Melbourne commercial market can expect tightening office yields, uptick in construction for 2020 - CBRE

Contact

Melbourne commercial market can expect tightening office yields, uptick in construction for 2020 - CBRE

Melbourne’s prime office yields will compress further in 2020 buoyed by continued buyer demand and limited investment opportunities, says CBRE.

New data from CBRE has shown Melbourne’s commercial office market will continue to remain tightly held in 2020.

This is one of the key Melbourne take-outs from the firm’s new 2020 Market Outlook report, which examines the outlook for the key property sectors and geographies across Australia.

CBRE Senior Director, Capital Markets, Kiran Pillai said Melbourne’s average prime office yields were expected to decline by some 25bps this year to a new low of around 4.50 per cent.

At a glance:

- CBRE has released its 2020 Market Outlook report, which examines the outlook for the key property sectors and geographies across Australia.

- The report has forecast Melbourne’s prime office yields to compress further in 2020 buoyed by continued buyer demand and limited investment opportunities.

- According to the report, 408,000 square metres of new space set to enter the Melbourne market in 2020 - an increase of 84 per cent from 2019.

“Strong investor demand, combined with declining bond rates, should drive further yield compression over 2020," he said.

Melbourne's office market is expected to remain tightly held, which will drive further convergence in prime and secondary yields as investors demonstrate preparedness to absorb more risk in order to get access to Melbourne office stock.

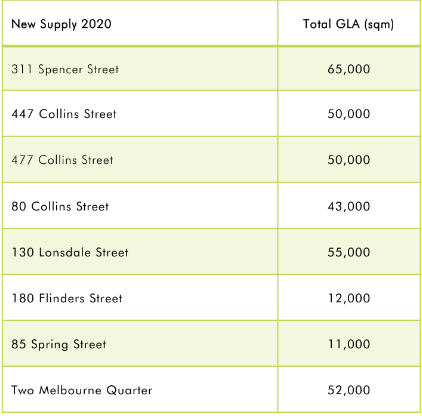

According to the report, the continued tightening in the market will coincide with the largest boost to new office supply in Melbourne in over 25 years, with eight new office buildings totalling 338,000 square metres (representing approximately 7.3 per cent of the total size of Melbourne’s CBD) due to reach completion in late 2020.

Source: CBRE Research

This will lead to a slowing in rent growth as a result of increased vacancy, which will see incentives increase over the short term.

However, Mr Pillai noted that Melbourne’s long-term rent prospects remained strong, which would continue to underpin interest in office investment opportunities, with the city’s yields still considered attractive when compared to other major global markets.

“In the mid-to-long term, Melbourne’s prospects for rent growth are strong as very few development sites will remain at the end of this current supply cycle and developers will increasingly need to withdraw or amalgamate existing office buildings to create new office product," he said.

CBRE Associate Director, Research, Kate Bailey. Source: CBRE

Other key takeouts from the report include the outlook for new retail supply, with 408,000 square metres of new space set to enter the Melbourne market in 2020 - an increase of 84 per cent from 2019.

CBRE Associate Director, Research, Kate Bailey said most of the new space would involve neighbourhood projects (125,500 square metres) and large format centres (98,600 square metres), being developed as a direct result of strong population growth.

At the same time, structural changes to the retail sector will drive the ongoing transformation of the shopping centre sector.

“Last year was a difficult year for the retail sector, with several national retailers entering insolvency, particularly those with a limited online presence,” she said.

“As a result, a range of non-traditional retail uses have popped up, including Catch of the Day opening a physical retail presence in Target at Highpoint Shopping Centre and Australia’s first Esports arena-filling the vacated Topshop box at Emporium, offering more than 10 screens broadcasting live tournaments, 160 esport gaming PCs and a tavern.

“As retailers continue to rationalise their physical store footprint, it is expected 2020 will see more unique retail spaces open that will provide increased foot traffic, especially from younger, tech-savvy consumers.

Increased pressure on household incomes may see retailers reduce their reliance on food and beverage retailers and instead look to online retailer pop ups and entertainment.”

Click here to download the report.

Similar to this:

St Collins Lane Melbourne for sale CBRE

Mark Curtain to lead CBRE’s Pacific Office Leasing business

Eastern Melbourne records yearly increase in commercial property sales value