Flight to quality in focus as lenders seek to increase their Australian real estate exposure through quality credit - CBRE

Contact

Flight to quality in focus as lenders seek to increase their Australian real estate exposure through quality credit - CBRE

Economic headwinds have failed to dampen lender interest in Australian real estate, with industrial assets garnering the most attention according to a new CBRE survey.

Economic headwinds have failed to dampen lender interest in Australian real estate, with industrial assets garnering the most attention according to a new CBRE survey.

CBRE Research tapped a mix of 43 local and international banks and non-bank lenders for its Q4 2022 Lender Sentiment Survey, with 44% expressing a desire to grow their commercial loan books.

CBRE’s Managing Director of Debt & Structured Finance Andrew McCasker noted that this was slightly up on the Q3 result and was led by non-bank lenders, with higher interest rates generating higher returns, making the Australian market more appealing.

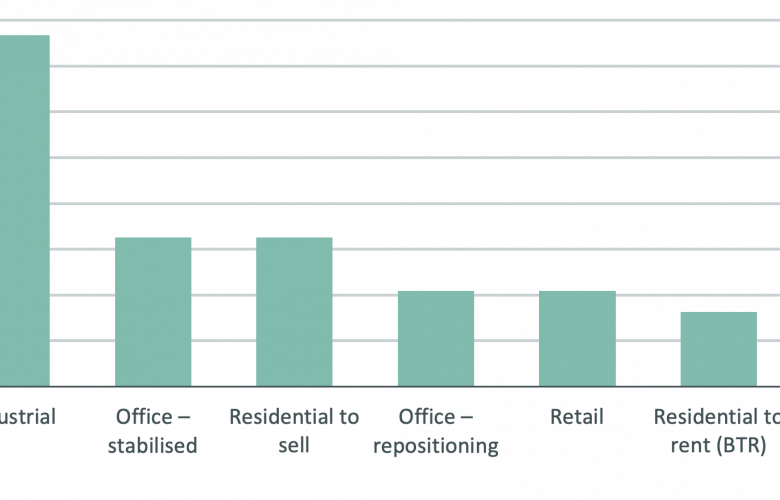

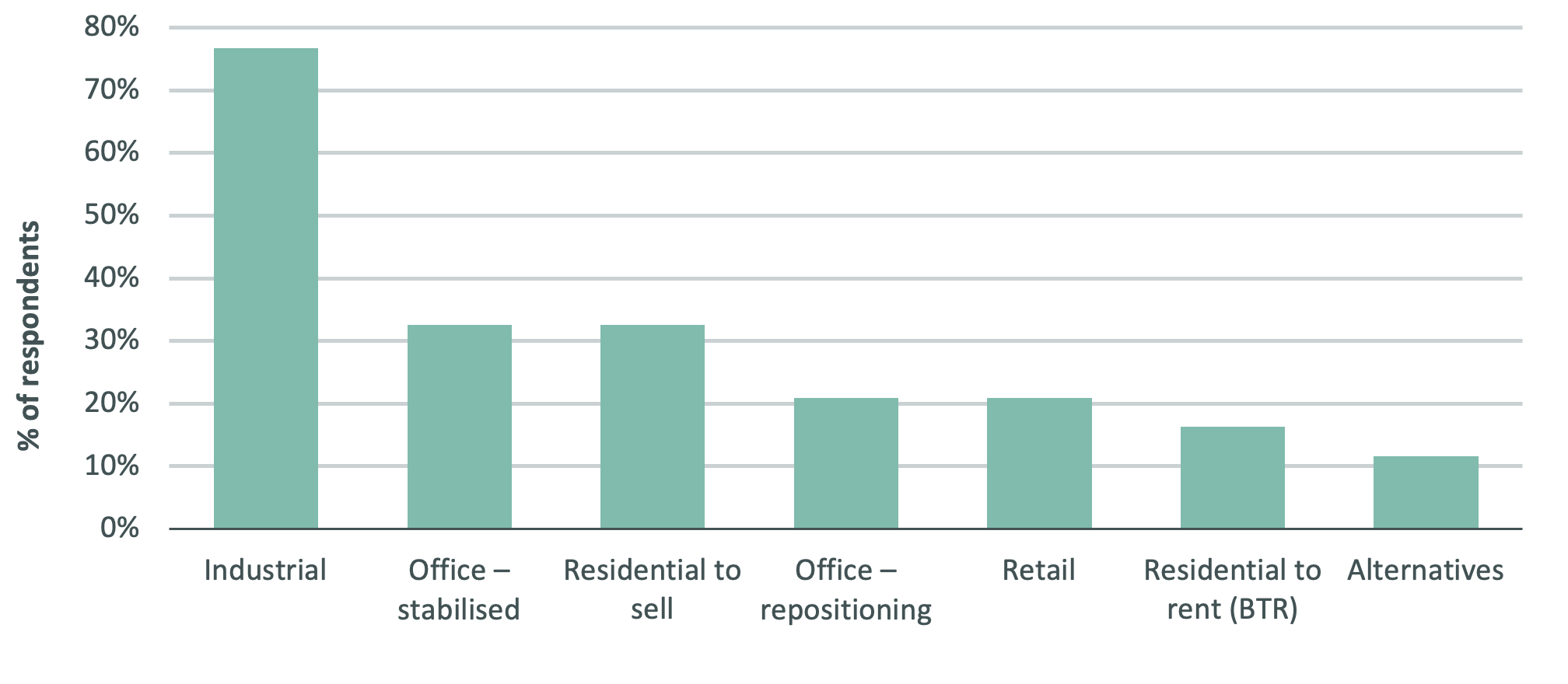

Industrial remains the sector of choice overall, with nearly three-quarters of the survey respondents expressing a preference for that asset class.

Preferred asset class for new investment

“Domestic banks are also favouring stabilised office and retail assets, which affirms a flight to quality for credit amid macro uncertainty,” Mr McCasker said.

“Non-bank lenders are meanwhile keen to grow their exposure to build-to-sell projects and office re-positioning opportunities, which is reflective of the higher returns available when lending against riskier assets. These lenders have also raised significant credit, suggesting that they are waiting on the side lines for distressed opportunities.”

The higher non-bank appetite for risk is also being reflected in pre-lease requirements for new development projects, with non-banks more likely to opt for a pre-lease rate of below 40%, while domestic banks are favouring projects that are over 60% pre-committed.

The survey shows that just 7% of respondents are looking to decrease the size of their loan books, with 49% expecting to remain at around current levels and 44% looking to increase.

Will Edwards, CBRE Associate Director, Debt & Structured Finance, noted that domestic banks were anticipated to hold, if not grow, market share given their strong balance sheets and lower exposure to wholesale markets.

Conversely, there were some early signs of liquidity issues from international banks, which might hinder their ability to grow their books, Mr Edwards said.

