Adelaide CBD office leasing market a beacon of light, with opportunities for landlords to add value as investment market stabilises - Knight Frank

Contact

Adelaide CBD office leasing market a beacon of light, with opportunities for landlords to add value as investment market stabilises - Knight Frank

Recent cash rate pauses and increasing demand for high-quality CBD space is breathing renewed optimism into the Adelaide CBD office market, according to the latest research from Knight Frank.

Recent cash rate pauses and increasing demand for high-quality CBD space is breathing renewed optimism into the Adelaide CBD office market, according to the latest research from Knight Frank.

Knight Frank’s Adelaide CBD Office Market Report found the leasing market had been a beacon of light this year amidst a subdued investment market caused by the rising cost of capital, with robust tenant demand and rental growth offsetting the extent of value diminution.

“Tenant demand, particularly for prime space, has been strong and rents have consequently risen,” said Knight Frank Partner, Research and Consulting Dr Tony McGough.

“Adelaide had been nation leading in CBD office occupancy in 2023, with the last recorded occupancy data released by the PCA in March showing Adelaide up to 80% of pre-COVID occupancy, signifying a positive outlook for the Adelaide leasing market and CBD building owners.

“Despite strong tenant demand, the vacancy rate rose slightly from 16.1% to 17% over the first half of 2023 due to supply additions of 87,016 square metres, which was a historic high.

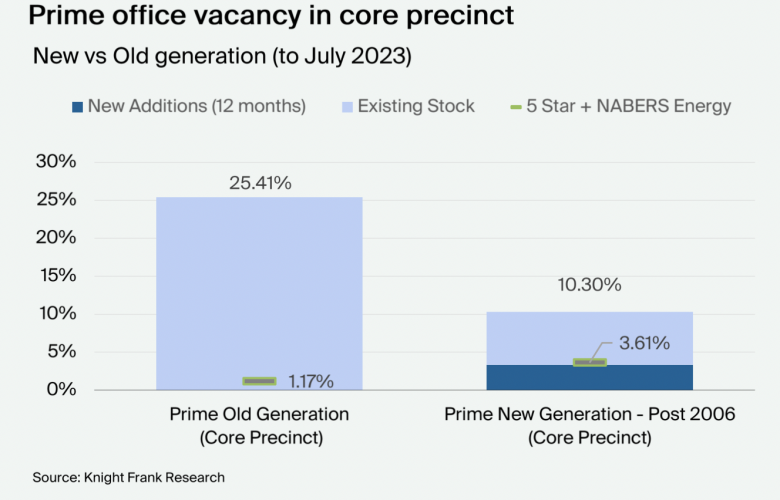

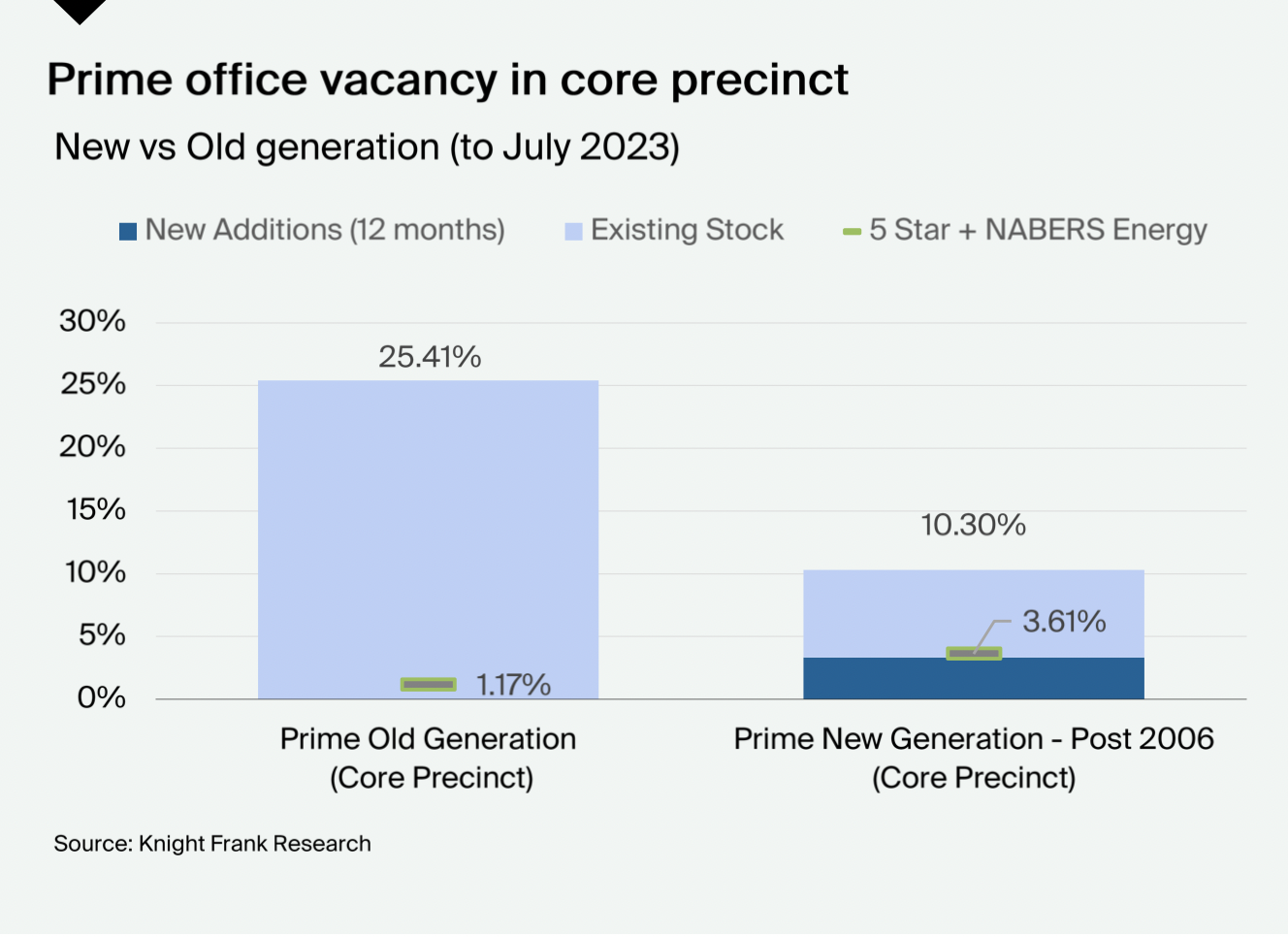

“There is clearly higher demand for prime stock, as we are seeing in every capital city around Australia, which is evident in the vacancy rate of 10.3 per cent for new generation prime CBD stock within the core precinct.

“Older prime core stock exhibits a markedly higher vacancy rate of 25.4 per cent, underscoring a substantial demand disparity between these two categories.”

