Yield Records Tumble as Metro Melbourne Dan Murphy’s leased investment sold by JLL and Burgess Rawson

Contact

Yield Records Tumble as Metro Melbourne Dan Murphy’s leased investment sold by JLL and Burgess Rawson

A Metropolitan Melbourne Dan Murphy’s store Pakenham sold $14.75 million at a record-low yield by JLL’s Stuart Taylor, Tom Noonan, MingXuan Li and Jarrod Herscu and Burgess Rawson’s Zomart He, Matthew Wright and Billy Holderhead.

A Metropolitan Melbourne Dan Murphy’s store Pakenham sold $14.75 million at a record-low yield by JLL’s Stuart Taylor, Tom Noonan, MingXuan Li and Jarrod Herscu and Burgess Rawson’s Zomart He, Matthew Wright and Billy Holderhead.

The property was sold via an on-market Expressions of Interest campaign handled by JLL’s Stuart Taylor, Tom Noonan, MingXuan Li and Jarrod Herscu and Burgess Rawson’s Zomart He, Matthew Wright and Billy Holderhead.

Dan Murphy’s Pakenham is located on the high-profile corner of Princes Highway and Lakeside Drive in the rapidly growing suburb of Pakenham approximately 52km south-east of the Melbourne CBD.

The property provides a strategic 1.216 ha parcel of land comprising a free-standing Dan Murphy’s tenancy, approximately 83 at-grade carparks and additional vacant land. The asset is underpinned by a 15-year Lease to Dan Murphy’s with options to 2056 providing a current net rental of approximately $433,559 p.a. including base rent and percentage rental.

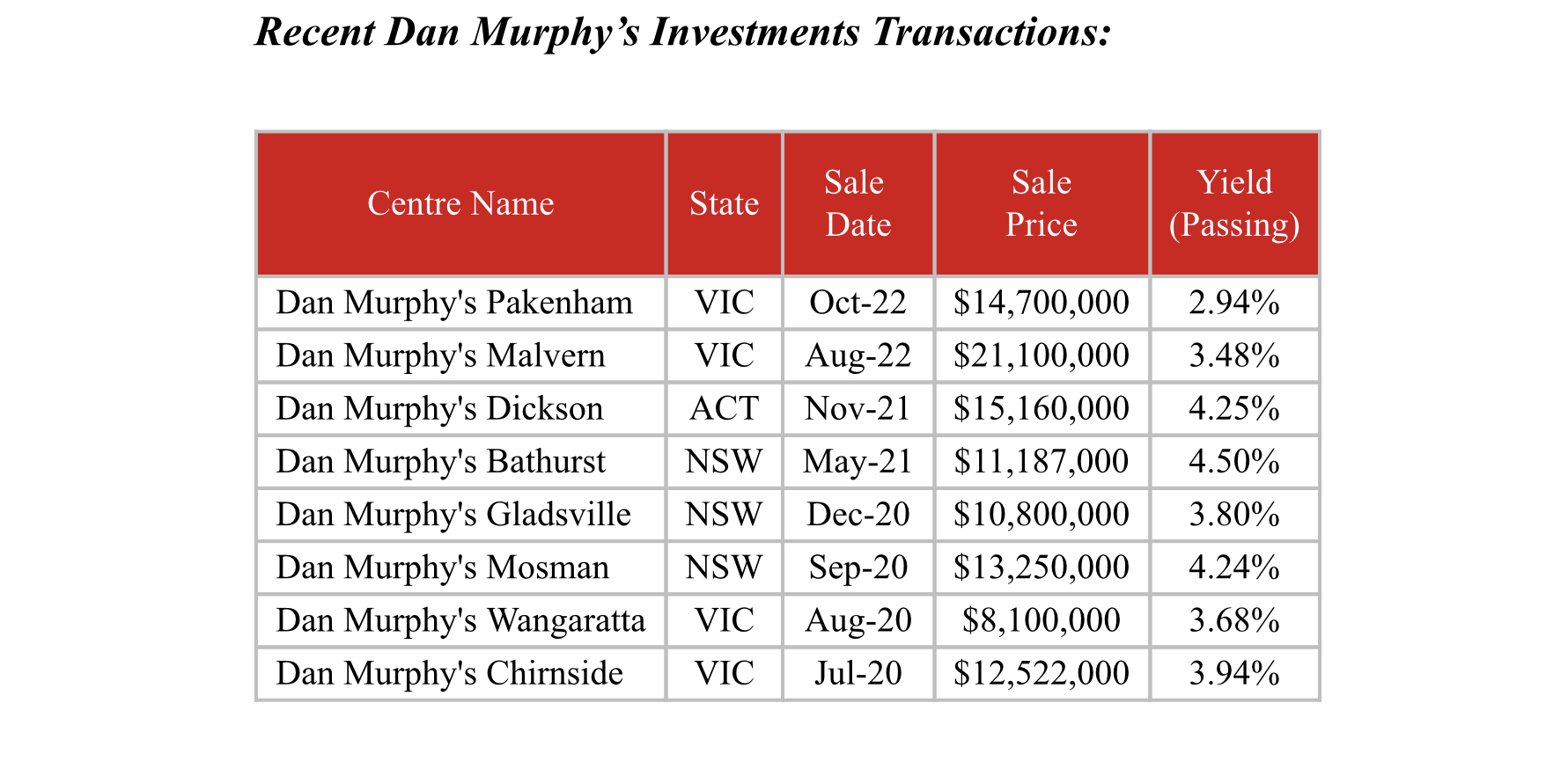

The sale reflects a new benchmark in the Dan Murphy’s freehold investment market, bettering the 3.22% yield for store in Alphington, Melbourne, in 2017 and the sale of the retailer’s site in Malvern, also in Melbourne, which transacted earlier this year on a yield of 3.48%.

Recent Dan Murphy’s Investments Transactions:

JLL Senior Director of Retail Investments Stuart Taylor said “The result sets a new benchmark in the free-standing retail market, representing the sharpest price paid for the liquor retailer in more than seven years.”

Burgess Rawson Head of Asian Investment Zomart He said: “The campaign generated over 400 enquiries between both agencies and 15 bids from a range private investors and developers, including several who are sourcing money offshore.”

Retail transactions have been subdued in Victoria in 2022, with YTD transactions totaling $676 million, down from $1.96 billion (or 65%) at this point in 2021 according to JLL Research.

Mr Taylor said “There has only been few major retail assets transact this year in Victoria, with neighbourhood and sub-regional centre transactions being extremely quiet. We attribute this to the record volume of sales in 2021, with many landlords already completing portfolio repositioning strategies, however there is no doubt that vendor confidence at the top end has waned.”

“The freestanding end of the market continues to display strong liquidity and even yield compression in some instances. This is due to the buyer pool being predominately high-net-worth private investors who are largely equity funded, and accordingly are less impacted by the rapidly moving debt markets” Mr Taylor added.

Mr He concluded that “the strong performance of the Endeavour Group (group which owns Dan Murphy’s) is being reflected in the premium that investors are paying for freestanding assets which benefit from this lease covenant. This outcome puts the Endeavour lease covenant right along side Woolworths, Coles and Bunnings in terms of appeal and demand in the private investor market.”

To request a sales analysis please contact one of the selling agents via the below contact details.

Related Reading:

Leased Retail Investment for sale set to spark investor interest - Colliers | Commo.

Chirnside Lifestyle Centre for sale by Stonebridge Property Group and Colliers | Commo.

New Queensland Woolworths Shopping Centres for sale by CBRE and JLL | Commo.