Knight Frank reveals its top 7 predictions for the commercial property market in 2024

Contact

Knight Frank reveals its top 7 predictions for the commercial property market in 2024

An improved vintage awaits the commercial property market next year, with 2024 to be a better year to acquire assets, according to Knight Frank’s Australian Horizon 2024 report.

An improved vintage awaits the commercial property market next year, with 2024 to be a better year to acquire assets, according to Knight Frank’s Australian Horizon 2024 report.

The forecast is one of 7 top predictions to come out of the real estate consultancy’s flagship report, which provides predictions for the commercial property market over the next 12 months, including emerging trends, opportunities and challenges.

Knight Frank’s Top 7 Property Predictions for 2024

- An improved vintage awaits investors: 2024 will be a better year to acquire assets

- Tilt to core strategies to drive sustained living sectors expansion

- End of the NICE era has important implications for investment strategy

- Wide divergence in yield impact depending on perception of risk and rental growth prospects

- New sustainability reporting requirements will raise the bar for real estate

- Slowdown in office development to create conditions for future shortages of new supply

- Global comparisons show that industrial rents have further to rise

Prediction 1: An improved vintage awaits investors: 2024 will be a better year to acquire assets

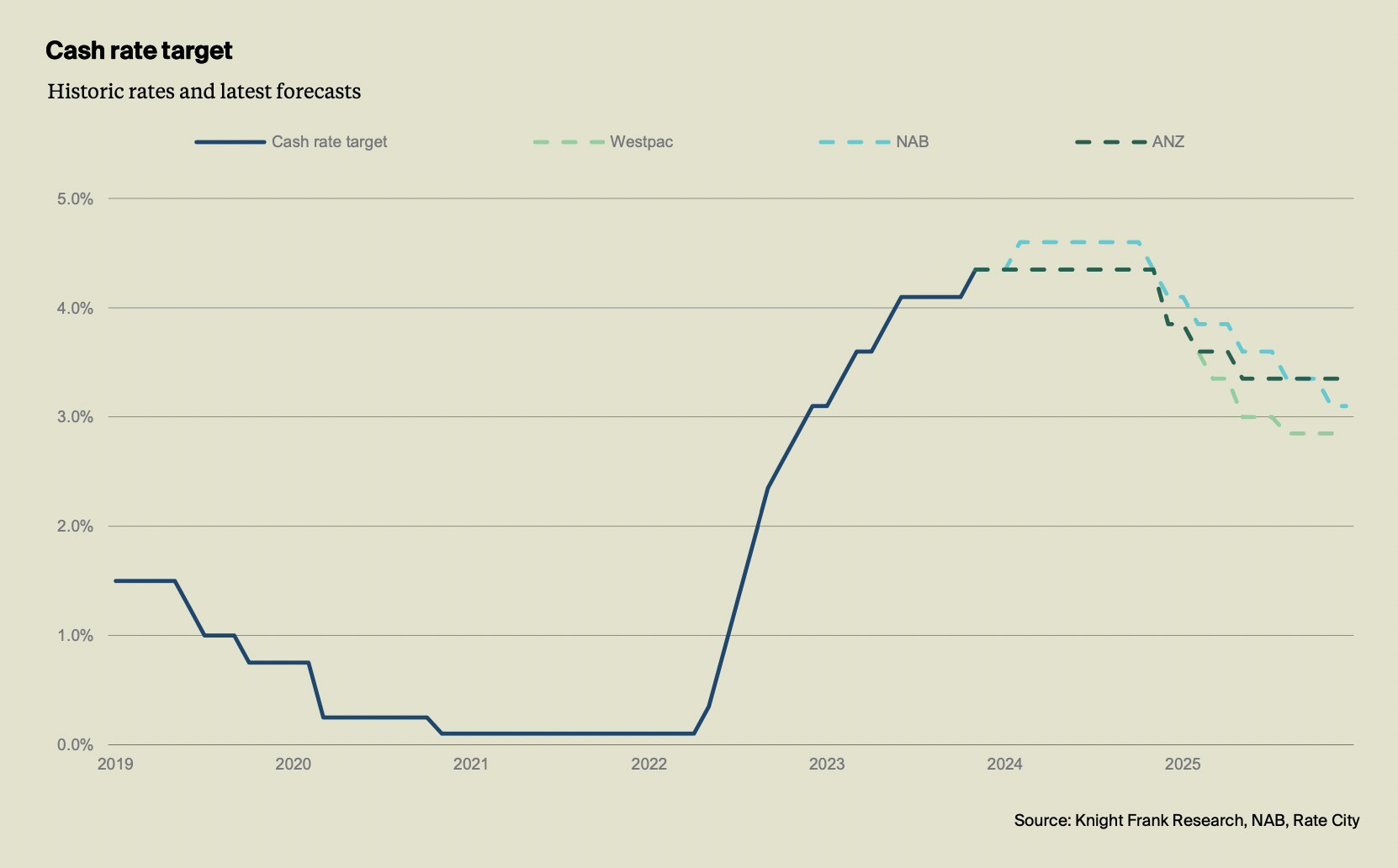

After a tumultuous period over 2022 to 2023, the commercial property market can look ahead to consolidation and the prospect of a recovery emerging in 2024, said Knight Frank Chief Economist and report author Ben Burston.

“The sustained pressure of higher rates has naturally put pressure on asset values and this is still playing out to varying degrees,” he said.

“Part of the uncertainty has been a disconnect between formal valuation metrics and market sentiment. However, with more deal evidence now coming through and formal valuations likely to be adjusted further in the December cycle, we expect the gap between sentiment and formal valuations to erode substantially over the next six months so that by mid-2024 the picture will be clearer for buyers and sellers alike, helping to restore confidence and liquidity.”

Mr Burston added that while reductions in asset value are never welcome, the flipside is the re- emergence of value looking forward.

