JLL transact two major properties in East Melbourne as the precinct carries the lowest office vacancy rate in the country

Contact

JLL transact two major properties in East Melbourne as the precinct carries the lowest office vacancy rate in the country

East Melbourne remains a major centre for residential and commercial investment activity, indicating that it may be a direct beneficiary of the desire of tenants and residents to be close to but not within the Melbourne CBD grid.

East Melbourne remains a major centre for residential and commercial investment activity, indicating that it may be a direct beneficiary of the desire of tenants and residents to be close to but not within the Melbourne CBD grid.

The suburb, which attracts some of the highest residential prices in Melbourne, has seen a diverse industry base settle in the precinct, including resilient sectors such as the health, medical and research industries.

JLL’s Head of Middle Markets & Metropolitan Investments – Victoria, Josh Rutman said, “Assets in Melbourne’s eastern fringe precinct are very tightly held. Throughout the past 10-years we have recorded just 10 major sales transactions over $5 million in East Melbourne. The ownership profile is substantially domestic and includes a mix of syndicates, private investors and developers.”

“Buyers have demonstrated that when opportunities arise in the precinct, they are prepared to pay a premium to secure both investment and development assets, which has seen prices largely maintained if not increase throughout the past 12 months,” Mr Rutman said.

According to JLL Research, at Q4 2020 the eastern fringe (which encompasses East Melbourne) has a vacancy rate of 2.9% marking it as the lowest in the country. The eastern fringe also has the tightest 10-year average vacancy rate of any precinct, at 2.0%.

The CBD’s Parliament precinct is to the immediate west and is also characterised by low vacancy with a 15- year average of 3.4% at Q42020.

This compares to much higher vacancy levels in CBD and fringe precincts generally. Melbourne's CBD and fringe office market vacancy is increasing and recorded at 13.2% and 14.7% in 4Q20 with 15-year averages at 6.9% and 8.8% respectively.

JLL’s Head of Middle Markets & Metropolitan Investments – Victoria, Josh Rutman and Capital Markets Executive, Michael Godfrey recently sold the building home to the Bionics Institute of Australia at 384-388 Albert Street following the organisation opting for the opportunity to relocate after owning and occupying the property since 1992.

The double-storey heritage listed building at 384-388 Albert Street sold to the Catholic Archdiocese of Melbourne for over $12 million following an Expressions-of-Interest campaign handled exclusively by JLL. The sale translates to a very strong yield of less than 3% and a building rate of $13,672 per sqm, well in excess of market expectations at the commencement of the campaign.

458 Victoria Parade, East Melbourne has also recently sold via JLL’s Josh Rutman and Michael Godfrey for $5.25 million to a local developer. The property includes 12 partially completed apartments originally built in the 1930’s which were undergoing a renovation when receivers were appointed on the site. The sale represented an apartment rate of $437,500 after attracting nine separate offers as a result of the sales process.

Other recent notable deals within the East Melbourne precinct have included 95-101 Powlett Street, East Melbourne which sold for $9 million to Prime Land Group and Singaporean group, Backsh Capital earlier in September last year and The Royal Australian and New Zealand College of Obstetricians and Gynaecologists (RANZCOG) headquarters at 254-260 Albert Street selling for $22 million in January 2020 to Queensland developer Pask Group.

