Private investors the most active buyers in Australia and globally- Knight Frank

Contact

Private investors the most active buyers in Australia and globally- Knight Frank

Knight Frank’s The Wealth Report 2024 found private investors* were the most active buyers in commercial real estate for the first time in Australia over 2023 and for the third consecutive year globally.

Knight Frank’s The Wealth Report 2024 found private investors* were the most active buyers in commercial real estate for the first time in Australia over 2023 and for the third consecutive year globally.

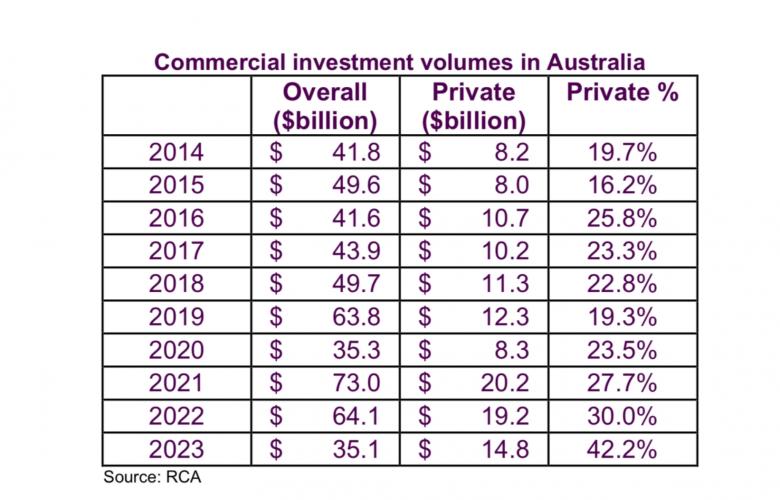

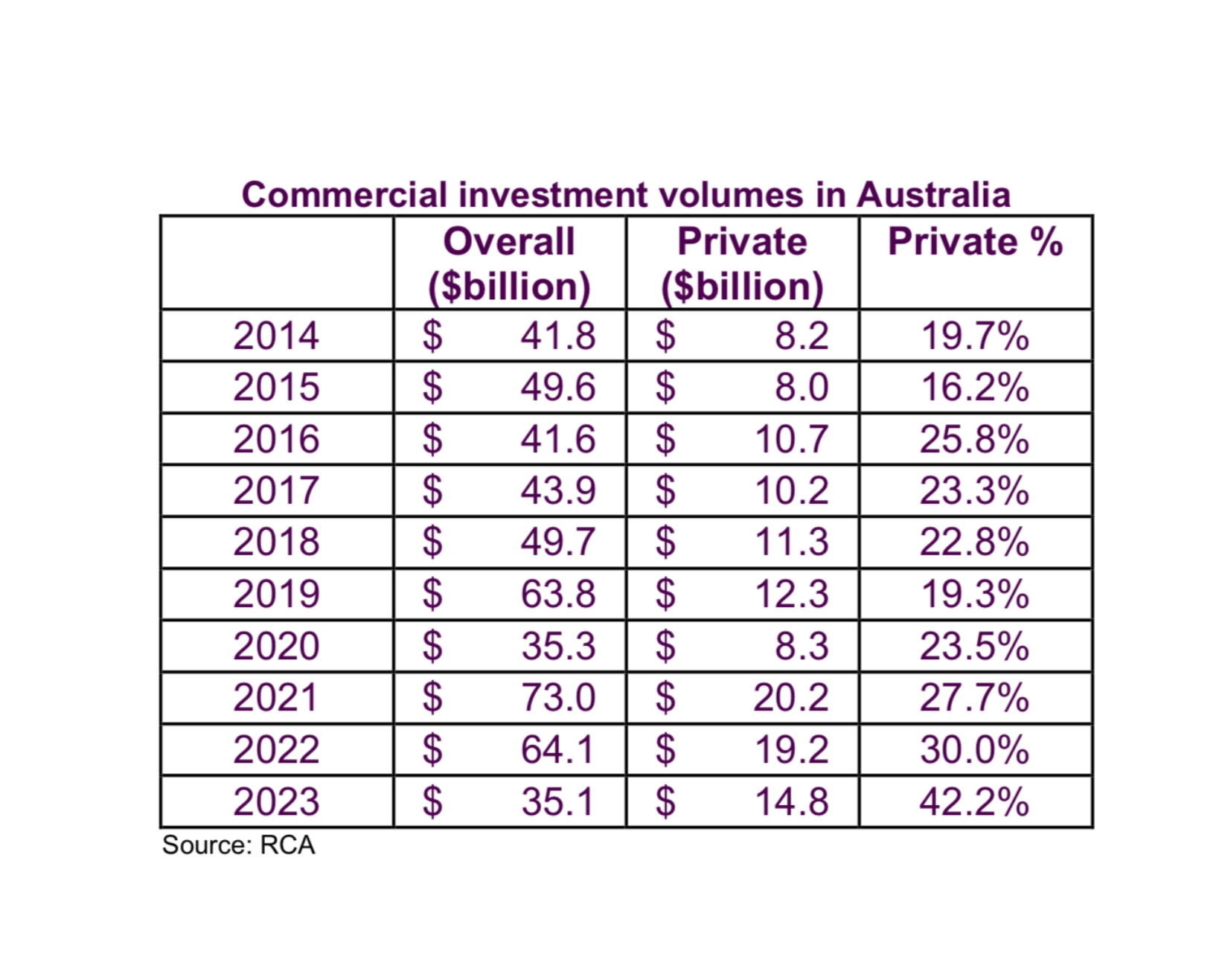

Private capital invested A$14.8 billion in Australia’s commercial market over 2023, equating to 42.2% of total investment, more than 12% higher than the 30% in 2022, and the highest share on record.

Globally, private capital invested US$338 billion in the commercial property market, equating to a 49% share of total investment, slightly up on 48% in 2022 and also the highest share on record.

