2024: Industrial, Hotels, and Alternatives Top 3 on Investors’ Wish List says Savills Australia’s Spotlight on 2024 Report

Contact

2024: Industrial, Hotels, and Alternatives Top 3 on Investors’ Wish List says Savills Australia’s Spotlight on 2024 Report

Savills Australia’s Spotlight on 2024 Report, Savills expects that ongoing strong population growth and a recovery in tourism will continue to boost consumer demand, supporting demand for space in the industrial, retail, and hotels sectors says Paul Craig, CEO and National Head of Capital Transactions at Savills Australia & New Zealand.

According to leading agency Savills Australia’s Spotlight on 2024 Report, industrial, hotels, and alternatives will be among the most popular asset classes in 2024, as greater clarity around the interest rate outlook and further pricing adjustment drives a recovery in investment activity. Savills expects that ongoing strong population growth and a recovery in tourism will continue to boost consumer demand, supporting demand for space in the industrial, retail, and hotels sectors.

Residential investment, including the emerging build-to-rent (BTR) sector, will become increasing attractive as population growth, coupled with limited supply of housing, drive an acute shortage of housing. Strong investor interest in student accommodation is also expected in 2024, says Savills, driven by the rebound in international student flows.

“The sectors that are benefitting the most from tailwinds are industrial and logistics, hotels, multi-family residential and student accommodation, and these sectors remain attractive to investors due to robust population growth, and the rebound in tourism and international education,” said Chris Naughtin, National Director, Capital Markets – Research at Savills Australia & New Zealand.

