Foreign investors sell back Australia’s agricultural land - RWC

Contact

Foreign investors sell back Australia’s agricultural land - RWC

According to Vanessa Rader Head of research Ray White Commercial, foreign ownership of agricultural land has reduced the last two consecutive years.

Recent data from Foreign Investment Review Board for June 2022, highlights foreign ownership of agricultural land has reduced the last two consecutive years.

After declining just 0.1 per cent in 2020/21, this has continued to fall by 10 per cent over the 2021/22 period, with foreign owners now representing 12.3 per cent of all agricultural land, the lowest rate seen over the last seven years of data.

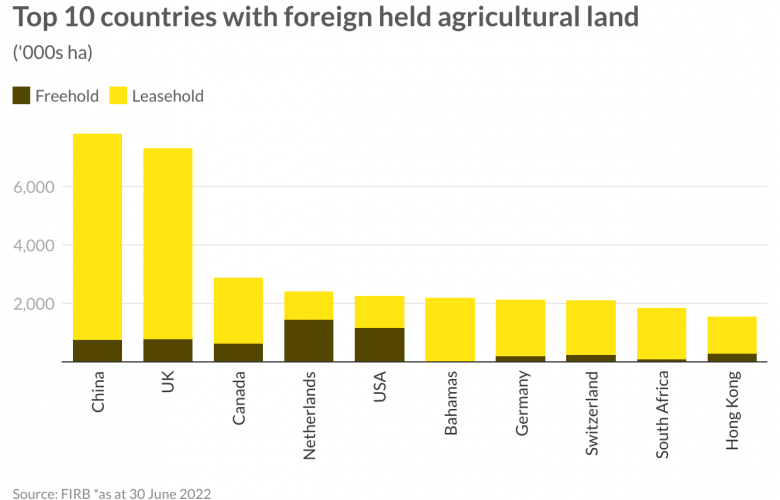

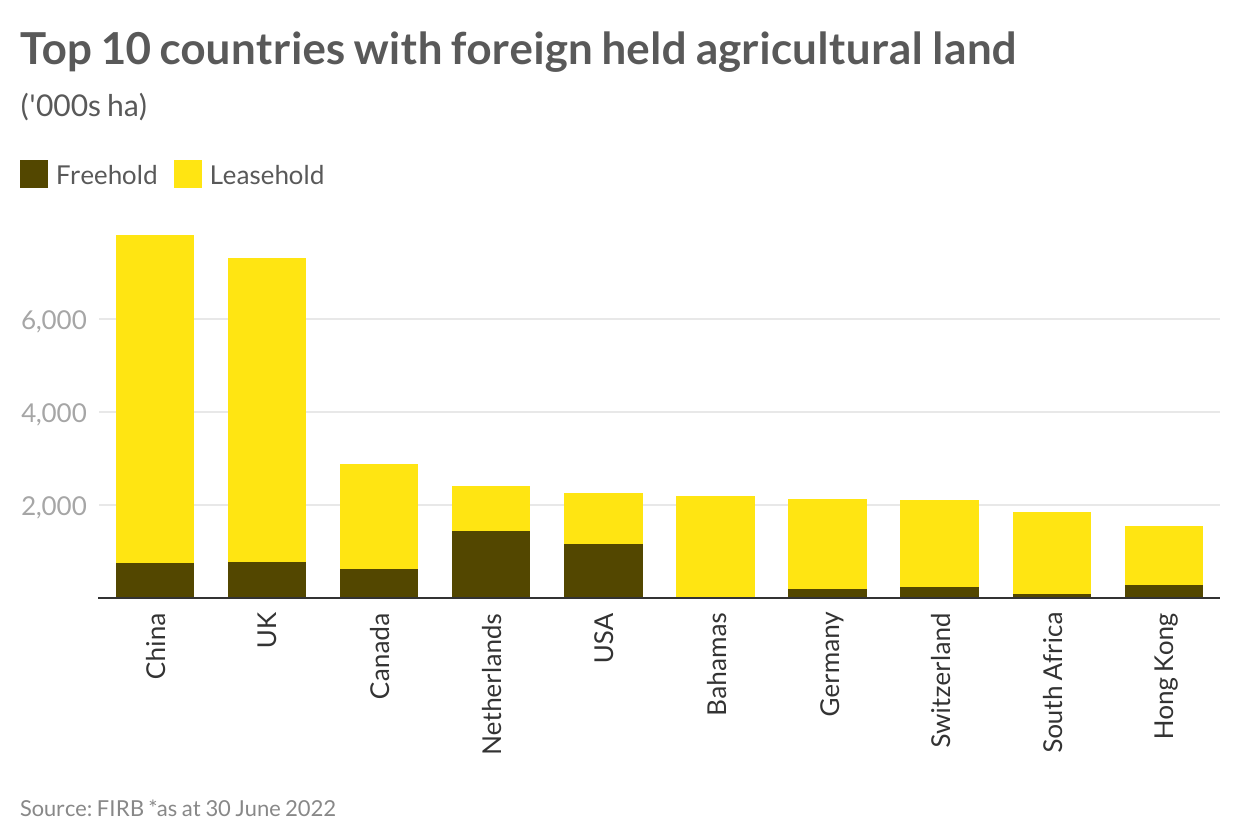

Leasehold land remains the major holding for most of these foreign entities, representing 82 per cent. Of the 47.71 million hectares held, only 10.22 million hectares is freehold. While China has the greatest land holding, representing two per cent of all agricultural land, markets such as the Netherlands and USA have a greater freehold ownership.

