Consistent demand for data centre services continues to drive growth across Asia Pacific - Knight Frank

Contact

Consistent demand for data centre services continues to drive growth across Asia Pacific - Knight Frank

Knight Frank, the largest independent global property advisor, has released the latest research from its Q1 2023 Data Centre Report, published in partnership with DC Byte, the leading data centre research and analytics platform.

Knight Frank, the largest independent global property advisor, has released the latest research from its Q1 2023 Data Centre Report, published in partnership with DC Byte, the leading data centre research and analytics platform.

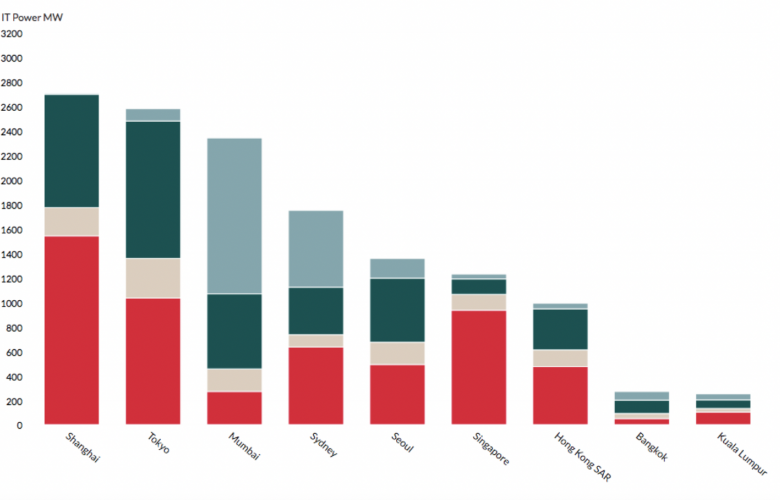

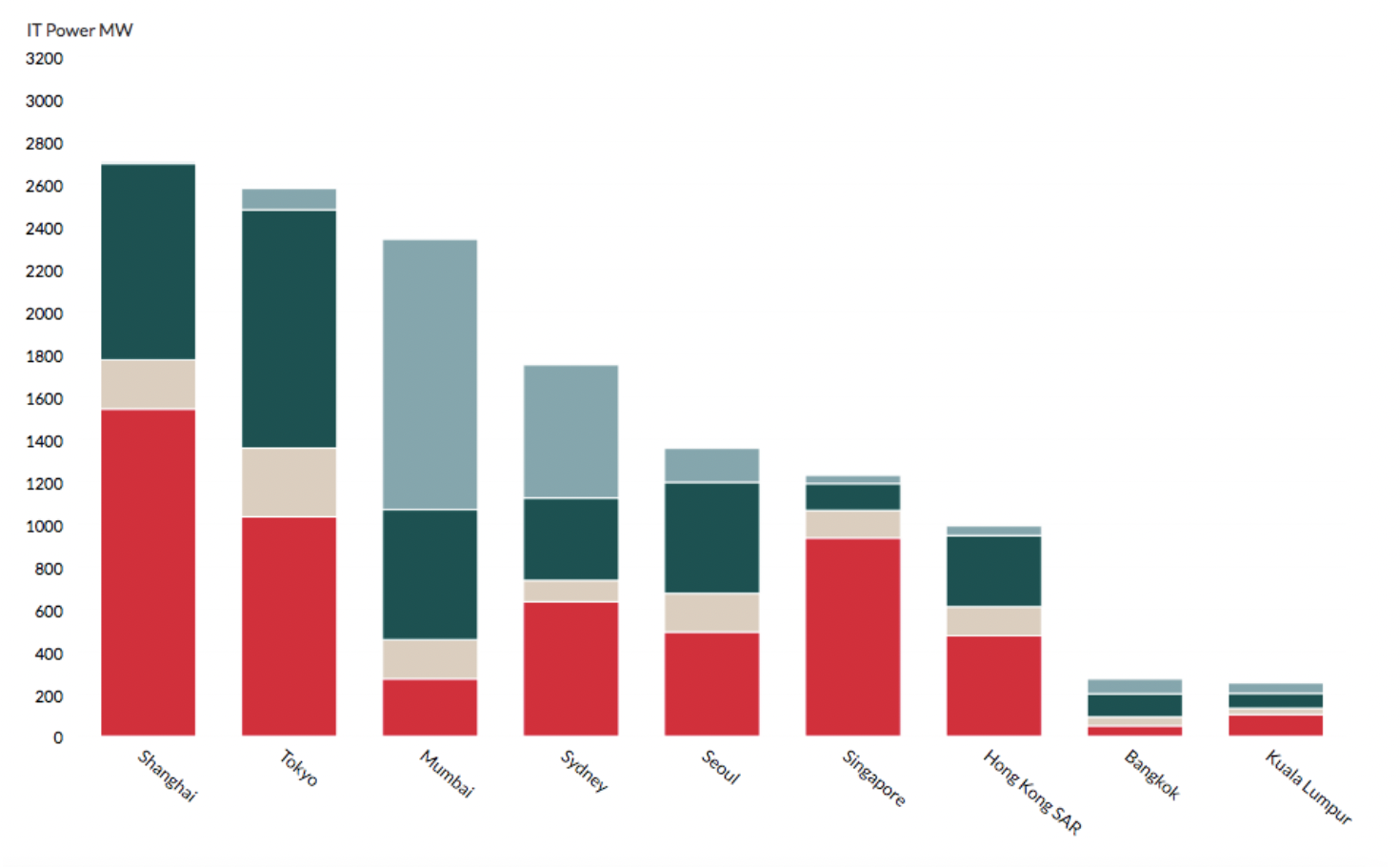

The report provides a comprehensive overview of the data centre landscape in Asia-Pacific (APAC), focusing on the established markets of Tokyo, Shanghai, Sydney, Singapore, and Hong Kong, and fast- growing tier 2 markets of Mumbai, Seoul, Kuala Lumpur, and Bangkok. In Q1 2023, the total market capacity across these nine markets surpassed 13,400MW, with a 425MW increase since the start of the year - this includes live, under construction and phased power. The positive trajectory across APAC is a result of both established and hyper-growth data centre markets leveraging the momentum of the previous four quarters. Much of this growth was fuelled by market expansions recorded in Mumbai and new capacity announcements in Bangkok, Kuala Lumpur and Tokyo.

IT power for each market. Source: Knight Frank Data Centre Report Q1 2023

Mumbai emerged as the standout growth story of Q1 2023, with the market’s total capacity expansion surpassing the 2,000MW milestone. Supply movements have moderated compared to previous quarters, with over 40% of its current live capacity absorbed throughout 2022.

Bangkok also experienced impressive growth, surging by nearly 30% since the start of the year. Building on the strong absorption witnessed in 2022, market players are actively expanding their presence and increasing their share of the market. Multiple operators are pursuing capacity expansions across different locations in the city, capitalising on favourable market conditions. Similarly, Kuala Lumpur witnessed substantial growth, accounting for one-third of the total supply (250MW) added to the market in the past year.

Supply in Singapore remains highly constrained as the data centre operator market awaits the government's results of the ‘call for applications’ program. On the demand side, Singapore and key markets like Tokyo, Sydney, Shanghai, and Hong Kong continue to exhibit robust activity, driven by leading cloud providers and financial institutions.

Sydney

