Leasing demand resilient across Melbourne’s City Fringe and Metro office markets - Knight Frank

Contact

Leasing demand resilient across Melbourne’s City Fringe and Metro office markets - Knight Frank

Demand for premium space is keeping Melbourne’s fringe and metro leasing market positive, according to the latest research from Knight Frank.

Demand for premium space is keeping Melbourne’s fringe and metro leasing market positive, according to the latest research from Knight Frank.

Knight Frank’s Melbourne City Fringe and Metro Offices Market Report October 2023 found leasing demand was resilient across Melbourne’s City Fringe and Metro markets, with a strengthening in net absorption of 46,102sq m in the first half of the year.

Net absorption strengthened particularly across the City Fringe (42,000sq m) while the Metro office market demand (4,000sq m) also improved as tenants chased higher quality stock.

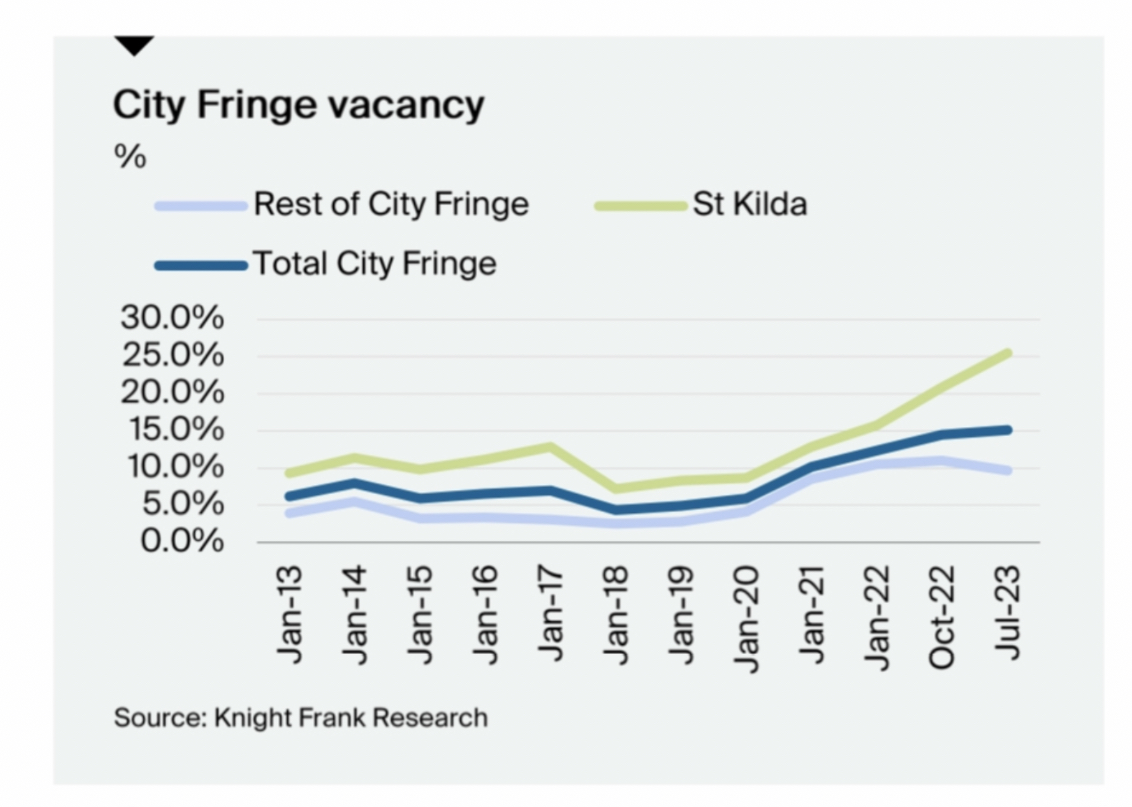

As a result of demand the overall vacancy rate improved from 11% in October last year to 9.7% in July this year in the City Fringe market, while the Metro rate has risen slightly to 7.9%.

Knight Frank Head of Research and Consulting Victoria Dr Tony McGough said the City Fringe office market had further strengthened in the first half of 2023 following robust demand over the past few years.

“The bulk of the leasing activity in the first half of the year was carried out in Collingwood and South Melbourne, which continues to attract tenants due to the abundant retail amenities surrounding the office buildings and easy transport access,” he said.

“We saw strong demand for new stock as tenants continued to upgrade their space and location.

“200 Victoria Place achieved full commitment within three months of practical completion, highlighting confidence in the City Fringe office market.

“Meanwhile 11 Eastern Road, South Melbourne is now complete, with Levi’s committed to 1,000sq m and a further 3,000sq m under offer.

“In the metro office market demand in the first half of the year started to rebound following a slowdown in 2022.

“However, in line with the economy as a whole, H2 2023 has quietened markedly compared to the start of the year.”

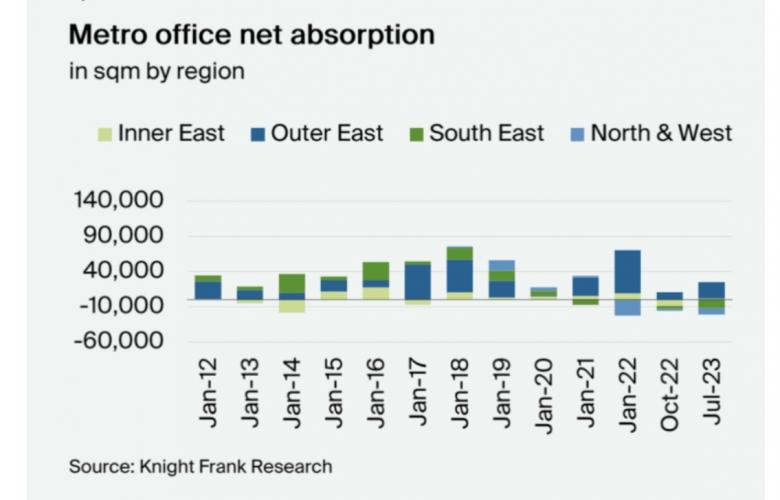

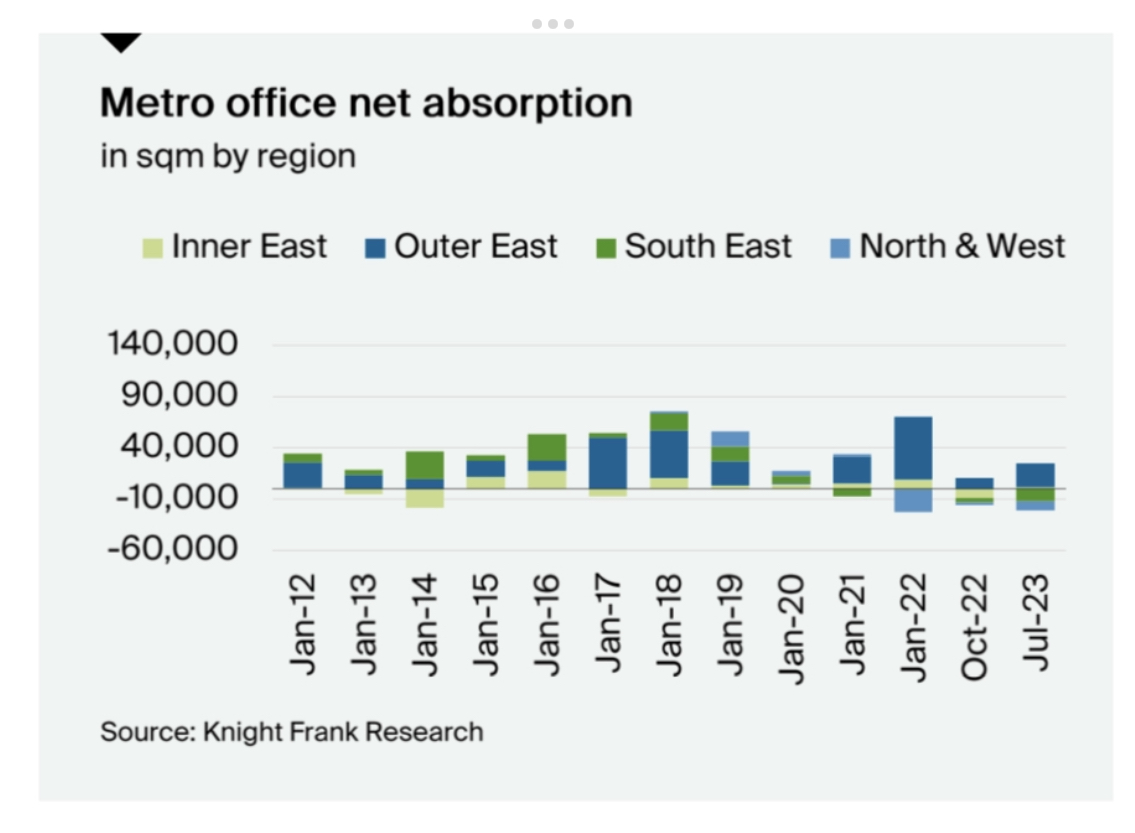

Dr McGough said in the metro office market, the Outer East had emerged as the strongest precinct in the first half of 2023, with nearly 23,000sq m of net absorption recorded.

“Inner East demand also improved with around 2,100sq m of net take up, but the South East and North West markets slowed, with negative net absorption, which has put the metro market’s net position at near neutral as we move into H2 2023.

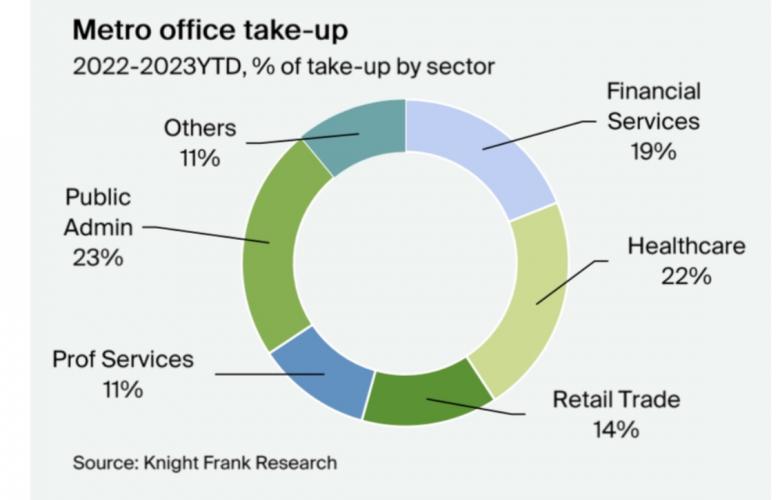

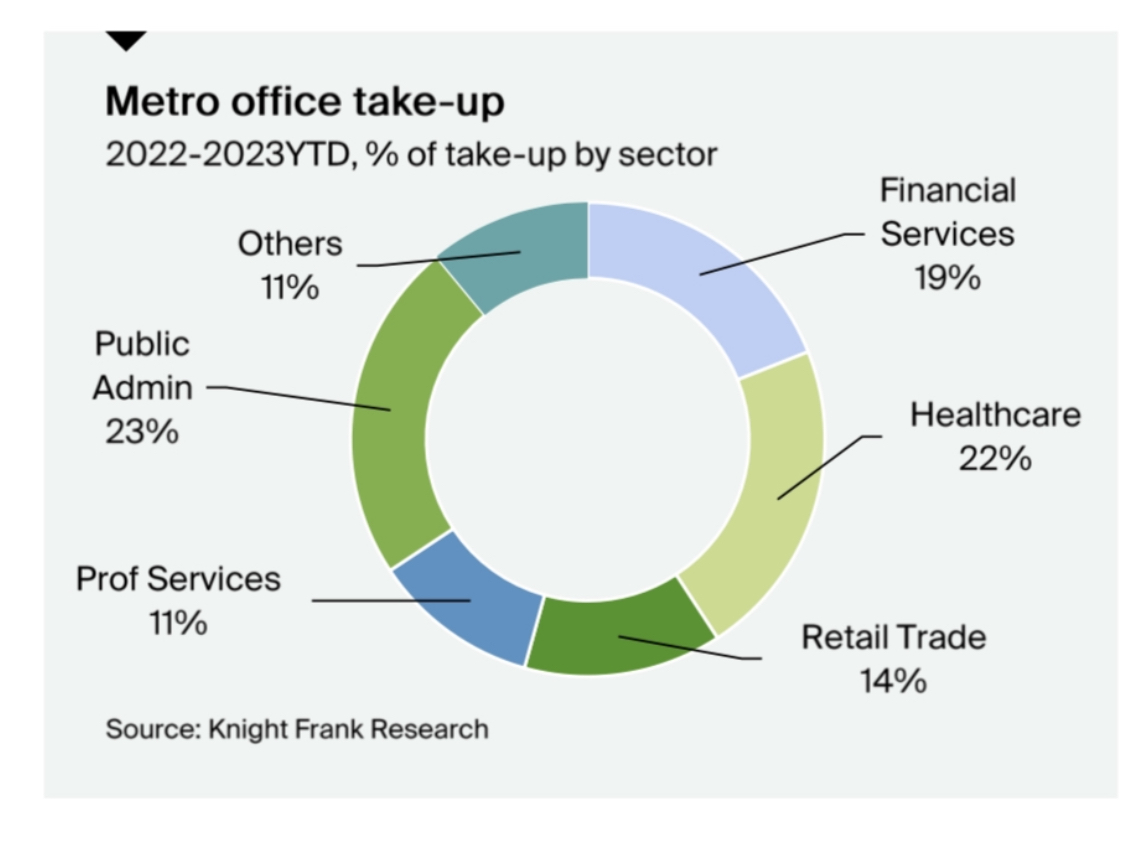

“Compared to the CBD, the Metro area continues to benefit from its tenant client mix.

“While 2022 started off strong for financial services, with 56 per cent of overall take up, space requirements fell back in this sector in 2023.

“However, public administration has filled the gap this year, and with health care, professional services and real estate all increasing their share of take up, with the latter rising from 4 per cent to 14 per cent, the diversified base provides a small but steady amount of demand in the wider metro area.”

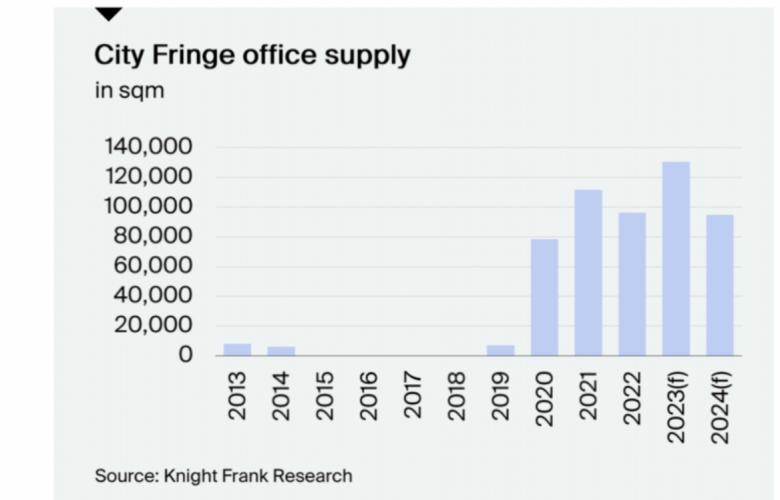

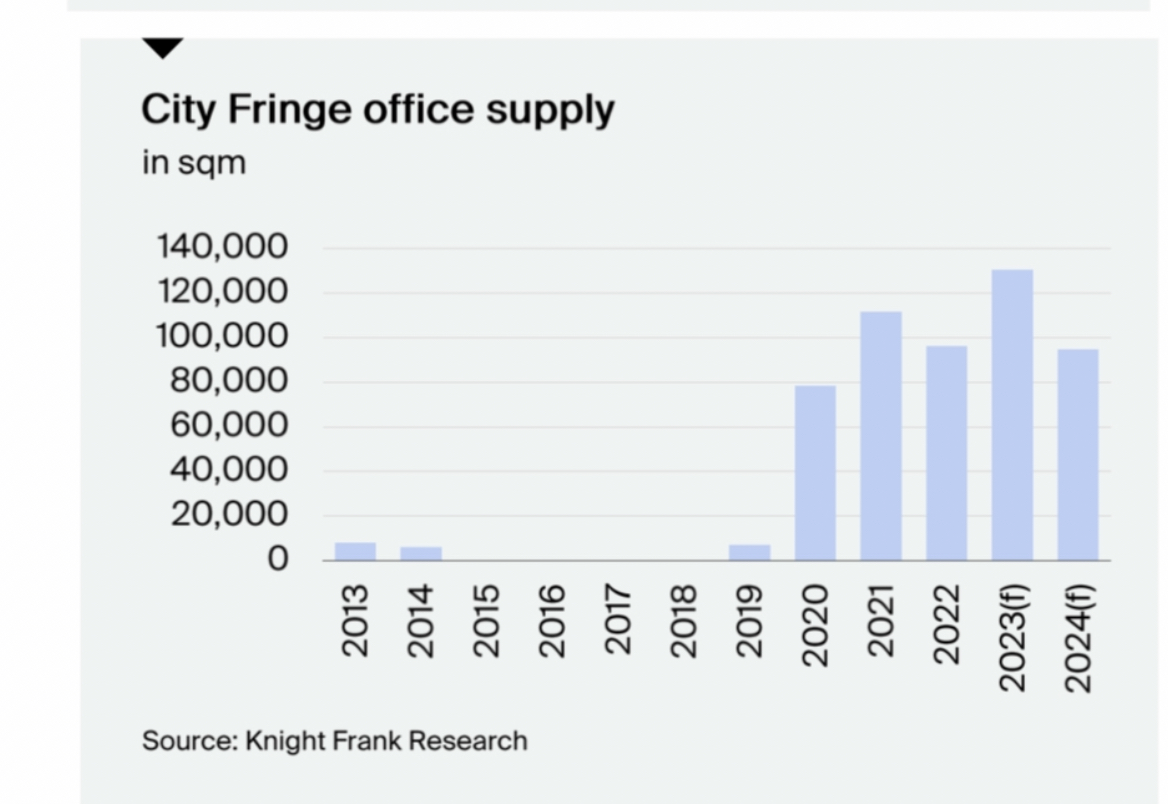

The Knight Frank research found the City Fringe will see record new developments in 2023, with over 130,000sq m expected to be delivered, however the supply pipeline is expected to slow down somewhat in 2024. The metro office market will see limited new developments.

“With tenant demand stable and reduced new supply expected to arrive next year, vacancy rates in the City Fringe are expected to remain low in the near future,” Dr McGough said.

“Overall there has been a tick up in vacancy rates metro wide to 7.9% but within a fairly tight band.

“Going forward there are major projects lined up for early 2024, including One Middle Road (20,000sq m) and 633 Springvale Road (8,600sq m), which will put some pressure on the vacancy rates outlook in the metro area in the short term.”

Dr McGough said the City Fringe and Metro areas were more resilient than St Kilda Road, which was affected by a weakening of tenant demand in the neighbouring CBD.

“The major refurbishment of Mirvac’s 380 St Kilda Road, providing high quality space positioned just opposite the new ANZAC train station, should provide evidence as to the strength of the location in attracting new tenants.”

The Knight Frank research found net face rents have remained stable across the markets, however incentives have risen again, leading effective rents lower.

Click here to view and download the report.