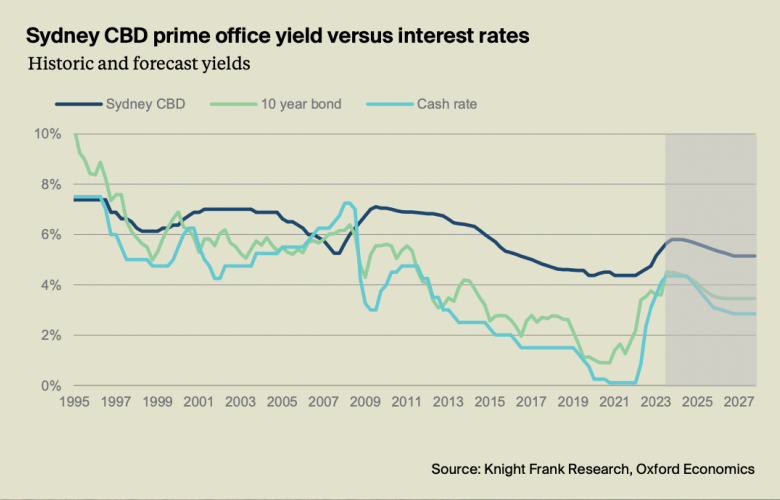

“Higher yields act to reset the market and provide a more attractive entry point for investors, generating the prospect of higher returns,” he said.

“This is clearly illustrated when we assess historic market cycles and the performance achieved after pricing is reset in the aftermath of interest rate hiking cycles. The period immediately after the conclusion of the rate hike cycle ending in 1994, 2000 and 2010 was in each case a very attractive time to buy, achieving above average returns over the following five years.

“This is not to say that history will repeat, and investors cannot take for granted that interest rates will fall exactly as anticipated. But careful asset selection will maximise the chances of strong performance whether it is achieved through income growth or boosted by a return to yield compression as interest rates revert in 2024-26.”

Prediction 2: Tilt to core strategies to drive living sectors expansion

When it comes to asset selection, the wider shift in the global investment landscape that has seen investors seek greater exposure to alternative sectors is predicted to continue in 2024, according to the Knight Frank Australian Horizon 2024 report.

