RWC asks, Have commercial sale declines been across all price ranges?

Contact

RWC asks, Have commercial sale declines been across all price ranges?

2023 has been a tough year for the commercial property market, with interest rates peaking, resulting in financing difficulty and borrowing levels inline with 2020 where volumes took a tumble. As interest rates show some stability, there has been a renewed confidence in commercial property investment with enquiry levels reportedly up says to Vanessa Rader Head of research Ray White Commercial.

As interest rates show some stability, there has been a renewed confidence in commercial property investment with enquiry levels reportedly up. 2023 has been a tough year for the commercial property market, with interest rates peaking, resulting in financing difficulty and borrowing levels inline with 2020 where volumes took a tumble. Coupled with mixed results across various asset classes, both buyers and sellers have been quiet the first half of the year opting to sit and wait and for market sentiment to improve.

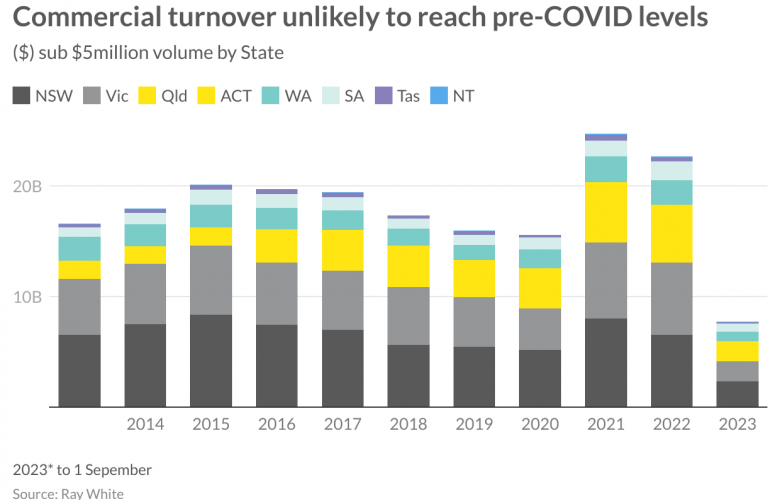

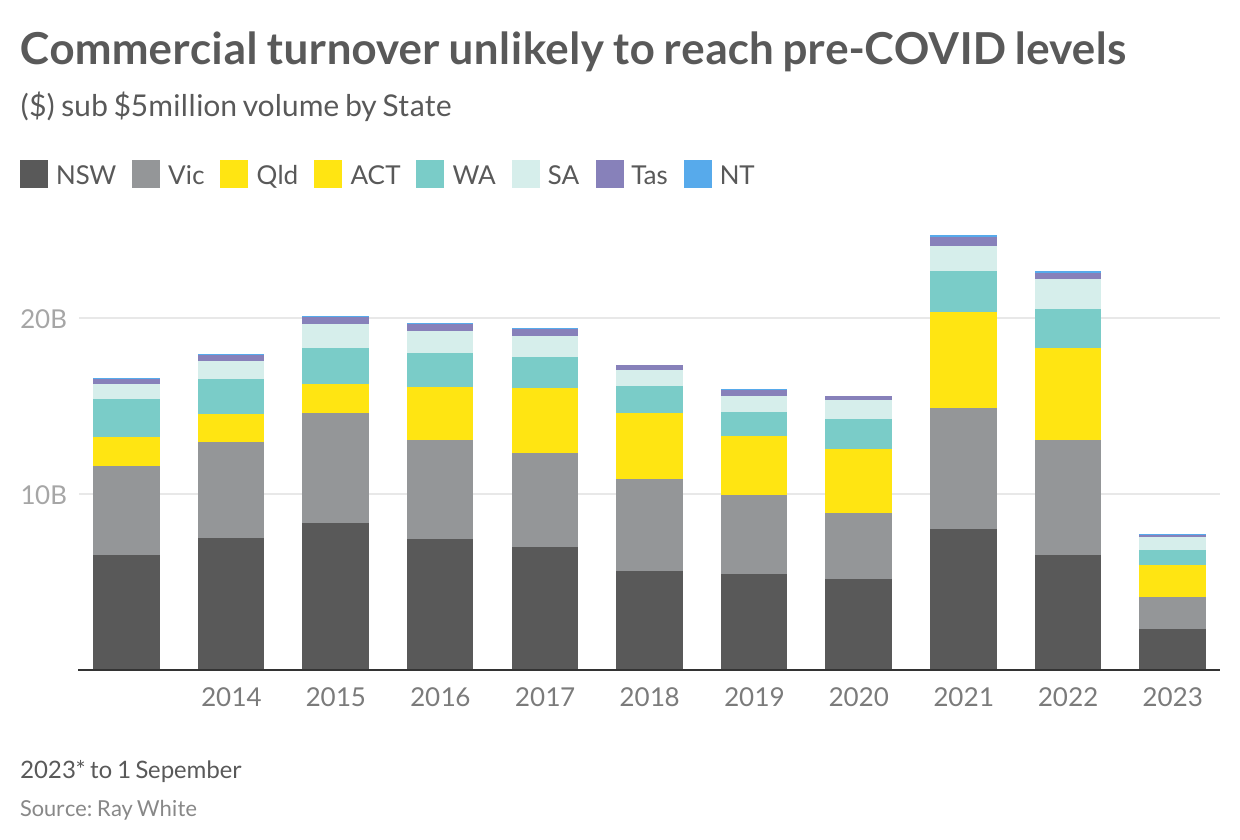

Private investor activity however has dominated the commercial landscape this year, with many opportunistic investors and “cashed up” speculators seeking out assets which offer a good rate of return or hedge to inflation. Across the sub $5 million price range, both owner occupiers and private buyers have grown in activity; to September 1, volumes have reached $7.7 billion well below the $24.7 billion, which turned over during the 2021 peak investment year.

Data from the first eight months of 2023 show a 65.9 per cent decline compared to the full 2022 year, however remains approximately 50 per cent down compared to the quieter 2020 period. Despite this anticipated uptick in activity, we expect 2023 to remain historically a low volume transaction year achieving below the 2020 turnover level of $15.6 billion and ten year annual average of $19.0 billion.

NSW, Queensland and WA have all seen similar levels of interest decline, however, Victoria and Tasmania have seen a greater decrease in activity. Encouragingly the smaller SA and NT markets have seen volume trends most aligned to prior years. However, these reductions are not limited to the smaller end of the market.

