What’s in store for Commercial property returns? - LJ Hooker Commercial

Contact

What’s in store for Commercial property returns? - LJ Hooker Commercial

As residential real estate markets enter a new cycle, attention has turned to the future for the commercial property sectors.

People are asking what’s in store for the commercial real estate market amidst the challenges of increased living costs, rising interest rates and global supply chain bottlenecks.

Countering these challenges, however, are some positive fundamentals which continue to make commercial real estate ripe for investors returns:

- unemployment is low;

- Gross Domestic Product growth remains positive;

- wages have begun to rise;

- international borders have opened-up, supporting population growth (albeit in small volumes).

Each of these factors will provide an uplift to industrial, office and retail property sectors across Australia, giving optimism to the sectors.

More people in work

Australian Bureau of Statistics data showed the unemployment rate for June hit a new low of 3.5% - the lowest rate in nearly 50 years. It’s a significant drop from the 7.5% recorded at the height of the pandemic.

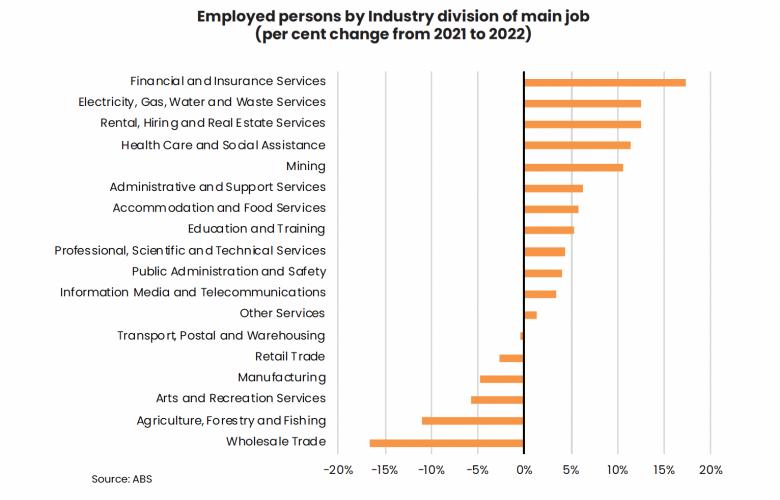

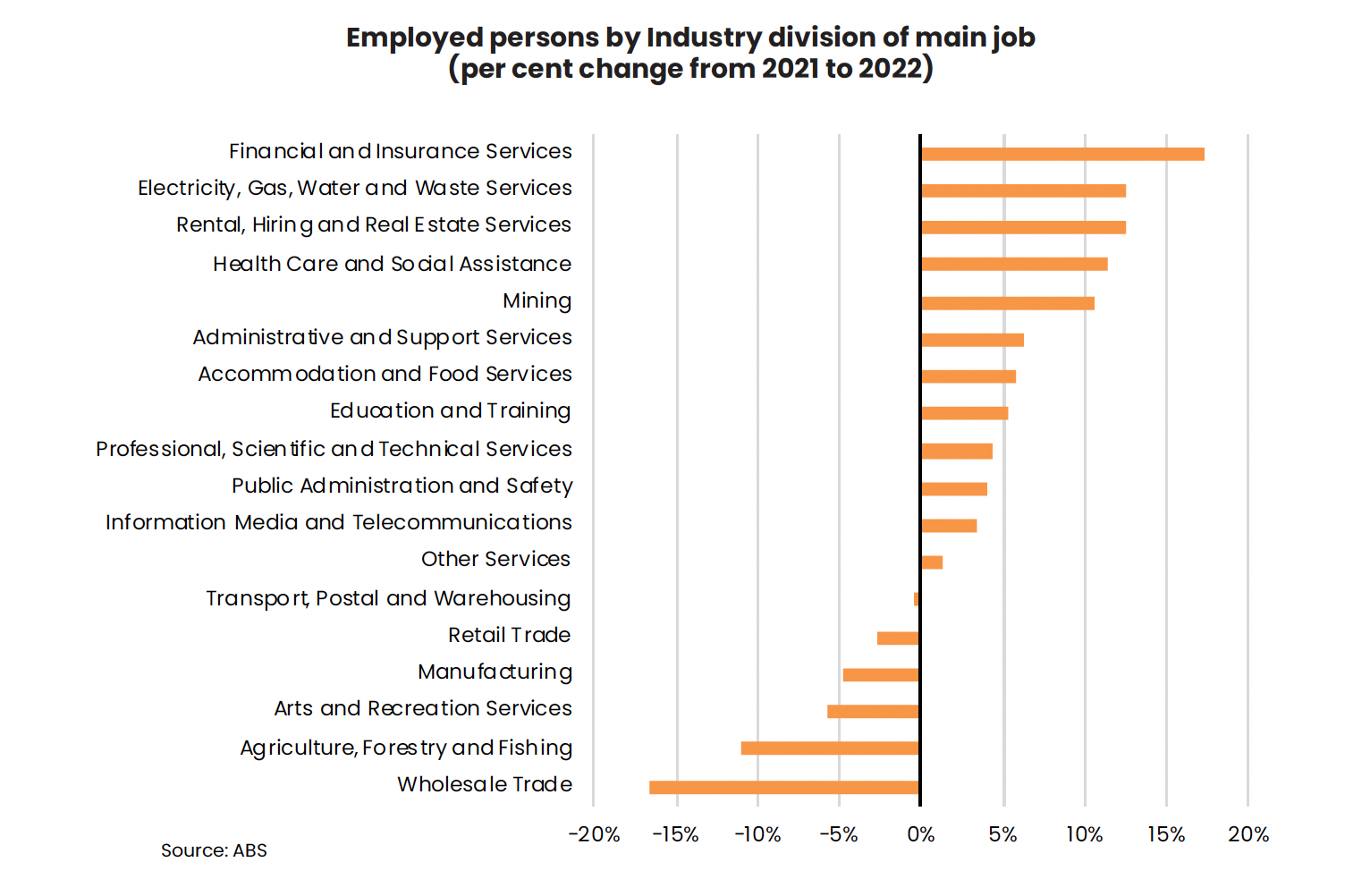

The underemployment rate – where people are only able to find work for shorter than normal or desired periods - also declined from 7.4% in 2021 to 5.7% in May 2022. Overall, an extra 385,800 people are now employed compared to May 2021.

Having more people in work is good for the economy, businesses, and households.

Benefits for retail property investors

Commercial real estate has been a beneficiary of improved employment figures.

For retail property owners, greater job security and the end to COVID-19 lockdowns has supported the recovery in spending. The ability for people to shop, dine and travel without restrictions has assisted leasing and re-leasing of small suburban shops and through to larger regional shopping centres.

The return to the office

Office occupancy rates have also begun to improve as more companies believe productivity is better when staff are located in a central space. ‘White collar’ employment growth has also assisted in the take-up of vacant office space, with the number of employed people in the financial and insurance services industry rising by 17% over the past 12-months.

The downside is that the tight labour markets have made it very difficult for businesses to find new employees to service the additional demand, plus additional spending by households has put upward pressure on inflation, which the Reserve Bank of Australia is aiming to curb at its monthly board meetings.

Population growth to support hotel and student accommodation

Foreign workers, international students and backpackers all returned home during the pandemic. With international borders closed, net overseas migration collapsed into negative territory.

In 2020, the decline in population growth played a role in:

- the economic downturn

- softer real estate demand (new purchases and rentals)