Of the top 10 countries which invest into Australia, only Canada has grown their holdings over the last year, while all other countries have reduced their exposure. During this year we have seen the sale of large perpetual leasehold and freehold interests as well as the disposal of multiple smaller properties given the uncertainty surrounding commodity prices and possible El Niño effects on weather patterns going forward, which has already impacted livestock values. 85 per cent of all foreignly held agricultural land is for livestock representing 41.01 million hectares, a 9.2 per cent decline over the last year with the remainder representing crops, forestry and intensive horticulture.

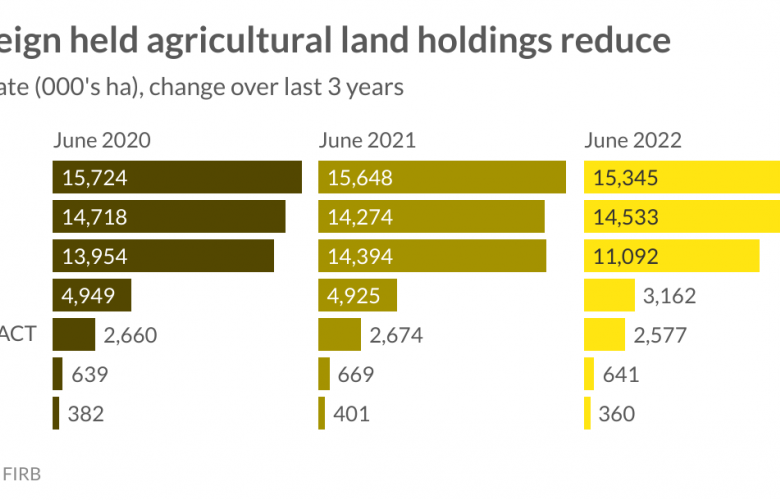

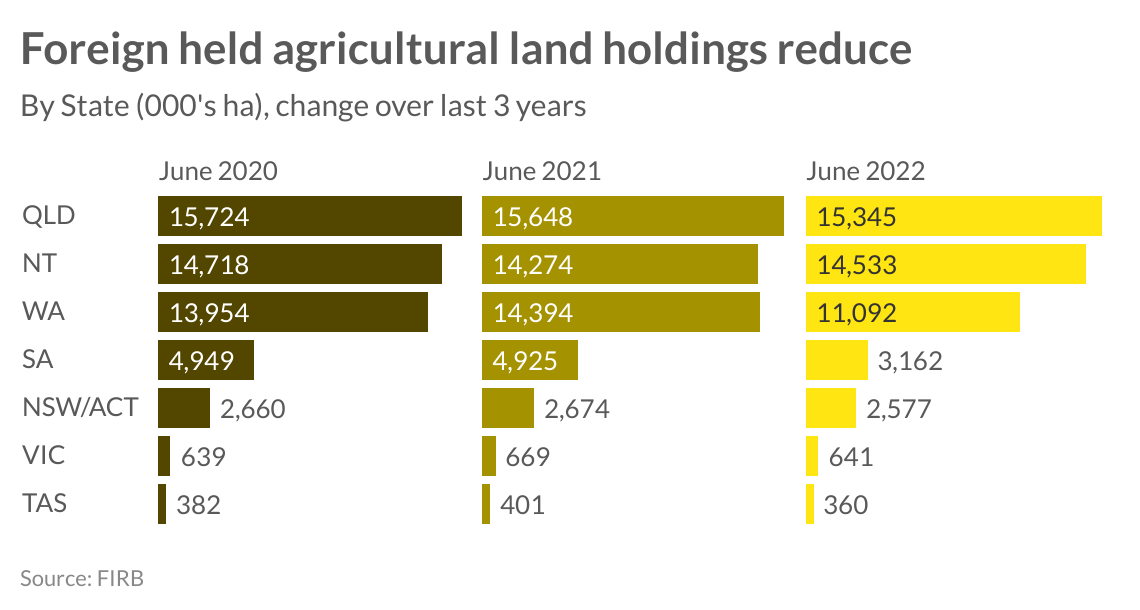

In terms of location, Queensland and Northern Territory have the largest foreign ownership representing 15.35 million and 14.53 million hectares respectively. All states except NT have seen a decline in these holdings, NT currently has 27.4 per cent of all agricultural land with some form of foreign ownership, while the smaller Tasmania market represents 23.9 per cent, Western Australia with 12.8 per cent and Queensland 11.4 per cent.

NT was the only state to see an increase in foreign holdings over the last year, and the only market to increase its livestock holdings. Overall assets for livestock production have decreased foreign ownership by 9.2 per cent due to uncertainty surrounding value, demand and expectations of a continued reduction in beef and lamb prices. Western Australia has been the market to show the greatest sell off of 3.30 million hectare or 22.9 per cent of the state’s foreign ownership, 95.5 per cent of this land was for livestock, while SA has seen a -38.5 per cent proportionate reduction in livestock property.

Given the robust levels of growth in the ABARAS Farmland price index over the past three years, we may continue to see the sell off by foreign investors looking to capitalise on these improved prices. National preliminary 2023 values have grown by 16.3 per cent to $4,689/ha over the last year or 70.3 per cent over the last three years. With the WA index moving at a record 99.7 per cent over the past three years, the continued sell-down of foreign controlled assets can be anticipated.