Hong Kong investor pays $19.5m for Richmond office building sold by JLL

Contact

Hong Kong investor pays $19.5m for Richmond office building sold by JLL

JLL Senior Director of Capital Markets, Josh Rutman, Tim Carr and MingXuan Li marketed the seven-storey building at 45 Wangaratta Street Richmond sold to a Hong Kong based investor.

JLL Senior Director of Capital Markets, Josh Rutman, Tim Carr and MingXuan Li marketed the seven-storey building at 45 Wangaratta Street sold to a Hong Kong based investor. In a sign of renewed confidence in Melbourne’s office sector, a brand-new office and retail building in the less established commercial precinct outside of the main Cremorne area in Richmond has sold to a Hong Kong-based investor for approximately $19.5 million on a very short 21 day settlement.

JLL’s Senior Director of Capital Markets, Josh Rutman, Tim Carr and MingXuan Li sold the seven-storey building at 45 Wangaratta Street following a competitive Expressions-Of-Interest campaign that generated more than 150 qualified enquiries from local private investors, syndicate groups and owner occupiers.

The property, which sits on a land parcel of a mere 368 sqm, sold on a 3.7% yield, which translates to a building rate of $13,829 per sqm and a land rate of $53,100 per sqm, all of which set new pricing benchmarks for the city fringe office investment market.

Mr Rutman said, “Whilst there haven’t been too many notable commercial office transactions to speak of in the past six- months, the sale demonstrates the resounding strength of the inner-city office market and noticeable flight to quality for investors who are seeking future proofed opportunities in strategic commercial locations.” “It’s becoming quite clear that investors are taking a reasonably bullish view on the future of the office, particularly for those assets that are well positioned to capture tenant demand as accommodation needs evolve post pandemic,” he said.

Mr Carr said, “The fact that the building continued to lease up well during the height of pandemic last year resonated well with buyers given the continued debate about the return to the workplace and what future levels of demand for office space will look like.” The Richmond interchange precinct forms one of the most tightly held commercial pockets in Melbourne, extending from Swan Street to Punt Road along the Richmond train line. Just four major transactions have taken place in the precinct throughout the past five-years. JLL’s Senior Director of Research, Annabel McFarlane said, “The Richmond/Cremorne pocket is Melbourne’s top performing office precinct, having outperformed the CBD and wider market in terms of office sector rental growth, significantly over the last 10-years.

This growth has been driven by a combination of strong precinct characteristics, which will continue to see the precinct thrive moving forward." “The decentralisation of the workforce from the CBD has led to the inner-city fringe office precinct being in high demand by healthcare, technology and creative industries. Investors are taking great comfort from this trend as office buildings in the city fringe are expected to soak up a great deal of this ongoing tenant demand,” Mr Carr said.

Overseas investor appetite for locations like Richmond has been relatively subdued in recent years, however a number of private Asian groups have started making strong moves toward larger and more substantial acquisitions in the area. Mr Li said, “When Asian investors started investigating Melbourne office building assets, they weren’t familiar with city fringe locations apart from Melbourne CBD, since then we have been educating newer investors in the market on the merits of the location and its underlying demographic drivers, and as a result, several Asian-based investors are becoming much more attuned to the nuances of the city fringe office market in Melbourne, and are now aggressively competing with local buyers."

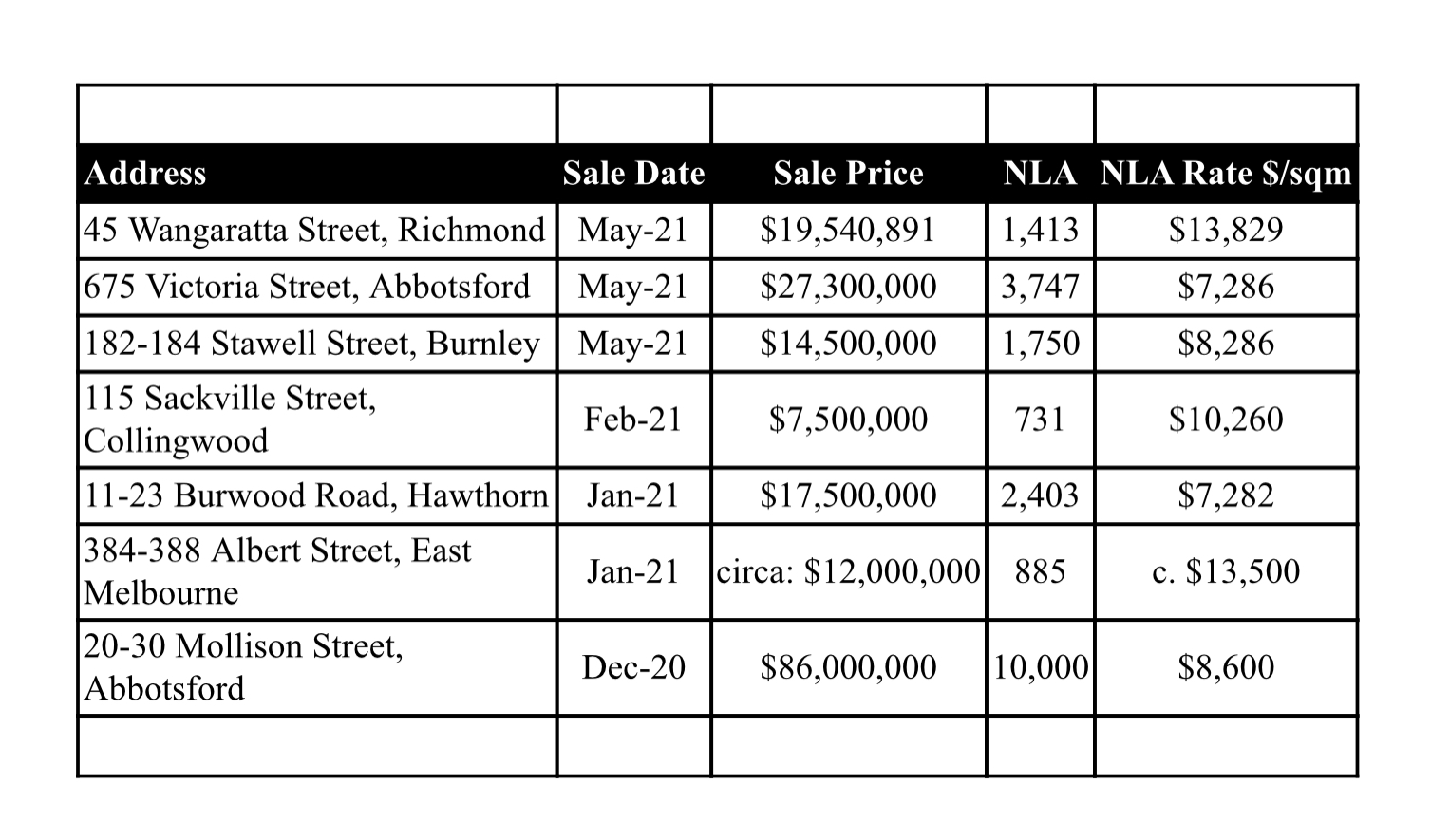

Figure 1: Office transactions around the Richmond/Cremorne precinct throughout the past six-months (source JLL)

To request a sales analysis please email either of the selling agents via the below contact forms.