- Disruption to business, particularly in hospitality and agricultural industries.

Queensland recorded the highest increase in net migration to the end of 2021, according to data released from the Australian Bureau of Statistics.

An additional 50,162 residents moved to Queensland from other states over the year. The increase in population movement was a result of departures from New South Wales (net –35,337) and Victoria (-19,386).

Since then, international and domestic borders have fully re-opened and capital cities have begun to welcome back international students, workers and tourists. While it has been a slow start, the indications are that international arrivals have started to pick-up and the second half of 2022 is expected to be close to pre-pandemic levels.

Student accommodation facilities will benefit from borders re-opening, as will hotel, resorts, and leisure assets as travel is undertaken more freely.

There are still challenges ahead

While these fundamentals provide an optimistic outlook for the market, there are still some challenges ahead. The biggest threat remains inflation with everything from the household grocery shop to the price of whitegoods going up.

To combat the inflationary pressures, central banks have looked to aggressively increase interest rates and tighten their monetary policy positions. This has had a knock-on effect to government bonds which have seen yields rise considerably since the beginning of this tightening cycle. This is important: large institutional investors use government bonds as a benchmark when investing in commercial real estate assets, and the strong growth in government bonds yields may reduce demand from these investors.

Implications for commercial real estate investment

Despite the headwinds, commercial real estate investors – from mum and dads looking to diversify their investment portfolios, through large-scale institutional investors – wanting to enter the market. And the demand is coming from various angles:

- investors who are yet to find the right asset

- owner-occupiers who want to capitalise on traditionally low interest rates for business security.

While this is expected to soften, as capital value growth slows, elevated competition will remain.

Businesses which are looking to expand or re-size in the wake of the pandemic have helped push down vacancy rates across most commercial markets.

Industrial markets in prime capital city locations have been the biggest beneficiary and have seen rental growth strengthen.

Retail rents remain flat but some sought-after areas are improving. Neighbourhood shopping centres and other suburban retailers have benefited from the ‘work from home’ movement and vacancies in these areas tightened.

Office rents have yet to see any major change but rising occupancy levels are expected to see this shift over the course of the next 12-months.

If you’re seeking advice on what’s in store for your commercial property asset, or simply want to know what opportunities are available to you, contact us or talk to your local LJ Hooker Commercial specialist.

By Mathew Tiller, LJ Hooker Group Head of Research.