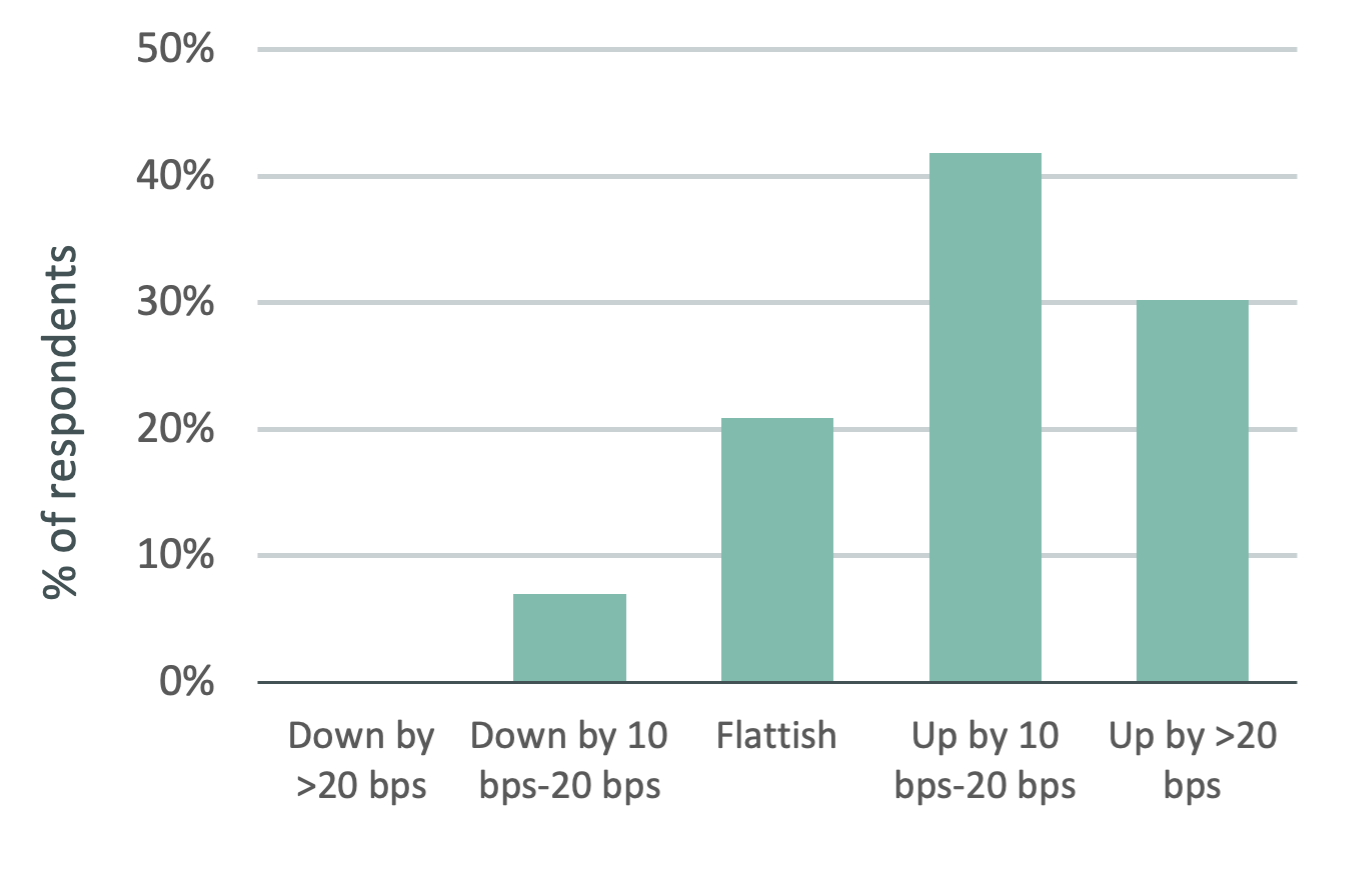

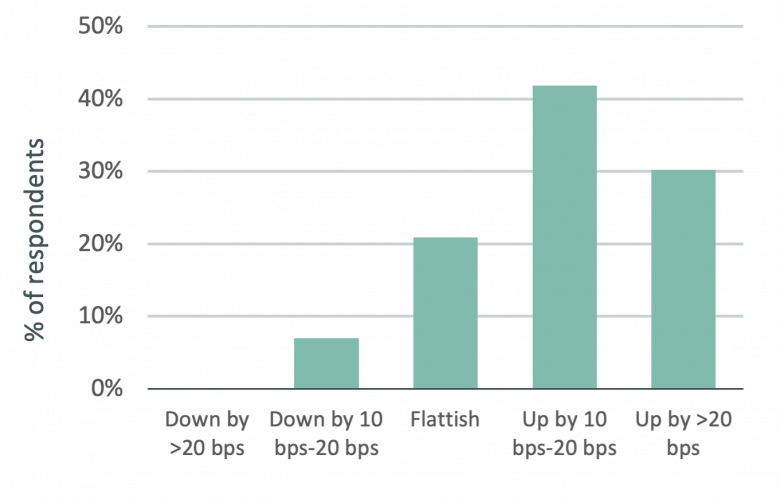

The survey highlights that rate expectations have increased since Q3, with over 40% of lenders expecting margins to increase by 10-20bps and a further 30% expecting a more than 20bps rise.

“While there are ongoing issues around loan serviceability, we have noticed a slight wind back in hedging requirements, suggesting lenders have comfort that the interest rate cycle is approaching a peak,” Mr Edwards said.

In the next three months, credit margins on new loans are likely to move: