More positive signs for the office sector as sublease space shrinks in most CBDs - CBRE’s latest H2 2023 Sublease Barometer

Contact

More positive signs for the office sector as sublease space shrinks in most CBDs - CBRE’s latest H2 2023 Sublease Barometer

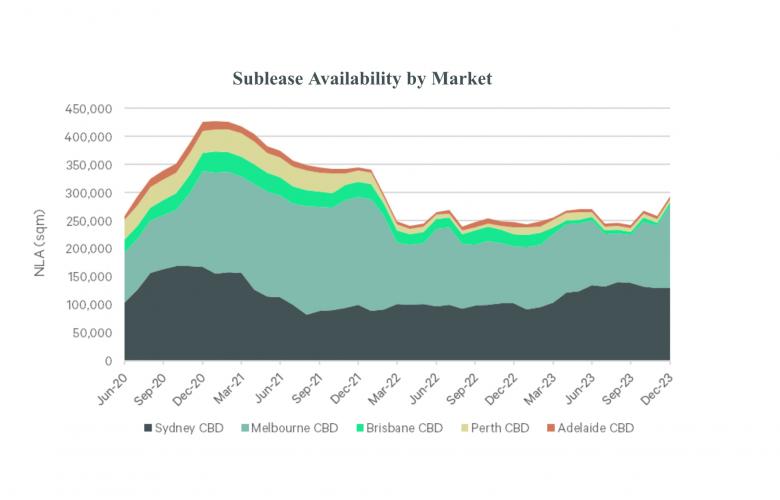

Availability declined in Perth, Brisbane and Sydney, by 23.4%, 17.2%, and 4.5% respectively, however the overall national sublease availability increased by 24,817sqm (9.2%) in H2 2023 to reach 295,000sqm, primarily due to two large Melbourne sublease listings totalling a combined 57,000sqm said CBRE Research Manager Thomas Biglands.

The supply of sublease space has shrunk in most of Australia’s major CBDs, pointing to a much healthier post-COVID outlook for the country’s office sector.

CBRE’s latest H2 2023 Sublease Barometer highlights that sublease availability declined in Perth, Brisbane and Sydney, by 23.4%, 17.2%, and 4.5% respectively, as office occupier demand increased and tenant contraction eased.

While the country’s overall national sublease availability increased by 24,817sqm (9.2%) in H2 2023 to reach 295,000sqm, CBRE Research Manager Thomas Biglands said this was primarily due to two large Melbourne sublease listings totalling a combined 57,000sqm.

“Prior to this, sublease levels in Melbourne had been showing signs of stabilising and it’s not anticipated that more large blocks of sublease space will be brought to market in the near term,” Mr Biglands said.