In Q1 2023 Sydney’s total capacity was 1,746MW, with a live capacity of 632MW, under construction capacity of 100MW, committed capacity of 387MW and an early-stage capacity of 627MW, according to Knight Frank’s Data Centre Report.

The take up over the quarter was 20MW. AirTrunk was the market leader at 29 per cent or 183MW, followed by CDC Data Centres (13 per cent or 85MW) and Equinix (11 per cent or 67MW), with NEXTDC and Amazon Web Services both at nine per cent (or 58 and 55MW respectively).

Knight Frank Chief Economist Ben Burston said: “Amidst higher inflation and a subdued economic outlook, property investors are seeking diversification into sectors aligned with behavioural and demographic shifts that will provide secure income in the near term and maximise long term growth potential.

“Data centres clearly offer these characteristics, as the sector has witnessed a remarkable acceleration in recent years, driven by the exponential growth of internet usage across commerce, social media, entertainment, and cloud adoption.”

Knight Frank Partner and Head of Alternatives in Australia Tim Holtsbaum said: “A wide range of investors are looking at data centres in Australia as an alternative asset class.

“As data centres gain prominence as an asset class, investors are leveraging various strategies such as mergers and acquisitions (M&As), joint ventures, and land acquisitions to tap into this thriving sector.

“We anticipate notable trends including increased M&As and land acquisitions in emerging Tier 2 cities, a growing emphasis on data residency and sovereignty, persistent supply chain disruptions and delays, and a heightened focus on sustainability in data centre development. Recognising that data centres encompass more than just physical infrastructure; these projects require expertise in areas such as real estate and digital infrastructure.

“Despite an increase in supply in recent years, demand remains in Sydney particularly from owner occupiers seeking to develop assets in key locations around Sydney such as Macquarie Park and Eastern Creek.”

James Murphy, APAC Managing Director at DC Byte, added: "Despite well-documented barriers to data centre development in the more established markets across the region, significant capacity is still being added as demand for cloud services continues to be strong. In the past, this demand would have been contained to a few markets but we are increasingly seeing new cloud regions and availability zones being established in new markets which accounts for the significant growth in both supply and demand regionally."

To view the latest Data Centre Report please click here.

Related Reading:

Cloud adoption and AI to power Asia Pacific’s future data centre market - JLL