Economic crisis casts a shadow over Australia’s CBD office markets - JLL

Contact

Economic crisis casts a shadow over Australia’s CBD office markets - JLL

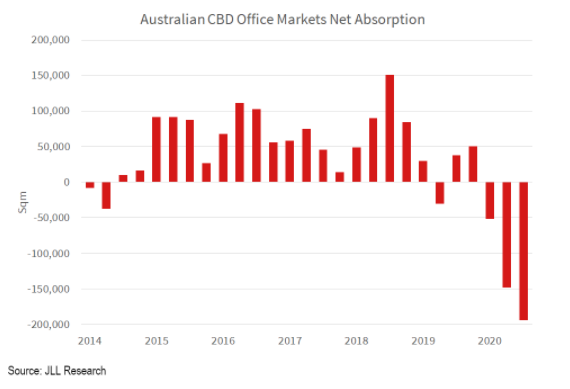

JLL national office statistics for the third quarter show negative net absorption of -193,700 square metres and a vacancy rate increase of 2 percentage points from 10.2 per cent to 12.2 per cent.

Canberra was the only Australian CBD office market to record positive net absorption in the third quarter, according to new figures from JLL.

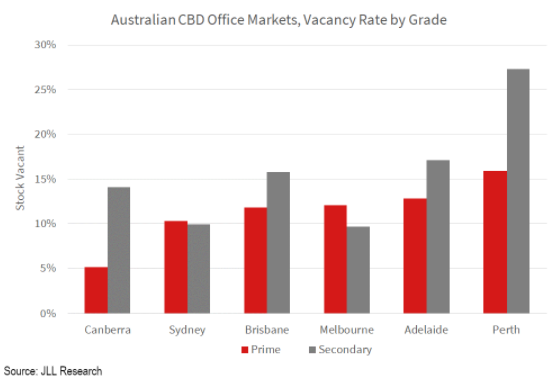

The firm's national office vacancy statistics, released this week, showed the nation's capital is also on its own in having a single-digit vacancy rate (8.4 per cent).

Of the two major markets, Sydney recorded -94,500 sqm of net absorption and vacancy of 10.2 per cent - up from 7.5 per cent in Q2 - while Melbourne vacancy is 11.3 per cent - up from 7.7 per cent in Q2.

At a glance:

- JLL national office vacancy statistics released for the third quarter show Canberra was the only Australian CBD office market to record positive net absorption and have a single-digit vacancy for the third quarter.

- The national office market recorded negative net absorption of -193,700 square metres and a national CBD office market vacancy rate increased of 2 percentage points from 10.2 per cent to 12.2 per cent.

- JLL Head of Leasing for Australia, Tim O'Connor, said the announcement within the Federal Budget of new investment incentives would be positive for private sector investment and should flow through to employment growth and renewed leasing enquiry.

JLL Head of Research for Australia, Andrew Ballantyne said the economic crisis had negatively impacted business confidence.

"A number of organisations are assessing headcount expectations for the next 12-18 months and releasing excess office space," he said.

“Corporate Australia is the new landlord in town with a sharp increase in sublease availability across the Sydney CBD and Melbourne CBD.

"The observation in Australia is replicated across developed economies with US sublease availability surpassing the levels recorded in the financial crisis and tech wreck."

JLL Head of Leasing for Australia, Tim O’Connor said while a number of large organisations were delaying decision making due to uncertainty about their revenue and profitability outlook, the research showed improved enquiry and deal activity across the country in the sub 500 sqm cohort of the market in what is "an important first step" towards improved activity in the leasing market.

"We are seeing decisions being made in relation to pre-commitment given the longer lead times involved.

"This is consistent with what we are seeing globally with deals being concluded since COVID-19 began by companies including Facebook and AIG in New York, Baker McKenzie in London and PwC in Shanghai."

Of the other CBD markets, Brisbane recorded -21,200 sqm of net absorption in 3Q20, while its headline vacancy rate increased by 0.8 percentage points to 13.6 per cent over the quarter.

The Perth CBD recorded -4,800 sqm of net absorption over the quarter.

As a result, the Perth CBD vacancy rate increased marginally to 20.4 per cent in 3Q20.

The Adelaide CBD recorded -10,200 sqm of net absorption in 3Q20 with the headline vacancy rate increased by 0.6 percentage points to 15.4 per cent over the quarter.

Mr O’Connor said the announcement within the Federal Budget of new investment incentives would be positive for private sector investment and should flow through to employment growth and renewed leasing enquiry.

"The Federal Budget is likely to be positive for the Canberra office market," he said.

"The budget papers highlighted an expected increase of 3,666 Australian Public Service employees (excluding military and reserves) over the 2020/21 financial year.

“The Federal Government expects to see a rebound in the Australian economy in 2021.

"The trajectory of the economic recovery will determine the employment outlook and demand for office space.

The most active organisations in 2021 are expected to come from the public sector, technology and healthcare industry sectors."

Similar to this:

JLL Capital Markets team boosts their national Middle Markets team with key hire in Melbourne

Retail store closures lower in neighbourhood centres during COVID-19 - JLL

North Sydney media and tech trend 'could accelerate' as a result of COVID-19 - JLL