Retail store closures lower in neighbourhood centres during COVID-19 - JLL

Contact

Retail store closures lower in neighbourhood centres during COVID-19 - JLL

The latest retail survey of JLL’s managed shopping centre portfolio shows neighbourhood centres performed well during the initial COVID-19 pandemic period, supported by strong supermarket sales.

Neighbourhood and large format retail centres have been much more resilient from a foot traffic, sales and rent collection perspective during the pandemic period as they benefit from a boost in sales of food and household goods, a new survey has found.

The firm's latest Retail Centre Managers’ Insights report, undertaken in July, shows the impacts of COVID-19 on retail trading conditions in the first six months of 2020 across JLL’s managed shopping centres.

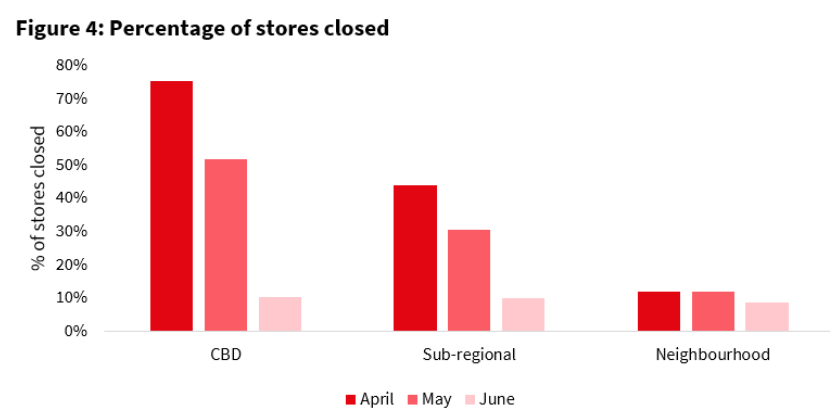

According to the survey, CBD assets were most notably affected, with an average of 75 per cent of stores closed during April, and 52 per cent closed in May.

JLL Retail Centre Managers' Insights report - At a glance:

- An average of 75 per cent of stores closed within CBD retail centre during April, and 52 per cent closed in May.

- Sub-regional centres also recorded a high proportion of stores closed during April (44 per cent) and May (30 per cent), followed by a vast improvement in June (10 per cent).

- Store closures in neighbourhood centres were comparatively low during the pandemic, as only 12 per cent of stores were closed during April and May, with this number reducing to just 8 per cent in June.

The number of closures reduced in June, as restrictions were lifted and a proportion of white collar workers returned to the CBD, with only 10 per cent of stores closed.

JLL reports that, anecdotally, while more CBD retail stores (excluding Melbourne) have since re-opened, in July and August, CBD retail sales remain subdued as office occupancy remains low and the lack of international tourism is weighing on spending.

JLL’s Head of Retail, Property & Asset Management for Australia, Tony Doherty. Source: JLL

Sub-regional centres also recorded a high proportion of stores closed during April (44 per cent) and May (30 per cent), followed by a vast improvement in June (10 per cent).

In contrast, the data shows store closures in neighbourhood centres were comparatively low during the pandemic, with only 12 per cent shutting their doors during April and May, with the number reducing to just 8 per cent in June.

JLL’s Head of Retail, Property & Asset Management for Australia, Tony Doherty, said strong supermarket sales supported surrounding retailers in neighbourhood centres.

“The Shopping Centre Council of Australia (SCCA) estimates that there has been AUD 1.6 billion worth of direct financial support to retailers nationally during the pandemic," he said.

Source: JLL

"These waivers on rent have supported many retailers across JLL’s national portfolio of 300 shopping centres.

“This rental assistance has alleviated some of the financial pressure experienced by retailers during the pandemic, but there remains a clear bifurcation in performance between discretionary and non-discretionary retailers.

"Neighbourhood centres have been a major beneficiary through COVID-19 restrictions, with many of the centres reporting resilient foot traffic and sales growth across our portfolio.

“Many discretionary-based retailers, including F&B, have pivoted their business models through this time, to adapt for click-and-collect and online orders to support and drive revenue."

Source: JLL

Changes in foot traffic – June 2019 to June 2020

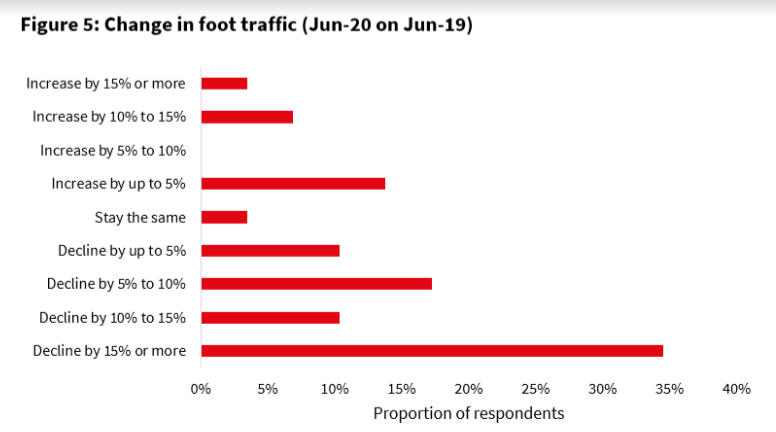

The JLL Survey showed 72 per cent of respondents nationally recorded a decline in foot traffic in the month of June 2020, compared to June 2019.

At the same time, more than one third of Centre Managers reported a decline of 15 per cent or more over this period, however it varied by state.

The 24 per cent of survey respondents that reported an increase in foot traffic were for neighbourhood and sub-regional centres.

According to JLL, no respondents managing CBD centres, including Melbourne, reported an uplift in foot traffic.

As restrictions gradually lifted in the majority of states in June, consumer confidence improved (+6.4 per cent), according to the Westpac Consumer Sentiment Survey, having a positive impact on foot traffic in many centres.

JLL Retail Research Senior Analyst Georgia Mack. Source: JLL

However, with the second wave of COVID-19 cases emerging in Victoria in mid-to-late June, consumer sentiment has fallen 9.8 per cent over the last three months to August, and is now back in-line with GFC levels.

JLL Retail Research Senior Analyst Georgia Mack said retail spending had been extremely volatile during the pandemic.

"Monthly growth in March 2020 accelerated by 8.5 per cent, coinciding with the commencement of grocery stock-piling in Australia," she said.

"This was followed by a 17.7 per cent decline in April, and a 16.9 per cent increase in May - both the largest monthly decline and largest monthly increase ever recorded in the ABS time series (since April 1982).

"Monthly spending in June moderated to 2.7 per cent, with y-o-y growth (currently 2.9 per cent), well below the five year average of 4.1 per cent.

She said there remained a clear divergence in spending growth between discretionary and non-discretionary categories.

"Non-discretionary spend has accelerated sharply over the past few months, to +7.1 per cent y-o-y (Jun-20)," she said.

"Meanwhile, spending in discretionary categories has notably declined, to -8.9 per cent y-o-y (Jun-20).

"The fall in spending in the cafés, restaurants and takeaway category has weighed on the discretionary average, with growth in this category down 16.6 per cent in June on the previous year."

Click here to view the full report.

Similar to this:

Dining out brings the customers into successful shopping centres -JLL

Strong interest in Woolworths assets expected as confidence in sector continues to rise - JLL