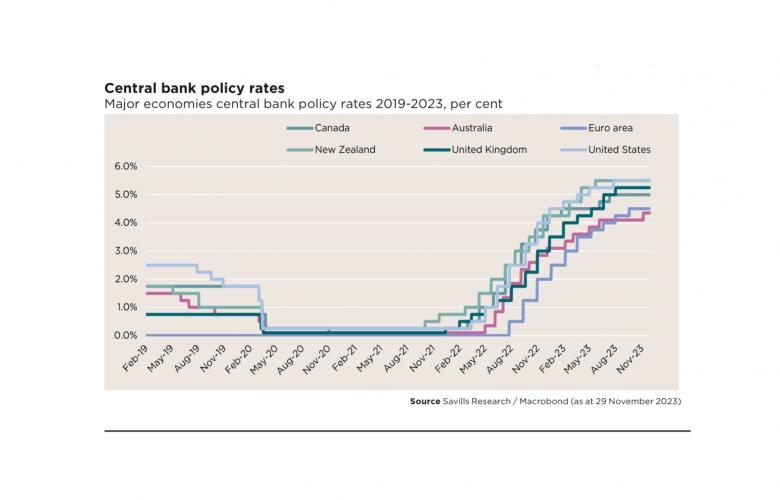

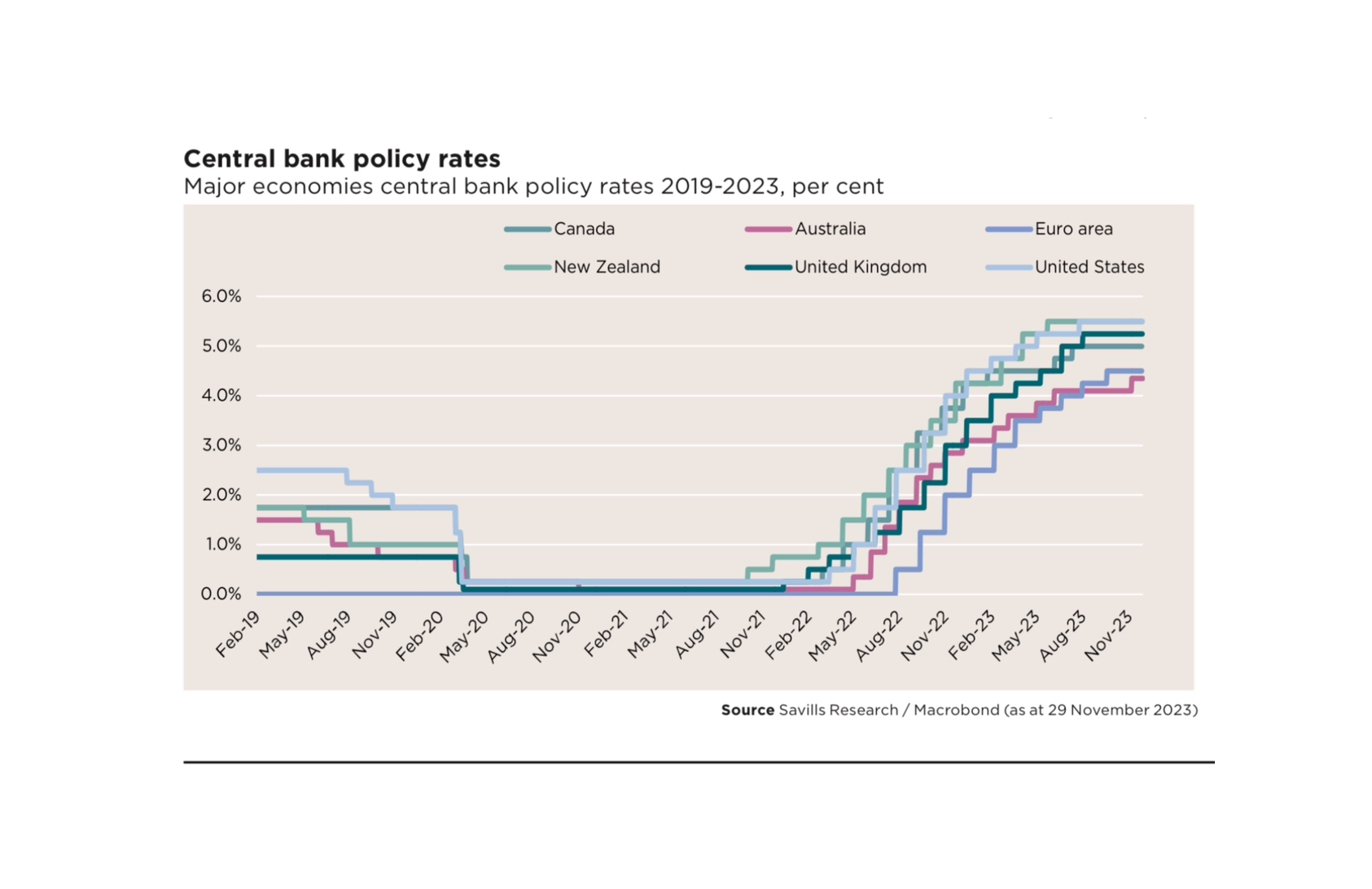

2024 & beyond: Slowing growth and inflation will see central banks pivoting to rate cuts

The Savills Spotlight on 2024 report predicts the global economy will slow next year but avoid a hard landing while inflation continues to moderate. In Australia, inflation will slow but remain sticky, with population growth adding to services price pressures and housing costs. While the RBA is expected to lag other major central banks in cutting interest rates, economists generally expect several cuts in interest rates towards the end of next year, with an expectation that the cash rate will be at 3.85% by the end of 2024.

Despite the general expectation of a shift to lower rates by late next year, rising volatility in bond markets points to the difficulty pricing the probability of interest rate cuts. Yields on 10-year Australian and US government bonds declined by around 40bps during the first three weeks of November after having risen by nearly 100bps over the three months to October.

“The exceptional volatility in bond markets in recent weeks highlights the potential for rapid and abrupt changes to the outlook,” Mr. Naughtin said.

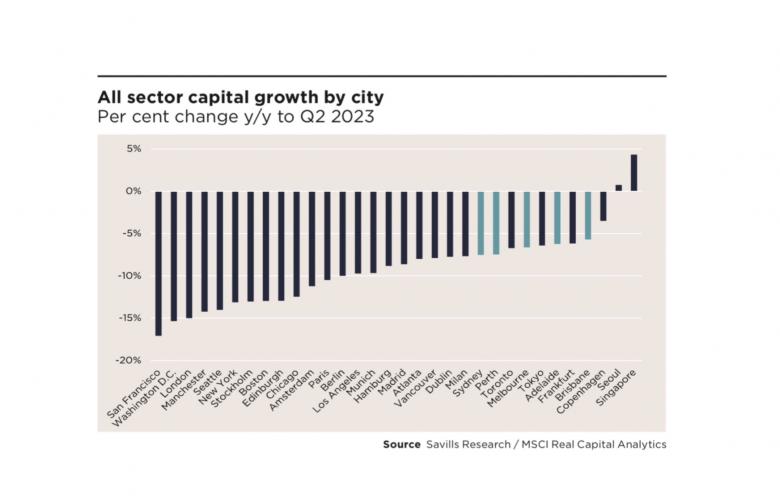

Capital Markets Impacts: Investment market recovery but not until late 2024

Interest rate stability and further pricing adjustment will reduce the gap between buyer and seller expectations and help fuel a recovery in investment market activity.

“We expect investment activity will gradually gain momentum in 2024, with ongoing subdued activity in the first half of the year and the recovery gaining more traction later in the year and into 2025,” said Paul Craig, CEO and National Head of Capital Transactions at Savills Australia & New Zealand.

Fundraising activity has fallen sharply over the year to date and points to ongoing subdued activity in capital markets the near term. However, dry powder remains ample, with around US$850 billion in unallocated capital sitting in global closed-ended funds targeting real estate according to RealfinX, highlighting the vast amount of capital ready to deploy.

Moreover, investor perceptions of real estate investment opportunities are improving, with the “Conviction Index” in the 2023 Institutional Real Estate Allocations Monitor rising to the second-highest level since the index inception in 2013, reflecting increasing optimism that buying opportunities will emerge as valuations continue to adjust to higher interest rates.

2024 – Savills’ Trends to Watch

Continued focus on industrial (and data centres, cold storage). Population growth and ongoing expansion of e-commerce (and technology) will sustain the demand for industrial floor space.

Alternative asset classes among the most preferred. The report predicts a further reweighting towards alternatives asset classes including data centres, residential, childcare, and healthcare, as well as industrial and logistics.

Investors to back student accommodation. Another attractive alternative asset class for investors is student accommodation, which is expected to receive ongoing investor interest in 2024, driven by a rebound in international student arrivals, rising occupancy, and strong rental growth.

Investor interest in hotels but buyers more cautious. Australia’s migration boost will also contribute to the underlying domestic demand for tourism and hotels, with CBD and gateway locations amongst the most attractive. This will drive investment demand, but buyers will be more selective as hotel occupancy rates normalise.

Residential rental growth to maintain momentum. According to the Spotlight on 2024 report, capital will chase scale in residential and build-to-rent, as the ongoing low vacancy of housing stock across the country continues to drive rental growth. Rental affordability is expected to remain a challenge throughout 2024.

Prime will be fine. The Spotlight on 2024 Report predicts that prime offices will remain a resilient asset class, with the economic outlook reinforcing the ‘flight to quality’ trend. As the multi-speed leasing market continues, secondary offices are tipped to be at greater risk of negative rental growth. Hybrid office working will increase the appeal of core locations and may see the rationalisation of larger mandates, particularly outside of CBDs.

