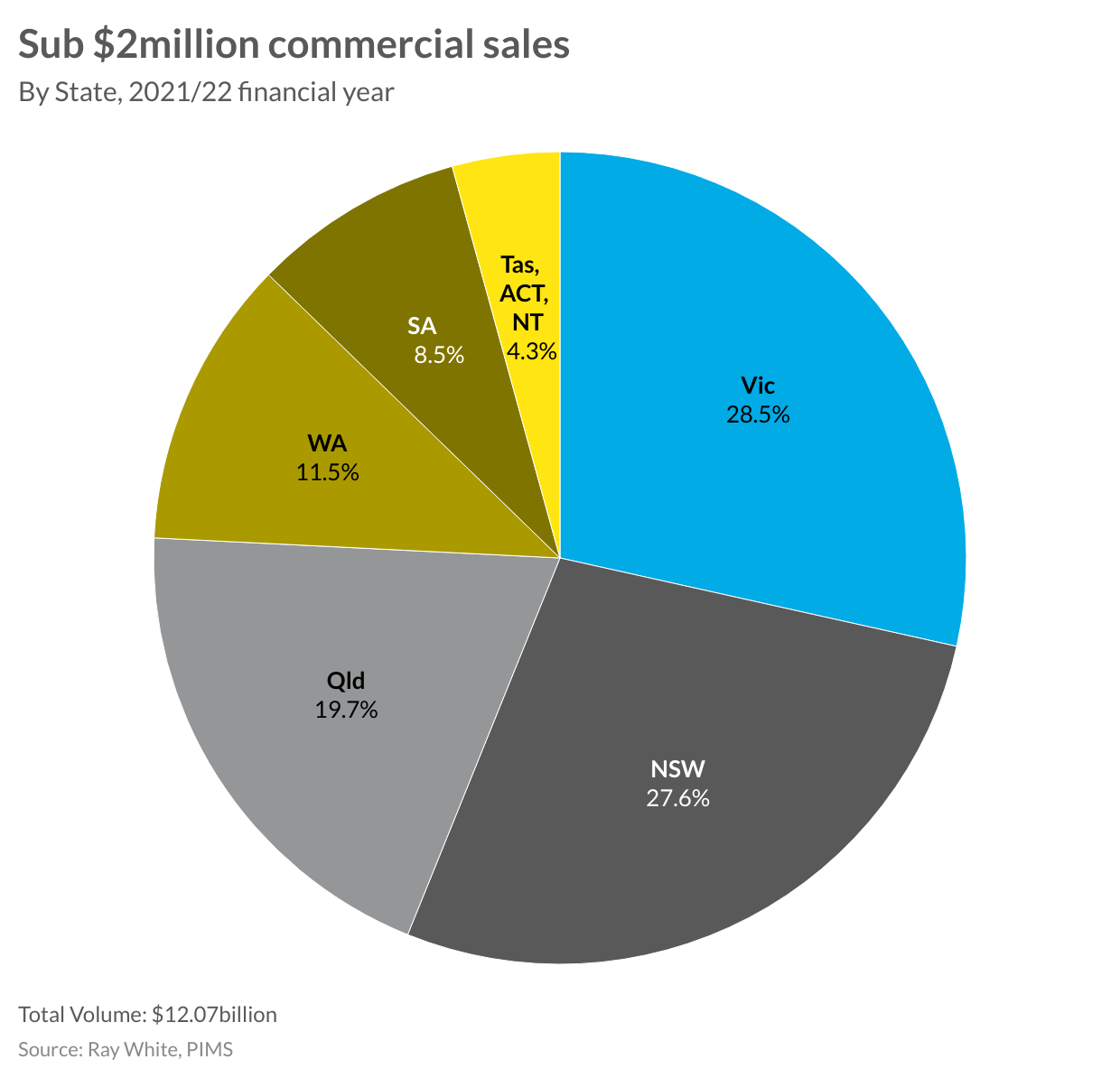

During the 2021/22 financial year there were over 16,000 transactions recorded in the sub $2 million price range across Australia for commercial assets. This has totalled more than $12 billion dollars which represents a 2.3 per cent increase on last year's results. This year Victoria switched places with NSW as the number one investment location followed by NSW and Queensland, with WA continuing its strong drive over the past two years, representing 11.5 per cent of sales. By asset class, industrial remained king, contributing to close to half of all sales. Office volumes dropped as retail, medical, and hotel/tourism continued to grow.

The strong turnover levels recorded over the last few years for the sub $2 million segment can be attributed to availability of finance and low interest rates, however, as market conditions change, what will be the outlook for this smaller end of the market?

Our top 5 predictions are:

- Industrial owner occupiers will continue to pursue assets. Industrial sales represented 47 per cent of all sales this last year, with owner occupiers competitive in securing assets to shelter from rising rents. With vacancies remaining historically low, owner occupiers will continue to actively compete for assets to give their businesses accommodation certainty.

- Interest rate rises will see first time buyers exit the market. We saw a large increase in first timers making their first foray into commercial real estate last year, seeking out higher returning assets to residential while moving up the risk curve. With financing likely to be more difficult over the next year the spread to yield will see these investors move back to other investment types.

- Tenanted investments will remain in favour. Over the last few years we have seen the growth in “set and forget” assets transacting, as buyers look for long term, secure income streams. While yields may see some amendments, these assets will remain attractive to private investors, however, greater consideration is likely on their location and quality of lease covenant and terms such as rent reviews. Assets in regional locations or with non-national, long term, tenants will see price corrections.

- Vacant assets are a new opportunity for savvy buyers. More experienced investors will look to capitalise on changing market conditions. Assets which are vacant or could be repositioned will be of interest to investors willing to get their hands dirty albeit at the right price.

- Medical assets will remain attractive. Over the last few years, medical assets have grown in popularity as both investors and owner occupiers capitalise on the increasing population. This has been a growth market off the back of not just pathology and general practice thanks to COVID-19 but also specialist services such sports medicine, cosmetic surgery and natural health services. Furthermore assets such as aged care and childcare which offer heavy government subsidies will also remain attractive.