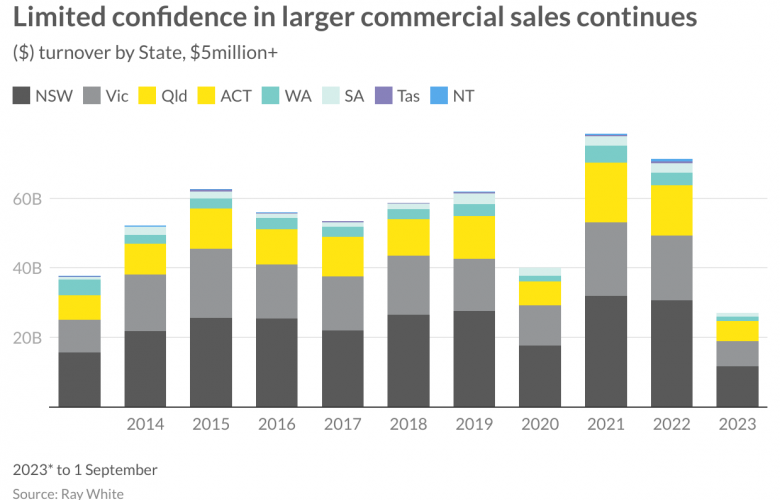

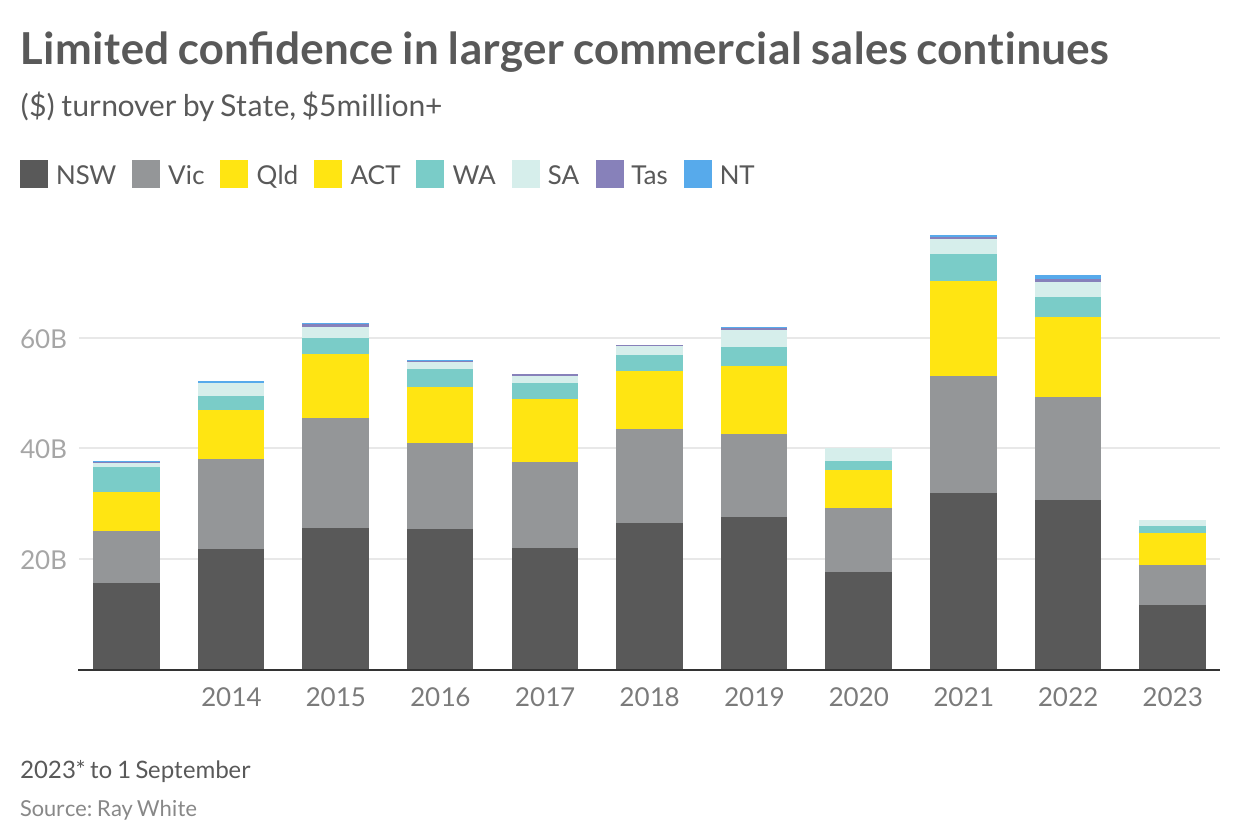

The difficulty in commercial transactions has been evident across all price points. The over $5 million market recorded declines in excess of 50 per cent (so far this year) compared to the highs of 2022. 2020 was a historically low volume year across the larger end of the market with $40.2 billion in sales recorded - below the ten year average $57.3billion per annum. As the first eight months of 2023 has achieved $27.1 billion, volumes are on track to exceed this low 2020 period, albeit not pull ahead of the longer term average.

While private investors have been the most active sellers this year, they continue to also be the most active buyers with net acquisitions in excess of $2 billion. This is the first time these buyers have held a positive net position in the last ten years, highlighting the opportunistic nature of this buyer type, capitalising on market uncertainty and future development, value-add or land banking opportunities. REITs and listed funds have been strong sellers in the marketplace, disposing of more than $7 billion in assets, with net acquisitions at -$5.4billion. This is their lowest net position of the last ten years. Similarly, cross border investment has had the quietest year of the last 10, despite the favourable Australian dollar, due to uncertainty in office markets and limited trophy assets on offer.

Transactions by asset type highlight this reduction in office assets, however, retail and industrial remain active with investment by state showing similar trends with NSW, Victoria and Queensland remaining the most active while the smaller ACT, Tasmania and NT markets have seen a greater decline.

Vanessa Rader Head of research Ray White Commercial.