Depreciation deductions in renewable energy - BMT case study: wind farm

Contact

Depreciation deductions in renewable energy - BMT case study: wind farm

BMT Tax Depreciation outlines renewable energy, the incentives available and what depreciation deductions look like in a wind farm of fifty wind turbines.

Latest data from the 2022 Clean Energy Report states that 32.5 per cent of Australia’s electricity came from renewable sources in 2021, an increase of five percentage points compared to 2020.

Renewable energy is undoubtably better for the planet but also favourable for property investors with lucrative depreciation deductions, other tax benefits and incentives available for investors who go green.

Here, BMT Tax Depreciation outlines renewable energy, the incentives available and what depreciation deductions look like in a wind farm of fifty wind turbines.

Renewable energy explained

Renewable energy is derived from natural resources that are replaced at a higher rate than used, meaning they will never run out and don’t impact the environment as much as other energy sources.

There are several types of renewable energy including solar, wind, hydro, tidal, geothermal and biomass energy. Wind is currently Australia’s most used form of renewable energy with small-scale solar in second place.

While most of these energy sources are primarily used in commercial settings many Australians have installed solar panels for electricity and incorporate geothermal and bioenergy energy for heating in their homes.

Australia is one of the leading countries in the solar PV market with over three million Australian (27.3 per cent) households having rooftop solar panels.

Government incentives

The Australian Government has been making considerable efforts towards using and encouraging more renewable energy sources with their commitment to reaching net zero emissions by 2050.

The Renewable Energy Target (RET) is an Australian Government scheme designed to reduce emissions of greenhouse gases in the electricity sector and encourage the additional generation of electricity from sustainable and renewable sources.

This scheme works by allowing both large-scale power stations and the owners of small-scale systems to create large-scale generation certificates and small-scale technology certificates for every megawatt hour of power they generate. These certificates are then purchased by electricity retailers (who supply electricity to householders and businesses) and submitted to the Clean Energy Regulator to meet the retailers' legal obligations under the Renewable Energy Target.

There are Small-Scale Technology Certificate rebates available for homes or small businesses which make buying and installing solar systems more affordable. Under the Solar Credit program there are various incentives available for small-scale solar systems.

There are more government and private incentives available across the country for both small-scale and large-scale energy sources with many of these focusing on solar energy.

Depreciation

There are lucrative depreciation deductions available in all forms of renewable energy but for the purpose of this article the focus will be the depreciation available on a wind farm.

Wind turbines are claimed under the two depreciation categories. Capital works deductions (Division 43) are claimable on the structure itself and plant and equipment depreciation (Division 40) is claimable on the mechanical parts of the turbine.

Wind turbines have an effective life of twenty years, are on average 150 meters tall with blades between forty and ninety meters long and are commonly found on hilltops or near the ocean.

The following case study outlines the depreciation deductions available in a wind farm.

Case study

The following case study outlines the depreciation deductions available in a wind farm located in Western Australia. This wind farm has a total of 50 wind turbines and was constructed in 2021.

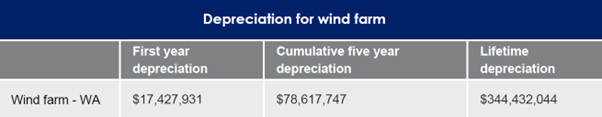

Because the owner of this wind farm claimed depreciation, they were able to reduce their taxable income by over $17 million in the first full financial year, nearly $80 million in cumulative first five years then over $300 million across the lifetime of the turbines (twenty years). They were also able to take advantage of the available incentives by then selling the energy produced by the turbines.

Not only are these deductions financially attractive to the investor but also provide an invaluable way to implement sustainable practices.

As shown wind farms hold millions of dollars in depreciation and the only way to tap into these deductions is to order a tax depreciation schedule.

BMT conduct site inspections so investors can rest assured all claims are maximised and fully compliant with current Australian Taxation Office rulings.

To learn more about the depreciation deductions available in a wind farm call the experts on 1300 728 726 or Request a Quote.

The information provided in this article is of general use only and should not be used as a quote or advice. BMT recommend consulting an accountant before making financial decisions. Contact BMT for a specialised tax depreciation schedule.