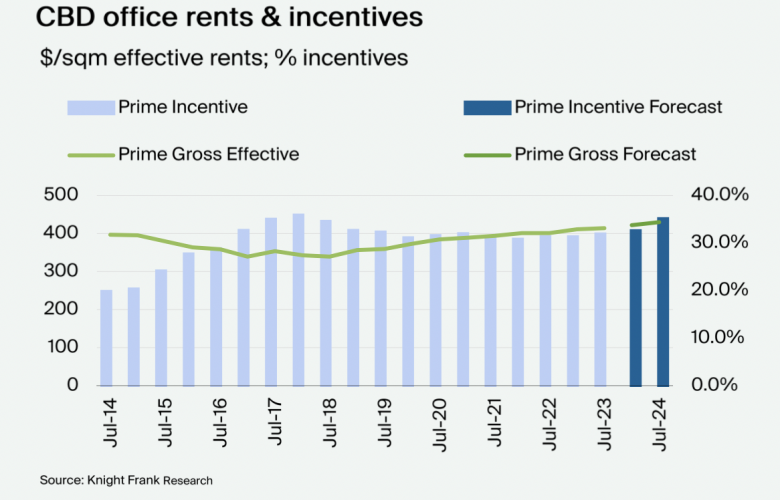

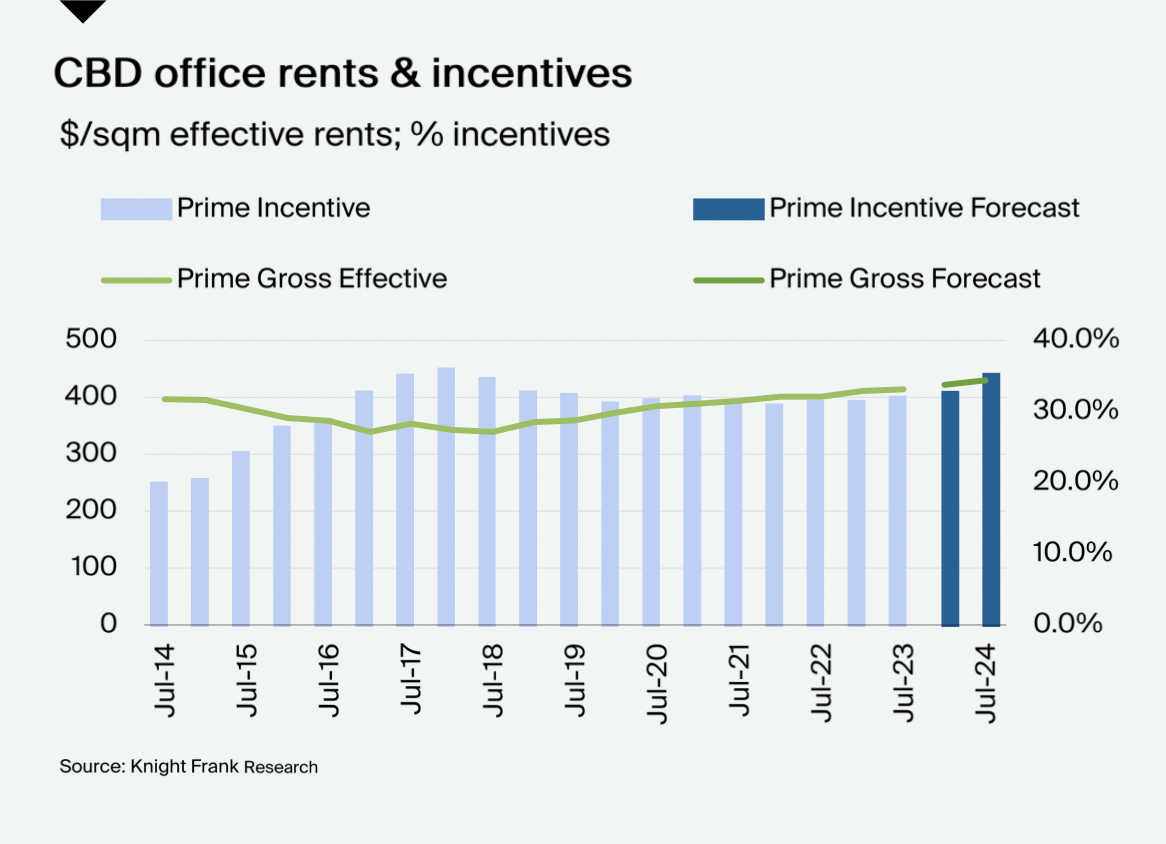

The Knight Frank report found gross rents have risen, and look to continue that way. As of July 2023, the Adelaide CBD’s average gross effective rents for prime and secondary stock increased by 3.4% and 2.7% respectively year on year to $414/sq m and $276/sq m.

“Forecasts have prime effective rents increasing another 3.7% over the next 24 months,” Dr McGough confirmed.

Knight Frank Partner, Valuation and Advisory Nick Bell said the Adelaide office market was at a major transition point in the standard of accommodation as a record amount of new supply comes online.

“Owners of older vacant stock need to commit to major reinvestment to compete for tenants,” he said.

“Indeed the Adelaide CBD is witnessing a rise in refurbishments, with one such project being 150 Grenfell Street - this building is undertaking a full scale reconstruction including a new façade and all new services, with a point of focus being on its environmental sustainability credentials. It will offer over 9,300sq m of brand new space once complete in early 2024.

“It’s expected that low A-grade property will see a rise in incentives as building owners try to backfill vacancy.

“Incentives are already rising, with average incentives for prime and secondary space up slightly in H1 from 31.2% to 31.8% and from 37.3% to 37.9% respectively.”

Opportunities for building owners to add value while waiting for investment market to stabilise

Total CBD asset sales over $10 million in value in Adelaide’s CBD office market totalled $217.6 million in the six months to July 2023, which is 40% lower than the $363.3 million in H1 2022, but 256% higher than the $61 million in H1 2021.

An additional $71.6 million has settled or is settling post July 2023.

Adelaide CBD prime yields softened 97 basis points from 5.84% to 6.81% over H1 this year, with the yield spread to Sydney widening 63 basis points to a current differential of 165 basis points.

The Knight Frank research found that while the investment market stabilises there are opportunities for building owners looking to backfill vacancy to capitalise on ESG and ‘flight to quality’ trends to remain competitive and boost occupancy and rents.

Knight Frank Director Institutional Sales in South Australia Max Frohlich said: “We continue to experience capital gravitate towards core-plus and value-add assets where the increased cost of capital can be offset with enhanced returns from active management initiatives, which often include building efficiency upgrades.

“Interestingly, our data shows the vacancy rate for prime assets positioned in Adelaide’s core precinct with strong environmental initiatives - a 5 Star NABERS energy rating or greater - is only 4.78%, compared to Adelaide’s overall vacancy rate of 16.8% for prime assets.

“This stock represents around 59% of prime office space in the core precinct and we see a genuine opportunity for owners (and incoming purchasers) of the remaining 41% of stock to enhance the lower performing assets, not only from a greater tenant demand side of the equation but also a push from the capital side.

“One example is major banks offering considerable discount for green debt products with little-to-no margins and/or establishment fees waived to fund building energy enhancements – it’s a no brainer.”