Office Fit Out costs continue to rise across APAC - Cushman & Wakefield

Contact

Office Fit Out costs continue to rise across APAC - Cushman & Wakefield

The average office fit out costs across Asia Pacific continue to rise in 2024, albeit at a much slower rate as compared to a year ago, according to Cushman & Wakefield’s APAC Office Fit Out Cost Guide 2024.

The average office fit out costs across Asia Pacific continue to rise in 2024, albeit at a much slower rate as compared to a year ago, according to Cushman & Wakefield’s APAC Office Fit Out Cost Guide 2024. While inflation has started to ease in some markets, concerns about the interest rate environment, supply chain issues and geo-political tensions remain prevalent although there is hope for an economic rebound in the second half of 2024.

Cushman & Wakefield also noted in the report that creating a workplace that enables employees to be at their most productive, promotes wellbeing and helps achieve corporate sustainability and inclusivity goals remain high on the agenda for occupiers even as they grapple with cost challenges and increased scrutiny on the quality of spend. These key considerations, broadly categorized as the 3Cs - Cost, Carbon and Culture – continue to shape companies’ strategies for the future of work.

Cushman & Wakefield’s Head of International Research and co-author of the report Dr Dominic Brown said, “The percentage rise in office fit out costs across Asia Pacific has eased significantly at 2% in both US Dollar and local currency terms compared to 18% (local currency) and 7% (USD) a year ago. This is primarily due to the decline in raw materials costs and the easing of inflation and supply chain pressures. However, the recent shipping crisis in the Red Sea is disrupting global supply chains again and increasing freight costs, which will have an impact in due course.”

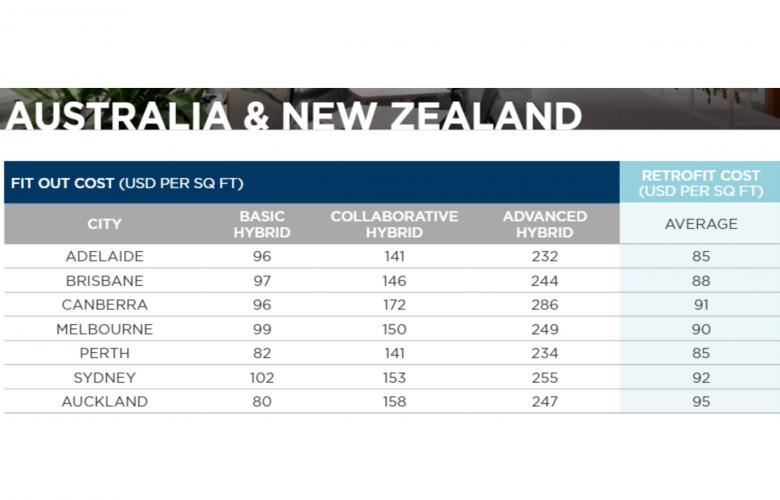

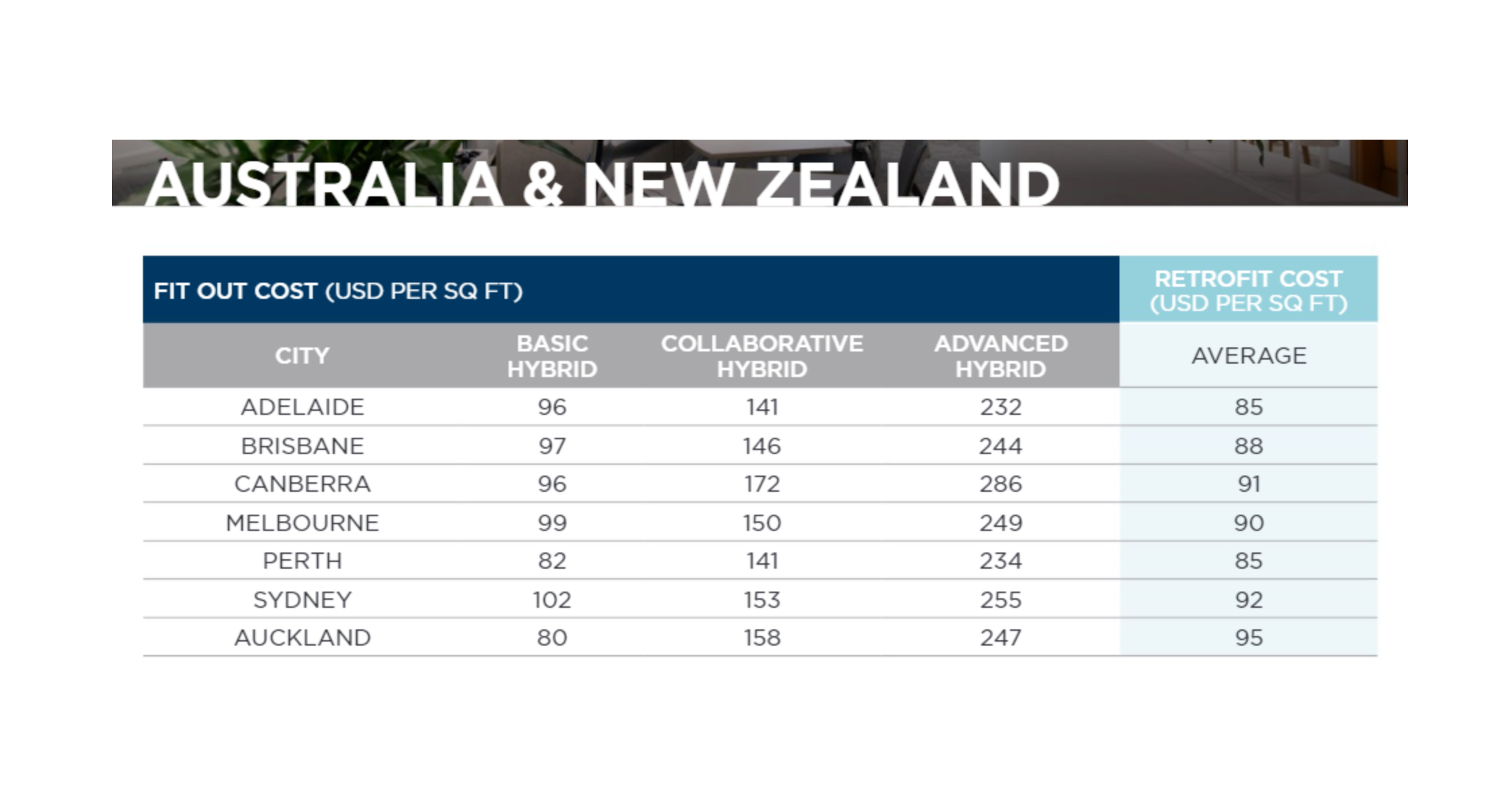

North Asia and Australia/New Zealand continued to feature prominently in the 2024 APAC cost rankings. Tokyo, Osaka and Nagoya remained the top three most expensive markets to fit out in a ‘Collaborative Hybrid’ style, followed by Canberra (Australia) and Auckland (New Zealand).

Cushman & Wakefield’s Head of Project & Development Services Australia & New Zealand, Mitch Wilson said "As Sydney and Melbourne secure their positions as the 7th and 8th most expensive locations for collaborative hybrid fit outs in the Asia Pacific region, it underscores the dynamic landscape of commercial real estate across Australia.

“Despite the challenges posed by interest rate hikes, geopolitical tensions, and economic volatility, the resilience of the global economy persists. These rankings reflect the intricate balance between demand for innovative workspaces and the ever-present pressures of cost and accessibility in two of Australia's leading business hubs."

Todd Hanrahan, Head of Project & Development Services New Zealand emphasised that the country's persistent ranking as the 5th most expensive location for hybrid fit-outs in APAC underscores its dedication to quality and innovation in workplace design. He highlighted the incorporation of highly coveted carbon-neutral buildings with exceptional interiors, which motivate the contemporary workforce to desire such environments, thus invigorating the fit-out market. He further stated, "This ranking reaffirms our status as a frontrunner in crafting modern, dynamic office spaces that prioritise functionality and employee well-being."

Top 10 most expensive locations for a collaborative hybrid fit out in Asia Pacific.

Creating office value comes to the fore amidst productivity and wellbeing concerns

Last year, Cushman & Wakefield noted that identifying the right office design that can balance working from home and having people in the office was the number one conversation in most markets across Asia Pacific. Today, this conversation remains important and in fact, has broadened to address other growing concerns such as lower productivity levels, lower sense of wellbeing, as well as net zero commitments and inclusivity goals.

Cushman & Wakefield’s Asia Pacific Head of Project & Development Services, Tom Gibson said, “The evolving workplace landscape continues to present both challenges and opportunities to companies as they strive to maintain and enhance productivity, connectivity and employee well-being. Scrutiny on capital expenditure will always be tight and companies have to be smarter and more creative in their workplace and office fit out decisions. Now that the office serves as a hub for social interaction, community building and innovation, the type, size and layout of space, furniture and furnishing details, technology-enabled amenities plus other fit out elements have to embellish this new purpose.”

Even as occupiers assess and rethink their space requirements while juggling cost, carbon and culture parameters, the flight to quality trend remains prominent with more companies opting for better quality buildings in business-strategic locations. The propensity to create destination offices that offer a workplace environment that is enticing enough to attract people into the office and compelling enough for them to repeat the experience is also expected to resonate even more.

Global Fit Out Cost Perspectives

Besides the APAC Office Fit Out Cost Guide, Cushman & Wakefield has also published the EMEA and Americas versions and a global summary. In total, the three guides provide a detailed look at office fit out costs for 134 markets across the world, to help guide occupiers through the early stages of defining their office relocation budgets.

Related Reading:

Navigating rising construction costs in commercial property investment - BMT | Commo.

Sustainable investments: Navigating the future of commercial office space | Commo.