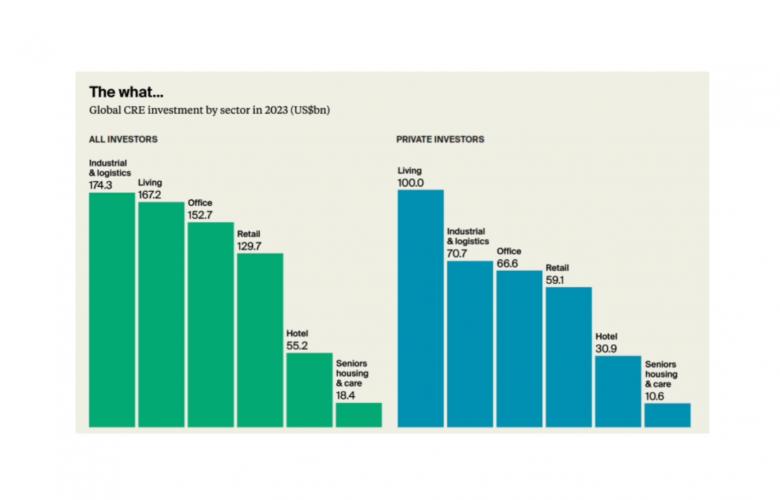

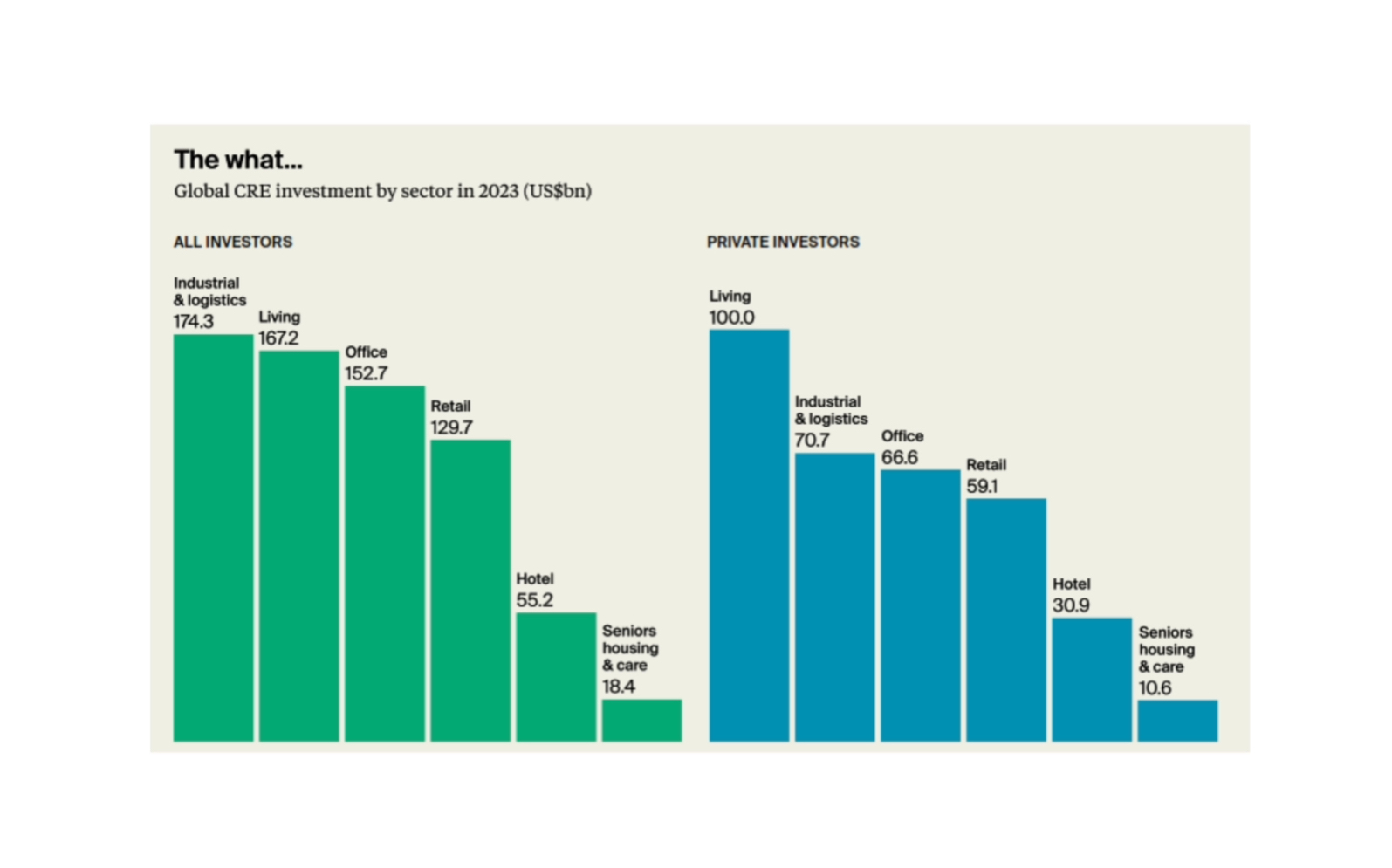

Globally, living sectors were the most targeted by private capital, followed by industrial and logistics, and offices.

Australia came in 7th for cross border commercial real estate investment flows in 2023, with US$5.7 billion invested amongst all investors.

Private investors* were most active buyers in commercial real estate for the first time in Australia and for the third consecutive year globally over 2023, according to Knight Frank’s just-released flagship report The Wealth Report 2024.

Private capital invested A$14.8 billion in Australia’s commercial market, equating to 42.2% of total investment, more than 12% higher than the 30% in 2022, and the highest share on record.

The share for private investors in Australia grew significantly despite overall investment in the country’s commercial property market nearly halving in 2023 from the previous year, falling from $64.1 billion in 2022 to $35.1 billion in 2023.