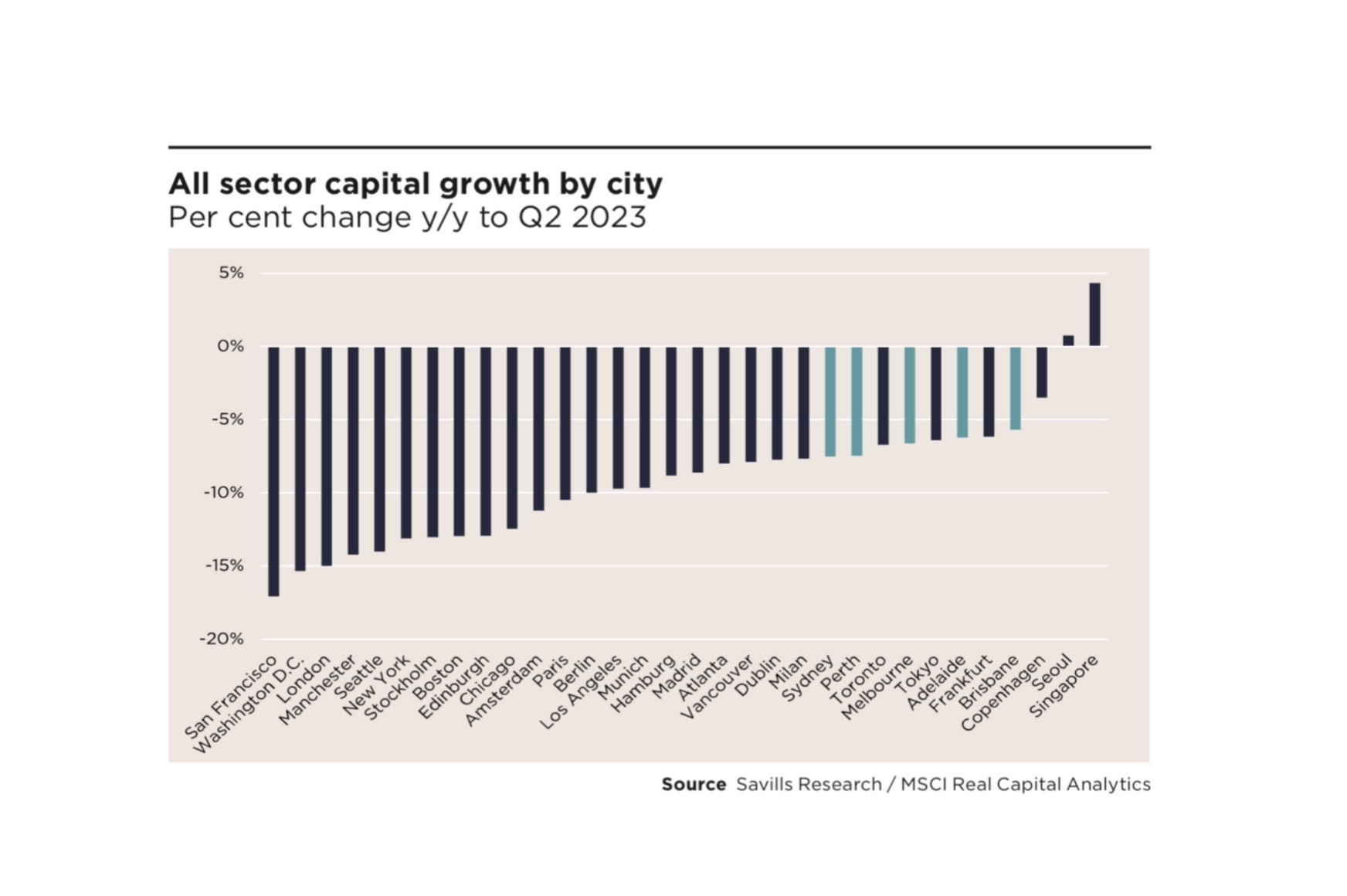

Capital values will fall further but some sectors will be resilient. Expect further contraction in capital values but this will vary by sector, with capital values holding up better in sectors with stronger rental growth prospects such as beds (accommodation) and sheds (industrial).

Expect investment market liquidity to increase. Capital market liquidity will be boosted by more motivated sellers, including open-ended funds under pressure from cash redemptions and capital recycling for redeployment opportunities.

Investors to divest low-grade assets. Some of the most significant transactions in 2023 have involved large institutional investors selling out of relatively low-quality assets that are exposed to significant leasing risk to fund future development pipelines. Savills expects this trend to gain further momentum in 2024, as investors look to rebalance their portfolios and redeploy capital to opportunities with stronger risk-return prospects, further adding to investment market liquidity.

To download a copy of The Savills Spotlight on 2024 report click here or visit the contact details below:

Related Reading:

Salter Brothers acquires first hotel in South Australia – Sofitel Adelaide - Savills

Award-winning commercial agent Benson Zhou Joins Savills Hotels team

Eastern Creek Industrial Site sold for $180 million to LOGOS in off market sale by Savills