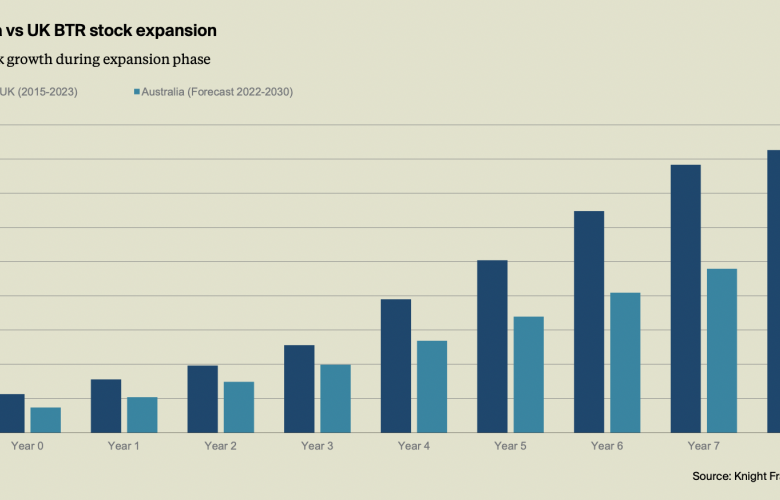

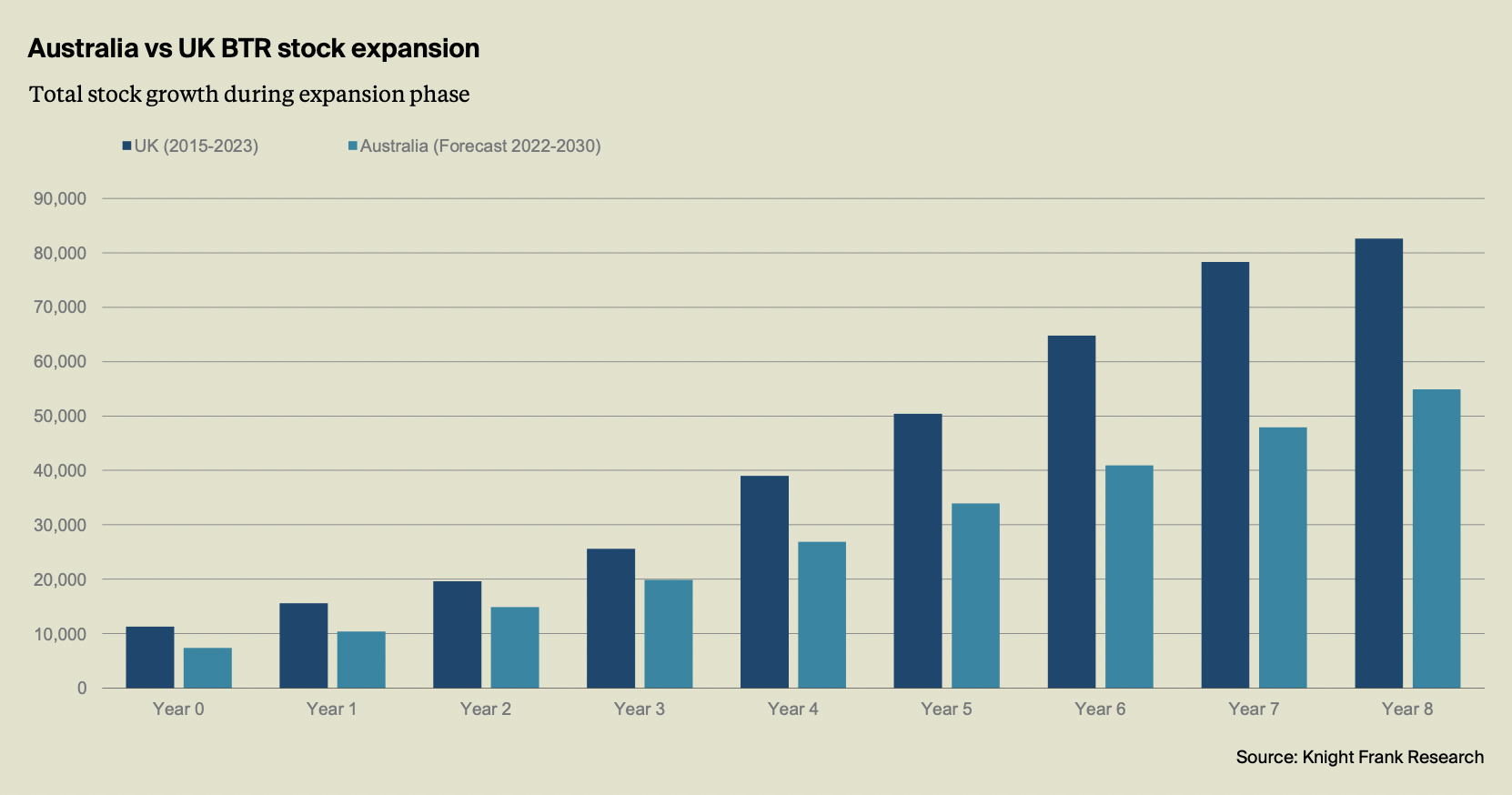

Within the alternative sectors, residential living sectors are in vogue, led by build-to-rent (BTR) but also encompassing student accommodation and retirement living.

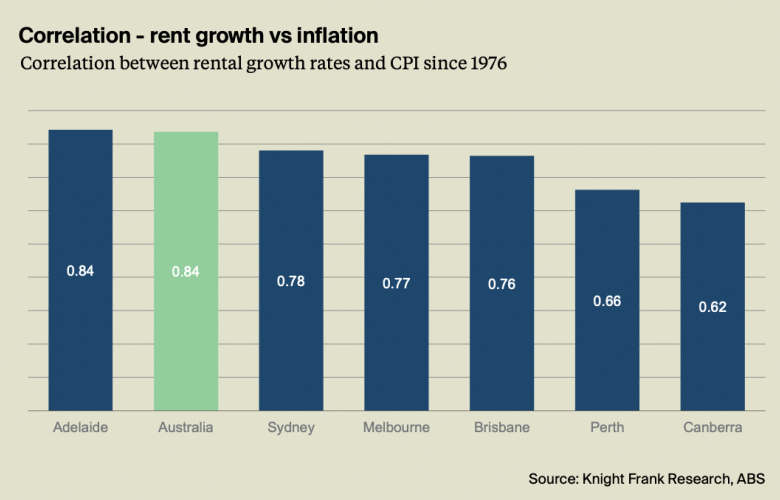

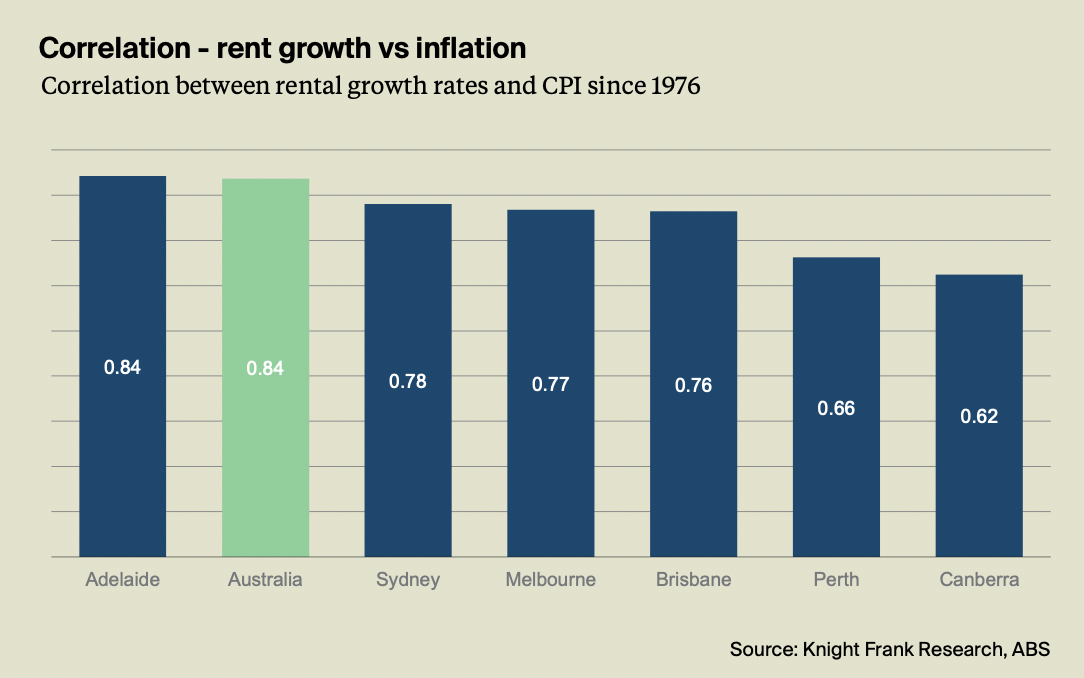

“The shift to living sectors is part of a wider shift from major institutions globally to focus predominantly on core investment strategies as they seek more exposure to the relative stability of the living sectors in response to a more uncertain global economic outlook,” said Knight Frank Head of Alternatives Tim Holtsbaum. “Related to this, investors are also gravitating toward living sectors because they offer the ability to adjust rental income streams more quickly than other sectors in response to high inflation.

“These drivers will remain in place in 2024, and we expect a further expansion of interest in BTR and other living sectors to be reflected in continued growth of the pipeline and additional capital partnerships being formed. However, we expect to see more variation in the strategies of different investors, with groups seeking large scale defensive investments favouring BTR while groups with a higher return target will gravitate to other assets types such as co-living and student accommodation.”