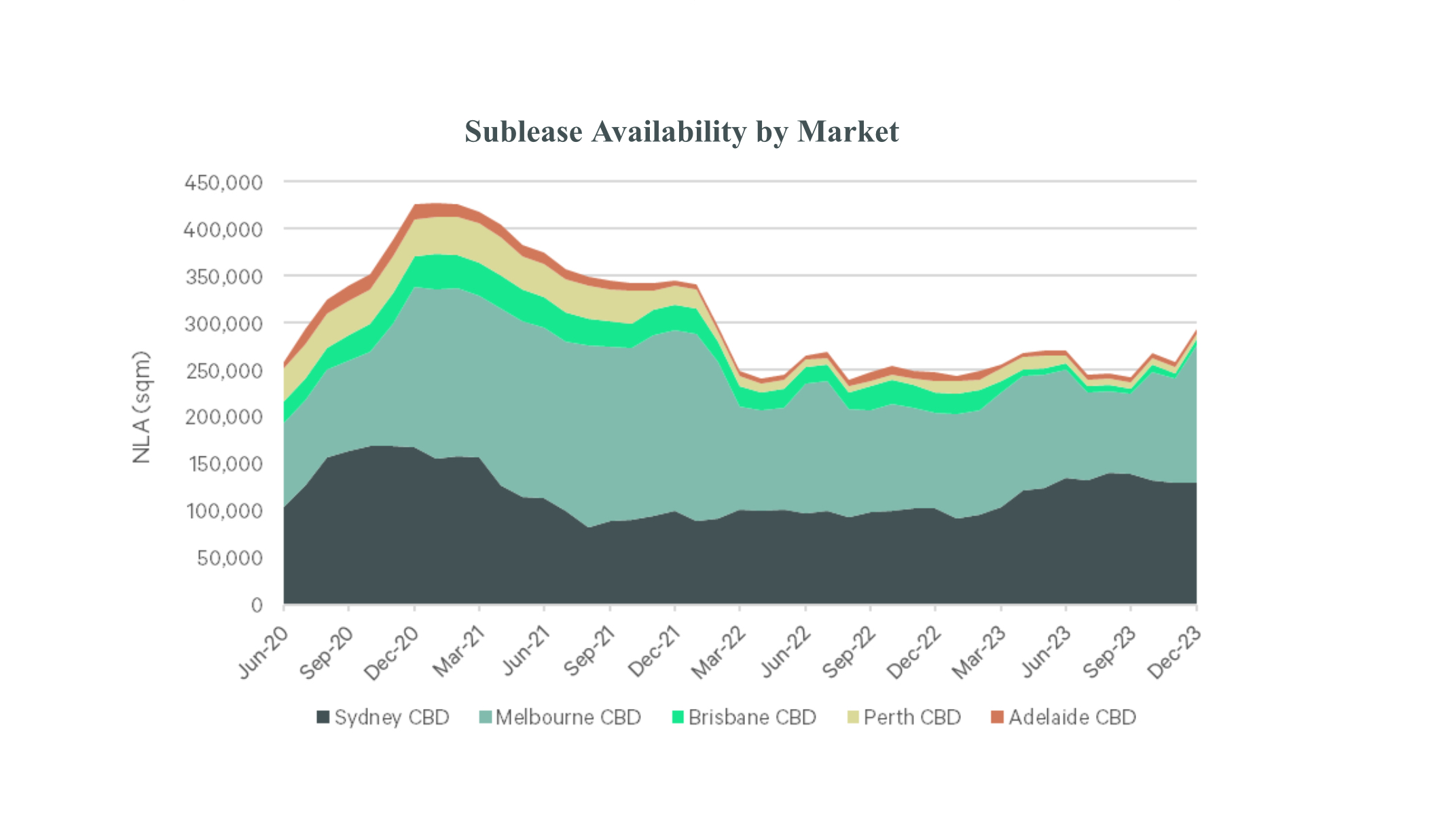

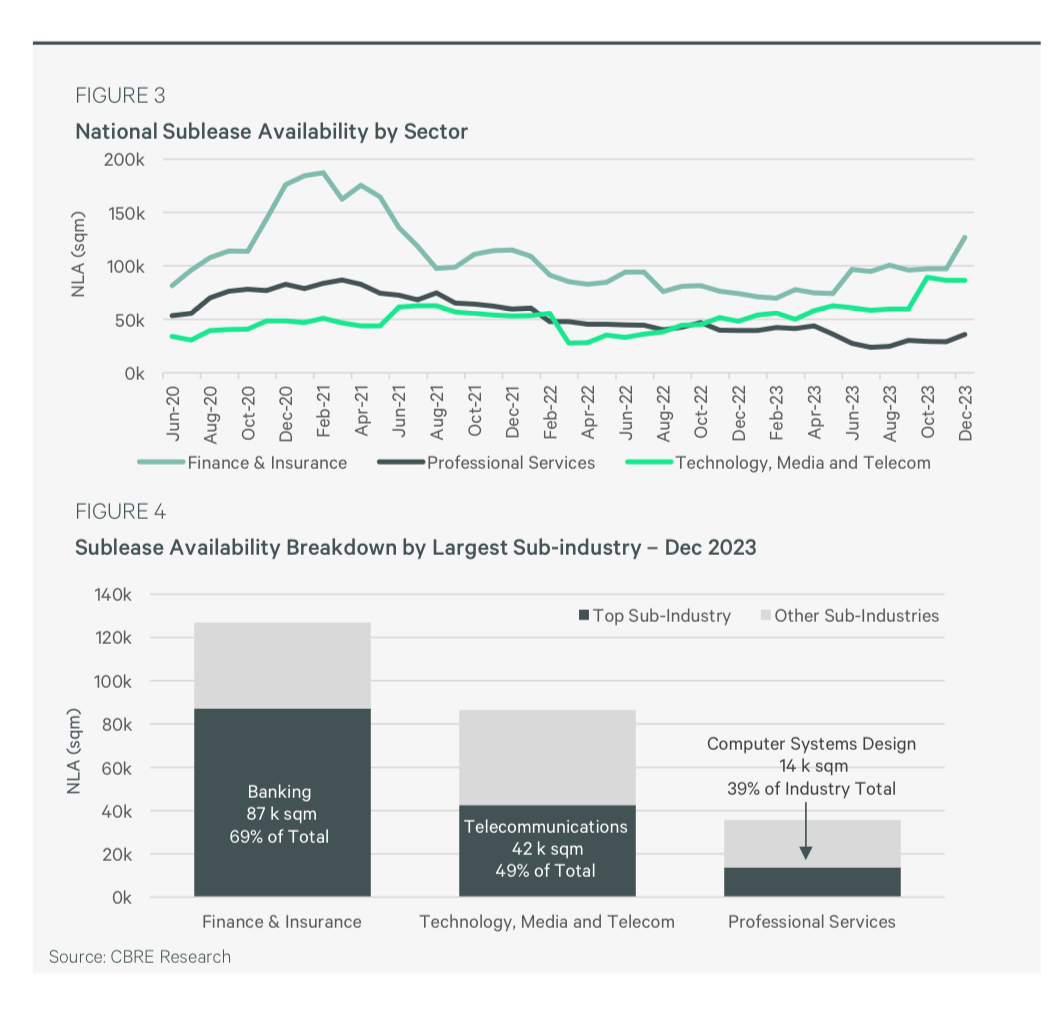

CBRE’s data highlights that the finance and insurance sector was the largest contributor to national sublease availability in H2 2023, accounting for 43% of the national total.

CBRE’s Pacific Head of Office Leasing Tim Courtnall noted, “While sublease offerings from this sector trended down over H1 2023, there was a reversal in the second half as several major bank occupiers put significant blocks of space on the market, determining that certain back-office job functions could be completed via hybrid work arrangements. However, while banks now account for 30% (87,000sqm) of the national sublease volume, they are still major occupiers in nearly all of Australia’s capital cities.”

Sublease volumes from technology, media and telecommunications firms increased over H2 2023, however, the increase was almost entirely due to one large listing.

Professional service firms continued to be the third largest sublease group as of December 2023, accounting for 36,000 sqm of available space.

Mr Courtnall said the forecast was for overall sublease availability to decline throughout 2024 as office occupancy rate improved and as tenants recognised the inherent value of existing fitouts and capitalised on attractive sublease terms.

To request a copy of CBRE’s latest H2 2023 Sublease Barometer report please contact of the CBRE agents via the below contact details: