Facebook co-founder and OIF back prop-tech platform Inspace

Contact

Facebook co-founder and OIF back prop-tech platform Inspace

Virtual inspection software company, Inspace, has secured AUD $6 Million in a round co-led by B Capital, spearheaded by Facebook Co-founder Eduardo Saverin, and Australian venture capital firm OIF Ventures.

Virtual inspection software company, Inspace, has secured AUD $6 Million in a round co-led by B Capital, spearheaded by Facebook Co-founder Eduardo Saverin, and Australian venture capital firm OIF Ventures. The round was heavily oversubscribed, and also included early Inspace backer Investible.

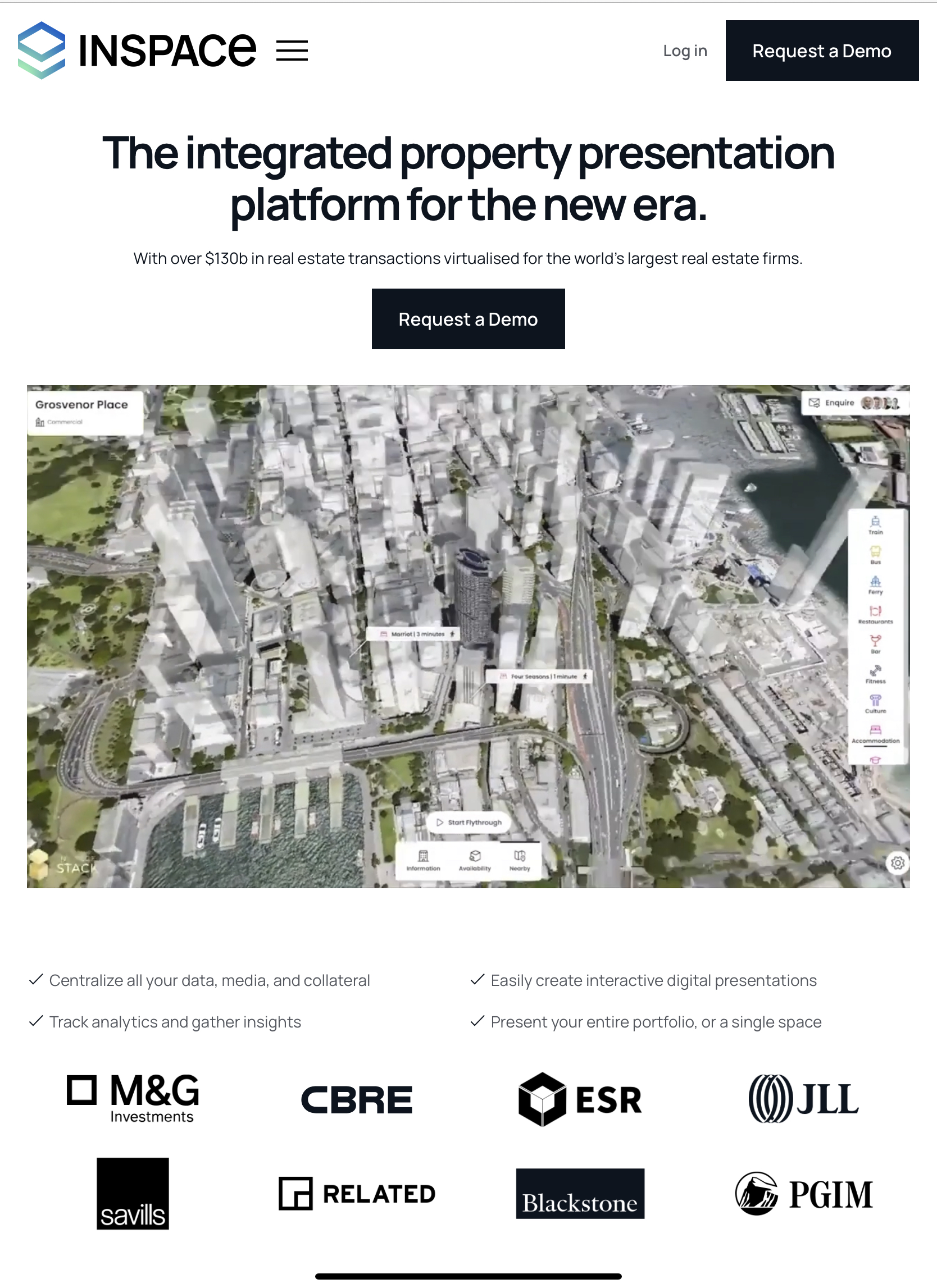

Inspace's 3D platform equips real estate professionals with the tools to virtually showcase properties to potential tenants, efficiently manage property portfolios, and engage with investors through immersive online experiences.

Just three years since launch, Inspace has already been deployed for over $130 billion in real estate across 11 countries worldwide, counting the world’s top commercial real estate companies as customers including M&G, CBRE, Dexus, Lendlease, JLL and PGIM. The virtual property inspection platform is already used by over 90 per cent of Australia’s top commercial property landlords.

Inspace’s subscription revenue has grown 398% (4x) in the 18 months since its Seed round led by OIF Ventures.

The recent funding will be used to accelerate Inspace’s R&D, including predictive insights, AI-generated documentation, and new tools for real estate fund managers to retain and raise capital. This comes at a time where $2.3 trillion of US commercial real estate debt comes due for repayment before the end of 2025.

Justin Liang, Inspace CEO said, "Inspace enhances communication between any group of people discussing commercial real estate - whether it’s in a boardroom, at a Starbucks or across the world. With instant remote access to buildings, we not only reduce costs and promote a greener world - but enable landlords and agents to present at scale, capture insights, and accelerate deal completion."

“Inspace has developed an innovative, end-to-end platform for CRE in the virtual era, leading to improved leasing, asset insights, and portfolio management for its customers,” said Anuj Varma, Partner at B Capital. “B Capital is excited to support Inspace in its mission, reflecting our global strategy of investing in technology that revitalizes existing industries, allowing them to adapt to a changing environment.”

Geoff Levy, Our Innovation Fund, said “We are incredibly excited to be continuing to support Justin and the Inspace team on this journey. They are providing property syndicators in a global market with , amongst other things, an excellent re-engagement tool to keep redemptions to a minimum. This, in addition to their core uses for those customers, at a critical time in the cycle when property investors are seeking to exit their investments."