Commercial real estate sentiment at highest level since Q2 2022 - Knight Frank

Contact

Commercial real estate sentiment at highest level since Q2 2022 - Knight Frank

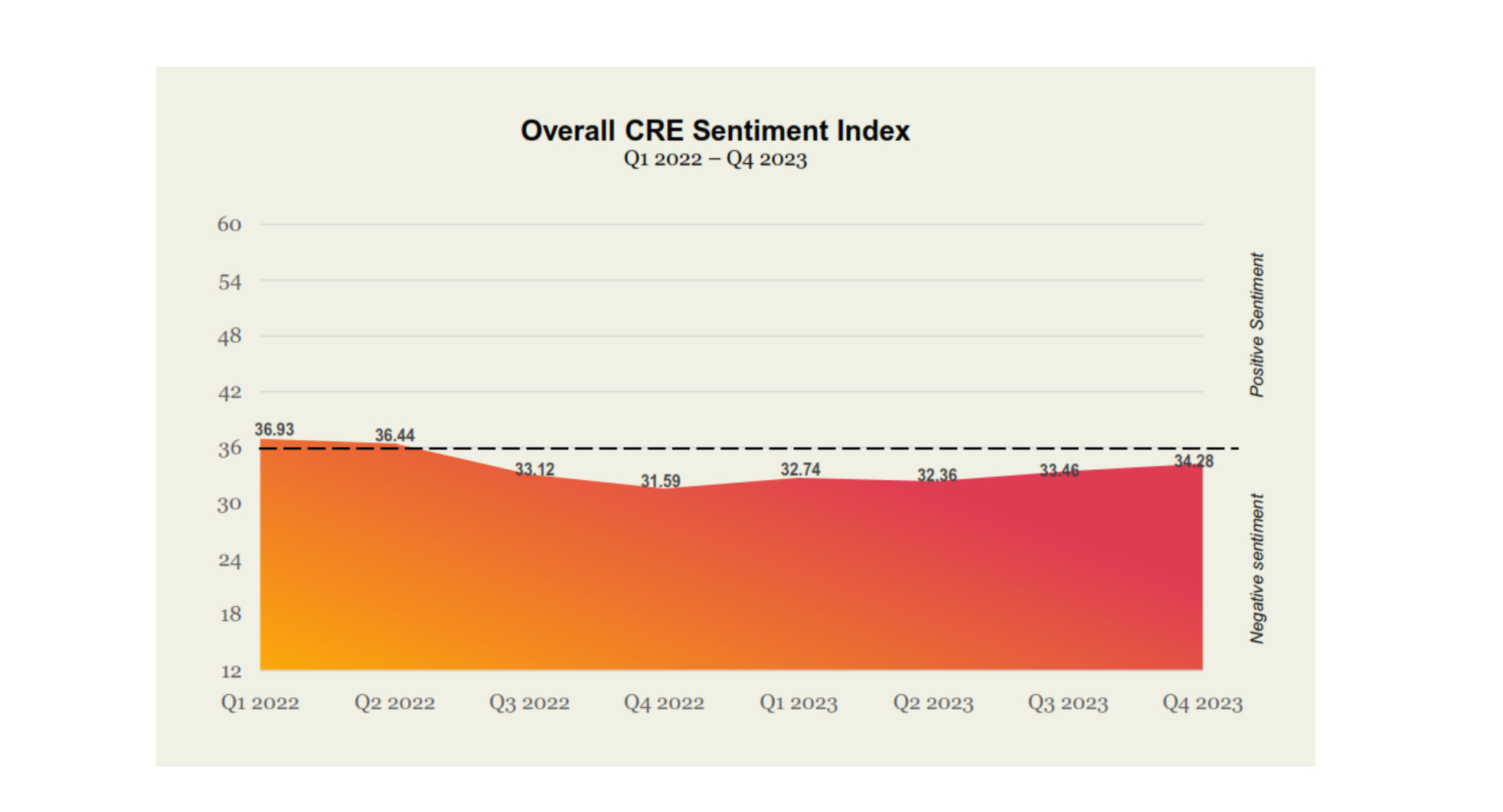

Overall corporate real estate leader sentiment is at its highest level since Q2 2022, based on Knight Frank’s latest survey results. The Global Corporate Real Estate Sentiment Index.

The survey for Q4 2023 found overall sentiment was at 34.28%, which was the highest level since Q2 2022 and a 2.45% increase from the previous quarter.

Knight Frank Chief Economist Ben Burston said the research showed improved sentiment was steadily increasing as corporate occupiers respond to an improving global economy and implement their evolving workplace strategies.

“While we are still going through a period of subdued growth, corporate occupiers are starting to look ahead to the economy picking up in the second half of the year. Alongside this, they are increasingly ready to implement changes to workplace strategy after reconsidering their approach over the past two years.

“More occupiers globally and in Australia are choosing to relocate core functions in response to growing physical and functional obsolescence. This is raising the bar on sustainability as tenants are seeking to secure highly accredited green buildings at the point of relocation wherever possible.

“While sentiment is improving and many tenants are choosing to upgrade, there is a renewed focus on densification and productive utilisation so in spite of strong employment growth, demand is not feeding through to an expanding footprint to the same degree.”

Knight Frank Head of Global Portfolio Solutions Australia Francesco Demarco said that whilst there were expectations of a stabilising global economy, largely due to cooling inflation, in Australia 2024-2025 was still likely to be a period in which businesses were focused on driving company performance through greater efficiencies, including through the optimisation of real estate portfolios.

“Effectively, we’re seeing companies trying to ‘do more with less’,” he said.

“Naturally, we’re seeing a lot more companies wanting greater use from the real estate they are paying for, which is driving some sectors back to the office, some with stronger return to work mandates. However, we’re not seeing many organisations expanding their footprint as a result.

“It’s a fascinating time for corporate real estate leaders. There are several dynamics occurring in the market across different sectors, but overall there is a focus on productivity. How teams work together has structurally changed, and this is clearly impacting the workplace.

“Whilst everyone is trying to figure out what their ‘utopia’ looks like, the one constant is that most companies currently seem to be very focused on driving greater cost efficiency through their real estate strategies.”

Mr Demarco added that within workplaces, occupiers were starting to create more ‘sanctuary zones’ to potentially address the productivity issue.

”Over the past few years, there was a push to increase collaboration space – or ‘we’ space - for when people were in the office because it was considered that the home provided an option for sanctuary – or ‘me’ - space,” he said.

“However, as employers seek to encourage more employees back into the office, we are now seeing companies provide more spaces that offer a sanctuary – or ‘me’ space - away from the distractions of the collaborative environments, as people are wanting to come into the workplace to do both focus work and collaborative work.”

Mr Demarco said many companies were also trying to be more creative within their existing footprints to improve utilisation rates and user experience in an office.

“This means more companies are trying to include more workstyles - more desks, more collaboration zones - into the same or smaller footprints,” he said.

“Given the difficulty of this challenge, there is a lot more focus on the design from a user perspective.

“There are also many creative examples of how companies are trying to make the workplace more comfortable and replicate the amenities in the home – for example, pet friendly work areas, larger and more advanced kitchen areas and exercise and wellness spaces, including outdoor areas where possible.

“Our clients are trying to ensure the office integrates more seamlessly into the wider workplace ecosystem with the goal of improving productivity.”

Download the report here to find out more: https://apac.knightfrank.com/cresi?utm_source=Organic_Social&utm_medium=...

More insights from Knight Frank:

Knight Frank reveals its top 7 predictions for the commercial property market in 2024 | Commo.

Global healthcare sector to grow despite economic uncertainty - Knight Frank | Commo.

BTR sector in Australia forecast to see 55,000 dedicated units by 2030 | The ASEAN Developer