Prediction 3: End of the NICE era has important implications for investment strategy

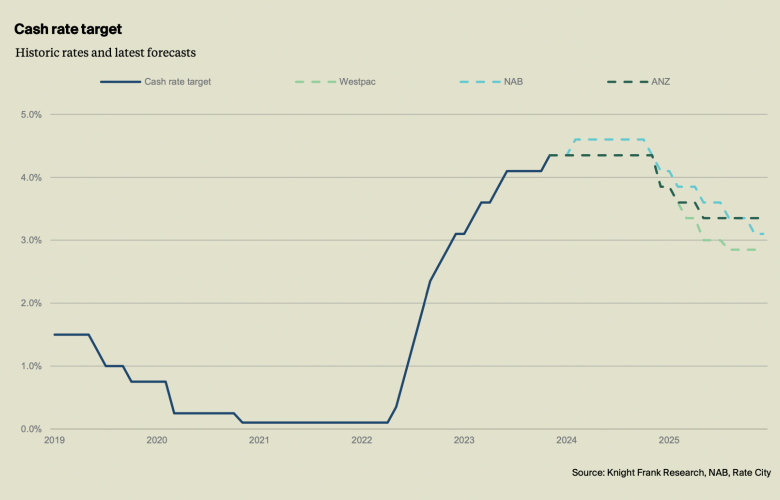

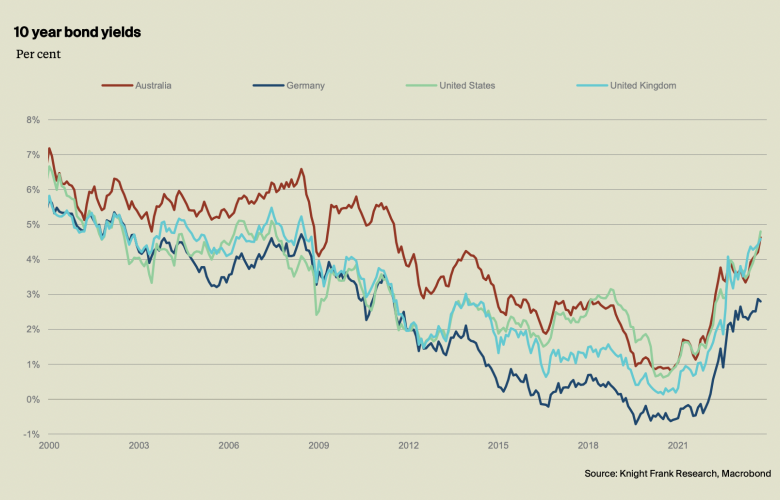

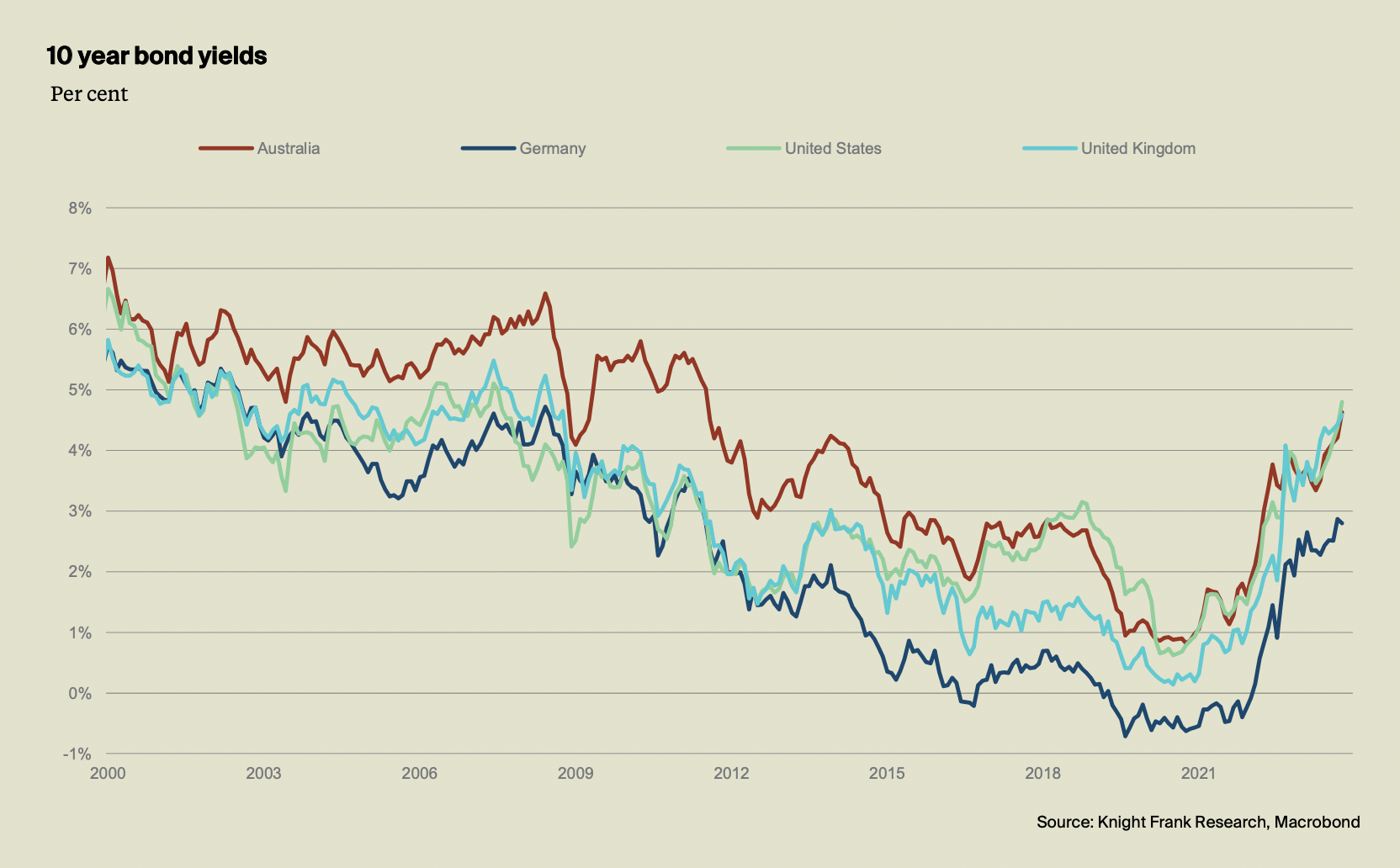

Former central banker Mervyn King coined the acronym NICE when referring to the end of global macroeconomic conditions that have driven a ‘non-inflationary consistent expansion’. NICE conditions have prevailed in Australia for many years, with inflation barely registering as a concern for investors since the early 1990s. Now, however, we see evidence that expectations are shifting, with higher bond yields globally signalling the expectation that rates will not swiftly return to the low levels that prevailed in 2016-21.

The Knight Frank report found this was partly due to Australia’s strong fundamentals, with a strong long-term growth outlook once we get through the current hiking cycle. However, this growth may come alongside a more variable outlook for inflation and interest rates over the next decade.

“Lower rates may return, but they are unlikely to return to the lows of 2016 to 21 and investors will need to strategise for multiple scenarios,” said Mr Burston.

Prediction 4: Wide divergence in yield impact depending on perception of risk and rental growth prospects