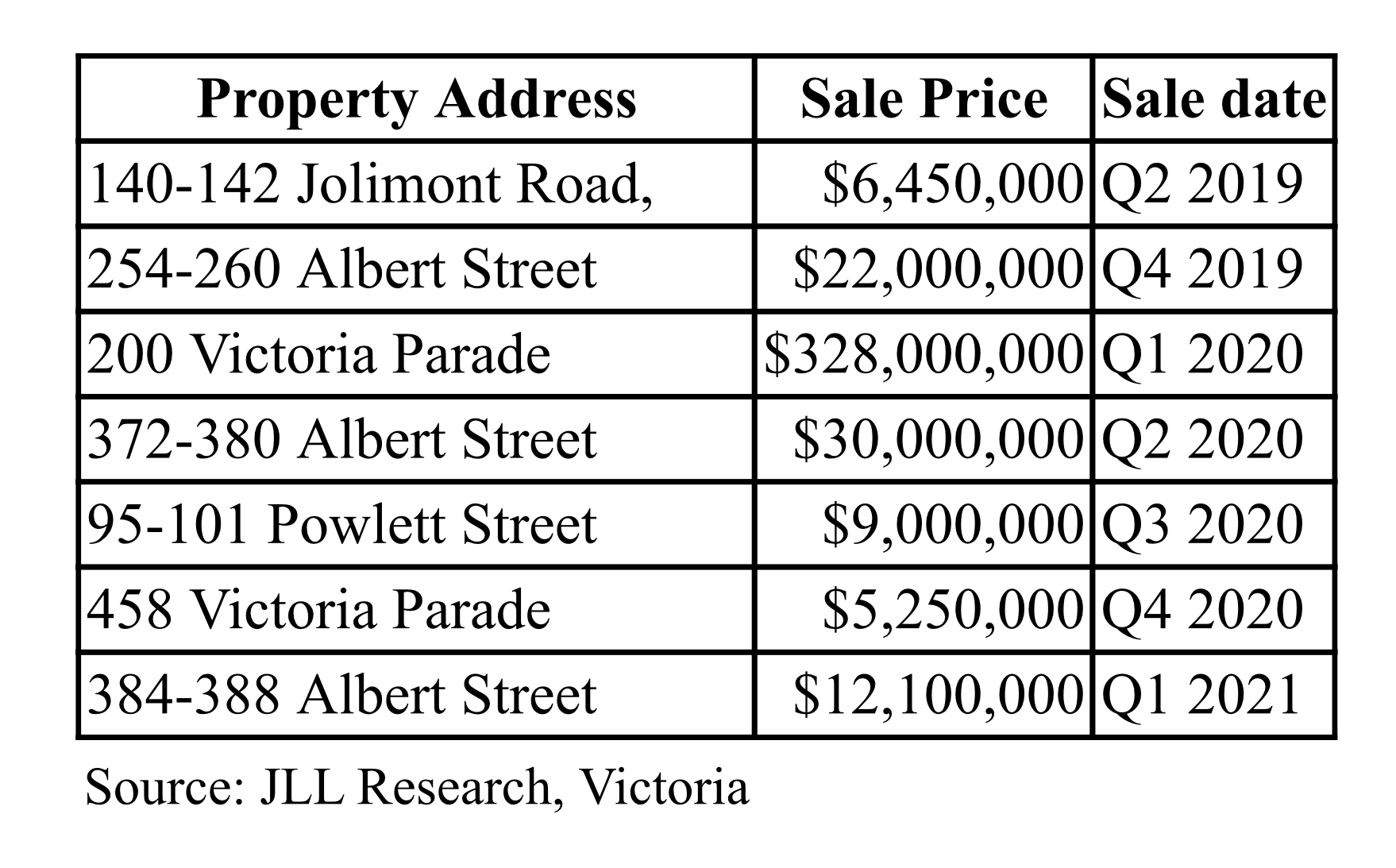

Figure 2: Table of office sales >$5 million in East Melbourne ranging from Q2 2019 and Q12021.

The significant development and construction movement has been increasing in the past three months with Luxcon Developments intending to create a prestige apartment complex out of an East Melbourne building at 372-380 Albert Street, after paying $30 million for the site in early 2020.

On the commercial front, a brand-new office development at 200 Victoria Parade, assembled by Melbourne based developed Time & Place alongside Golden Age is now under construction with the project expected to be completed in 2023.

The latest proposal of the St Vincent’s Hospital plans to demolish and redevelop its building on the corner of Victoria Parade and Nicholson Street further highlights the amount of investment going into the precinct.

“Leading public and private hospitals in the area and proximity to Government buildings create sector weighting to the health and public sector occupiers. Exposure to these stable sectors contributes to low vacancy in the precinct and this is proving to be a very attractive proposition for investors and developers looking for opportunities in a post COVID-19 market,” Mr Rutman said.

The new 11-storey building, set to be called the Aikenhead Centre for Medical Discovery, would house a research and training hub, a ground-floor cafe and boast additional rooftop and basement floors. It is said to be the latest in a string of upgrades and developments happening within the medical precinct, with the Royal Victorian Eye and Ear Hospital undertaking significant projects in recent years.