Commercial investment volumes in Australia Overall ($billion) Private

Source: RCA

Globally, private capital remained the most active buyers for the third consecutive year in the commercial property market, investing US$338 billion. This equated to a 49% share of total investment, slightly up on 48% in 2022 and the highest share on record.

Although globally private investment in 2023 also nearly halved on 2022 volumes, falling by 46% in 2023 to US$698 billion, this was a smaller contraction than institutional and public investment, both falling by 53%.

Knight Frank Australia Chief Economist Ben Burston said: “In a quiet market, private investors took centre stage in 2023, taking a record share of overall transactions volumes in Australia and globally.

“While major institutional and cross-border investors have taken a step back for the time being on account of high debt costs and protracted uncertainty over the outlook, private investors tend to be less reliant on debt and more opportunistic in focus, and this has enabled them to be more active.

“Private investors have positioned themselves for a recovery in the commercial property market, which we believe will start to emerge in Australia later this year.

“The outlook is improving, with sentiment picking up off the back of the reduction in funding costs since October, hopes for interest rate cuts later in the year and gradual erosion of bid-ask spreads. This will see the level of activity grow and the investor base normalise as the year goes on, but this process will take time and private investors will continue to take significant market share.”

The most sought-after sectors in commercial real estate:

Globally industrial and logistics were the most invested sector in commercial real estate for the first time on record in 2022, taking a quarter of all global investment at US$174 billion, according to Knight Frank’s The Wealth Report 2024.

While industrial and logistics, retail, hotel and senior housing and care all increased their share of total global investment in 2023, the office market fell from 25% in 2022 to 22% in 2023, and the living sector share contracted from 30% to 24%.

All sectors recorded an annual decline in total investment in 2023, with senior housing and care (-28%) seeing the smallest decline.

However, the story was slightly different for private buyers in 2023. Globally, living sectors were the most targeted by private capital, followed by industrial and logistics, and offices.

Looking ahead, Knight Frank’s The Wealth Report 2024 Attitudes Survey found that 19% of respondents were looking to invest directly in commercial real estate in 2024, with investors from the Middle East (23%) and Asia (21%) likely to be the most active.

However, investor preferences are shifting and for the first time in four years, a new sector has topped the investor wish list. The living sectors are the most in demand in 2024, with 14% of respondents looking to target the asset class. Interest is strongest in Europe, the Middle East, North America and Asia.

Healthcare is not far behind, attracting 13% of respondents. However, intentions do not necessarily equate to transactions, due to factors including availability of stock, market size and competition.

Knight Frank Australia National Head of Capital Markets Justin Bond commented: “With interest rates expected to remain elevated globally into the second half of 2024, we anticipate private capital to remain active.

“Indeed, during previous times of dislocation, private capital has typically rotated back into commercial real estate.

“In Australia, we also see interest from institutional capital from Singapore, Japan and some parts of Europe, with the expectation of increased transactional activity in the latter part of 2024.”

Cross-border commercial real estate investment flows Australia came in 7th for cross border commercial real estate investment flows in 2023, with US$5.7 billion invested amongst all investors, behind the US (US$29.6 billion), the UK (US$20.3 billion), Canada (US$9.7 billion), Germany (US$9.6 billion), Japan (US$8.7 billion) and the Chinese Mainland (US$6 billion).

Melbourne and Sydney ranked 9th and 10th respectively for total cross border investment in 2023, with US$2.2 billion and US$2.1 billion invested.

Data source: The above is based on Knight Frank’s analysis of RCA data and Knight Frank’s Attitudes Survey

Definitions: *Private investors: Companies whose control is in private hands and whose business is primarily geared towards operating, developing or investing in commercial real estate.

Attitudes Survey: The 2024 instalment is based on responses provided during December 2023 by more than 600 private bankers, wealth advisers, intermediaries and family offices who between them manage over US$3 trillion of wealth for UHNWI clients.