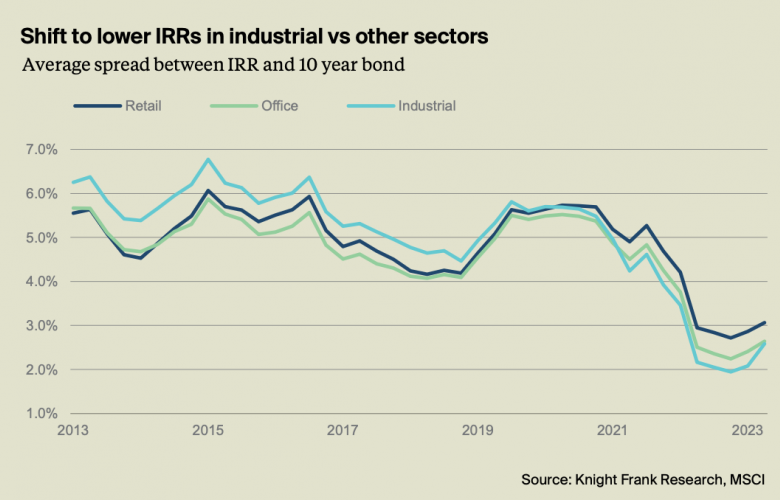

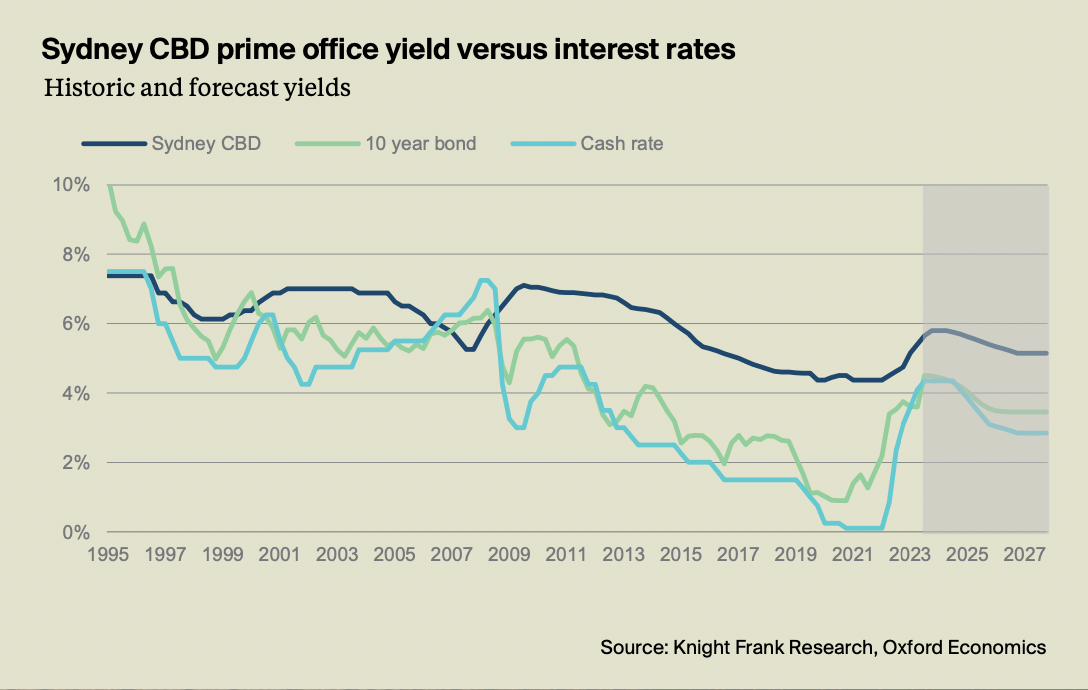

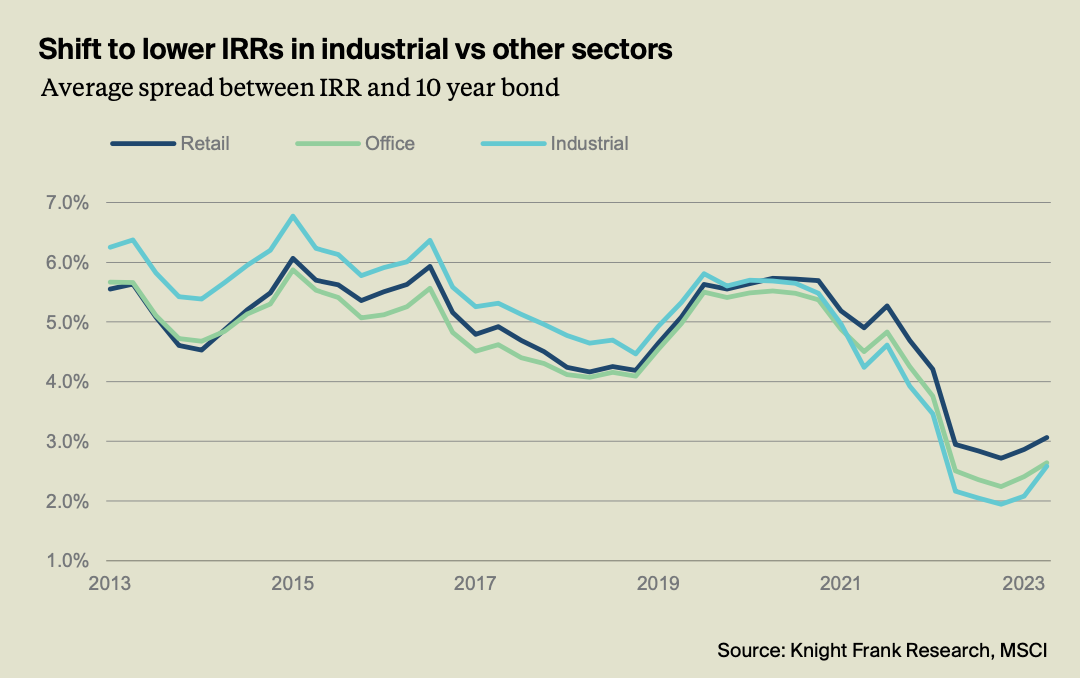

The Knight Frank Australian Horizon 2024 report found it was clear there would be divergent impacts on pricing in the commercial property market owing to the very different ways in which higher return targets will be achieved by different property types.

“Core assets that are perceived to offer better income security will trade at tighter internal rates of return (IRR), and for those that also come with strong income growth prospects this will imply that a given return target can be achieved with a lower yield,” said Mr Burston.

“On the other hand, weaker quality stock is likely to be perceived as higher risk and offering less income growth potential, so yields will need to be significantly higher to achieve a given return target.

“This plays relatively well for industrial assets, which are benefitting from strong rental growth and tight supply that is starting to appear structural rather than purely cyclical.

