Sydney CBD sublease stock hits 10-year high- CBRE

Contact

Sydney CBD sublease stock hits 10-year high- CBRE

The volume of Sydney CBD sublease space has surged to levels not seen since the height of the Global Financial Crisis, according to new research from CBRE.

A sharp increase in available Sydney sublease space as a result of tenants committing to new developments or leasing refurbished office space is expected to be exacerbated by the COVID-19 pandemic, new research from CBRE has found.

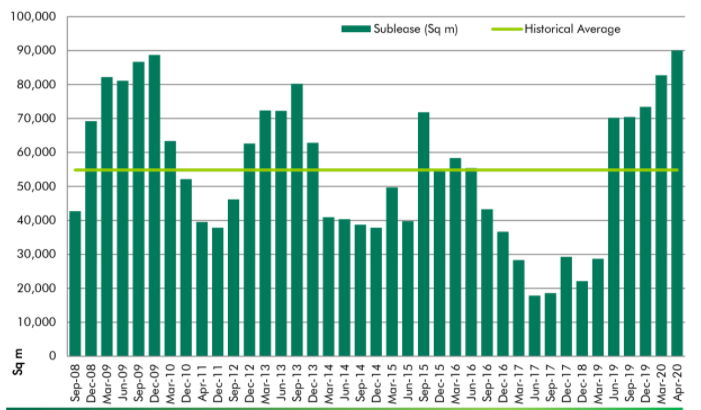

The firm's latest Sublease Barometer shows that Sydney CBD sublease space increased from 73,431sqm in Q4 2019 to 82,739sqm as at March 31, 2020.

By comparison, the sublease vacancy was just 28,706sqm in Q1 2019.

At a glance:

- CBRE's latest Sublease Barometer for the Sydney CBD has shown sublease space increased from 73,431sqm in Q4 2019 to 82,739sqm as at March 31, 2020.

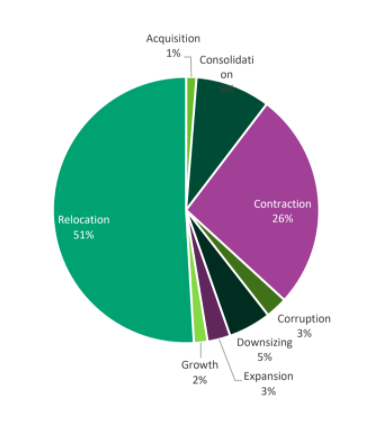

- Of the stock being made available at the end of Q1, tenant relocation accounted for 51 per cent, compared to contraction (31 per cent) and consolidation (9 per cent).

- CBRE’s preliminary statistics to the end of April 2020 indicate a further increase in sublease space to 90,031sqm, well above the long-term average of 54,856sqm.

The data indicated that tenant relocation accounted for 51 per cent of the total sublease stock available at the end of Q1, compared to contraction (31 per cent) and consolidation (9 per cent)

CBRE Office Leasing Director Chris Fisher told WILLIAMS MEDIA while COVID-19 had not been the primary cause of the trend, the full force of its impact was yet to be seen.

“In the strong market pre-COVID-19, developers, landlords and tenants were willing to carry tenant lease tails to secure tenancy commitments," he said.

The motivations for subleasing, according to the CBRE subleasing barometer. Source: CBRE

"A lot of businesses are still working out what COVID-19 means for them.

"Most people aren't in the office yet and a lot of businesses will be trying to gauge the office habits of their staff going forward.

"Businesses might think they will need less space but the flipside of that is they may actually require more space because you can only occupy the space at a certain density due to social distancing regulations."

CBRE’s preliminary statistics to the end of April 2020 indicate a further increase in sublease space to 90,031sqm, well above the long-term average of 54,856sqm.

In comparison, sublease availability was approximately 90,000sqm at its GFC high in October 2009, with Property Council Australia (PCA) records showing that Sydney’s highest sublease vacancy was 119,588sqm in July 1992.

Historical subleasing rates. Source: CBRE

Mr Fisher noted that some 84 per cent of the current vacant sublease space was fitted out and 65 per cent of the supply consisted of Premium and A-grade stock, providing opportunities for occupiers to secure space with a high-quality fit-out.

“We are already seeing tenants alter their requirements, honing-in on fitted stock which allows them to avoid capital costs and reduce rent via incentives in the form of rental rebates, which lowers their effective rent,” he said.

“However, many tenants are also adopting a ‘wait and see’ approach as they contemplate the effects of COVID-19, the impacts on their business and what their future office requirements will look like.”

Click here to view the CBRE sublease barometer.

Similar to this:

New North Sydney Zurich tower tops out ahead of schedule

Frankston office sold to Collective Capital for $20 million - CBRE

South Melbourne Emerald Hill Terrace sold for $2.94m - CBRE Melbourne