“For office and retail assets, there will be a sharp divergence depending on asset quality and perceived growth potential. Prime assets that are the demonstrated preference of tenants and consumers within their local market and are experiencing rental growth associated with the recognised flight to quality will also see a reduced shift in required return targets and hence reduced yield shift.

“However, assets facing heightened vacancy risk and without the prospect of seeing effective rents rise in the near term will suffer a larger shift as investors demand a higher premium for risk. In these cases, the yield shift experienced will also be larger because investors will perceive that a higher proportion of the return over the medium term will need to be achieved via income as opposed to future growth.”

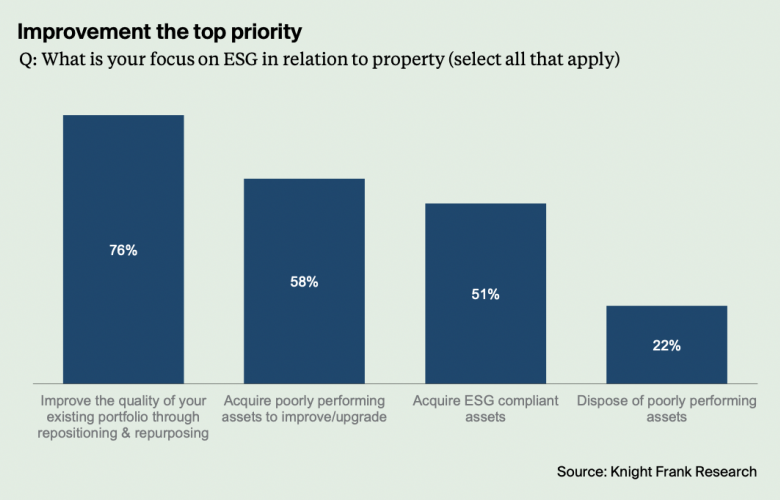

Prediction 5: New sustainability reporting requirements will raise the bar for real estate

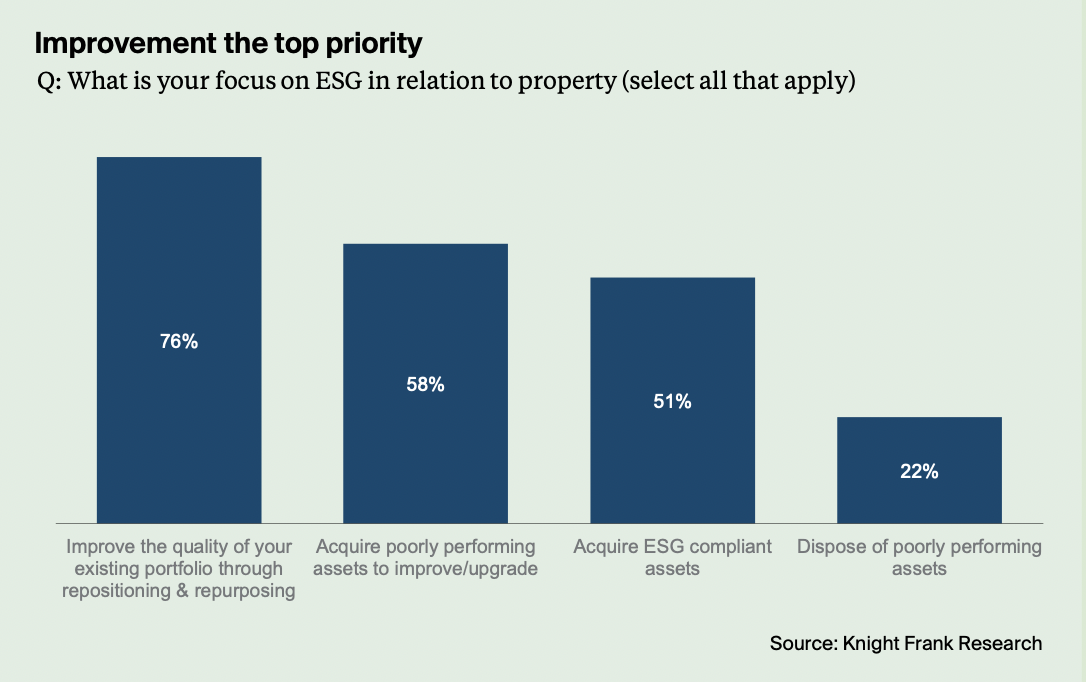

Another key prediction from the Knight Frank Australian Horizon Report 2024 is that new mandatory sustainability reporting requirements will raise the bar for real estate over the coming 12 months, requiring investment in data and processes.

The new standards mark a huge shift in reporting requirements - up until now there has not been a need to provide hard data, but now businesses will need a report with audit-ready data and this will be transformational for property.

It will require businesses to get on the front foot now with improved processes for capturing and storing data so they are not caught off guard when their reporting deadlines hit, with the reporting being phased in from financial year 2024-25.

Prediction 6: Slowdown in office development to create conditions for future shortages of new supply

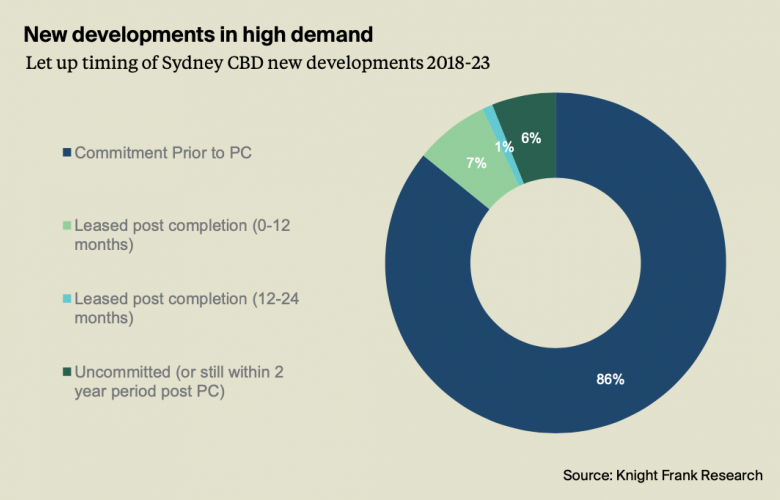

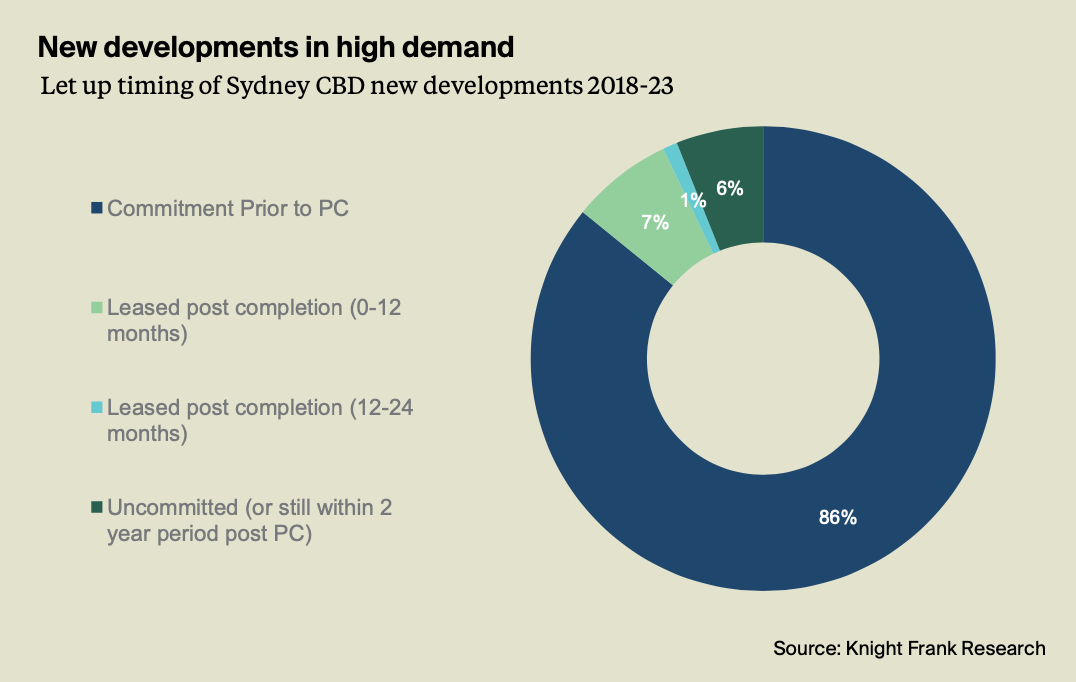

The Knight Frank Australian Horizon 2024 report found several factors are pushing against new commencements for office developments in 2024, with developers likely to find it difficult to meet feasibility thresholds in the face of rising construction and funding costs, amidst a backdrop of higher yields impacting asset values. In addition, higher vacancy rates and elevated incentives are traditional signals pointing to a need for caution.

“However, a slowdown in commencements will impact the pipeline in 2027 and beyond, and even at this early stage it is possible to identify a risk of a shortage of prime space later in the decade,” said Mr Burston.

“While overall market vacancy rates may remain elevated for some time, the demonstrated strength of tenant demand for newly built space will mean a potential shortage of new buildings at this time.”

Prediction 7: Global comparisons show that industrial rents have further to rise

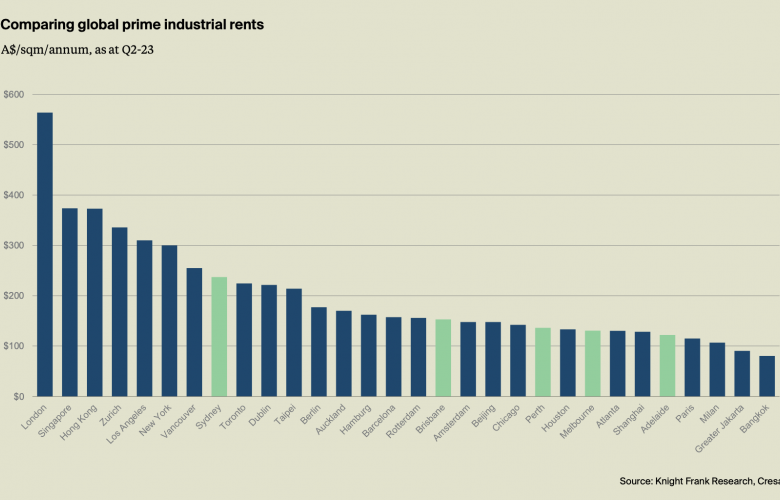

Off the back of sustained and substantial increases to industrial rents over the past three years across all markets, a key question being asked in the industrial market as we head into 2024 is ‘Does the current phase of rental growth have further to run?’ The Knight Frank Australian Horizon 2024 report found that the answer is yes.

The first reason for this is that an assessment of rental costs as a proportion of total operational costs suggests that rents are not presenting an unmanageable burden, representing even less than five per cent to up to 10 per cent for most occupiers.

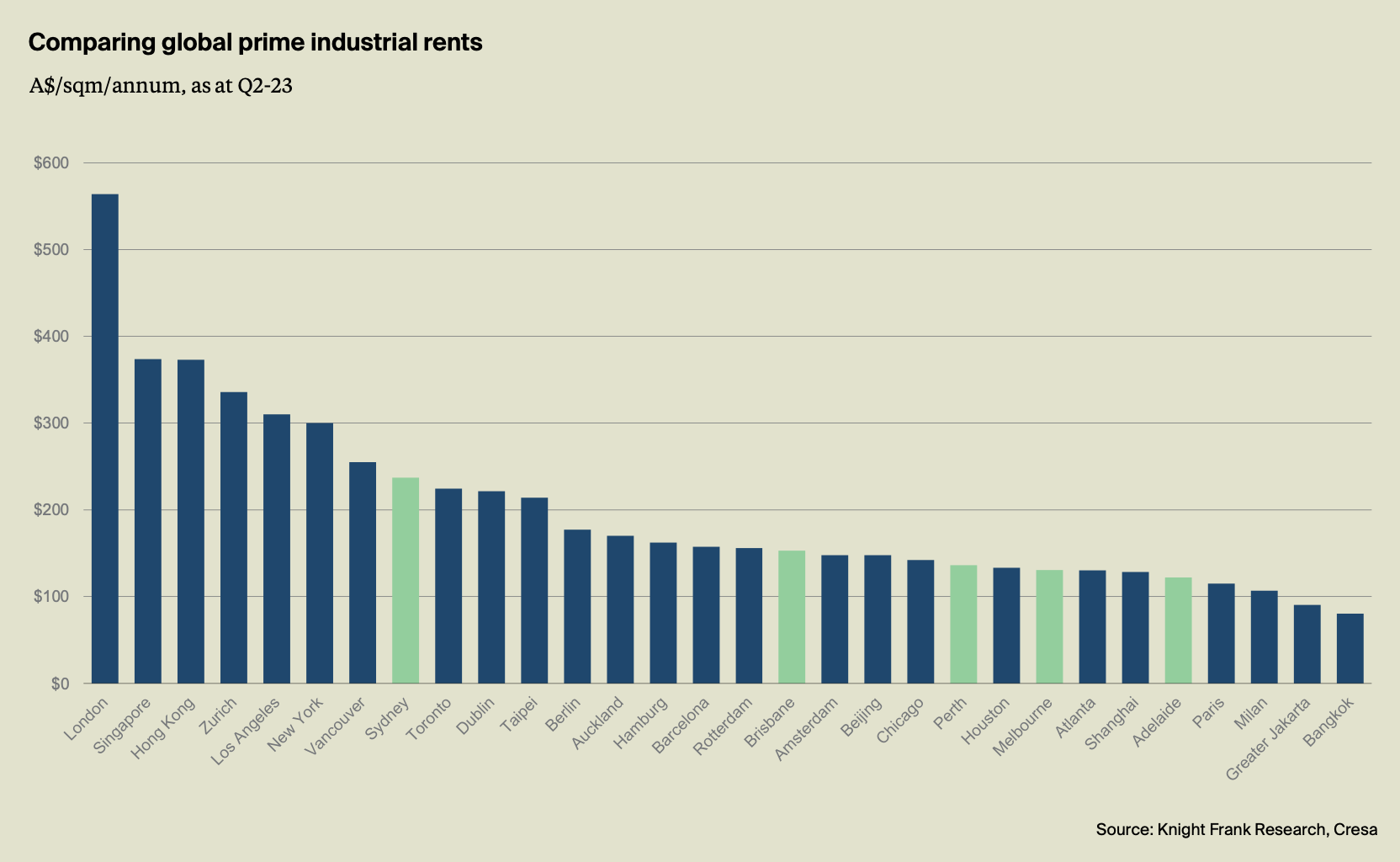

Secondly, rents in Australia are by no means out of line with the level of rents in comparable cities globally, most of which have also seen a sharp rise in recent years.

Comparing Australia’s current prime industrial rents to other major economies indicates that the rent levels in our markets fall in the middle of the pack when compared on a like-for-like basis and the growth experienced has been in keeping with, rather than running substantially ahead of, the rise experienced in other major markets over the past five years.

Amidst rapid population growth and ongoing supply shortages, rents can be expected to continue to grow, although the pace of growth will be more modest than in 2022-23 and greater differentiation between the pace of growth for prime and secondary can be expected.