Depreciation available on a medical centre - BMT Depreciation

Contact

Depreciation available on a medical centre - BMT Depreciation

In recent years medical centres have grown to accommodate larger patient numbers. According to IBISWorld, there were an estimated 49,463 medical practices operating in Australia in February 2022.

The general practice medical services industry in Australia has grown 1.6% per year on average between 2017 and 2022.

Research shows that to accommodate for this growth, rather than new medical centres opening, larger existing medical centres are expanding. Some healthcare professionals say this is because smaller centres don’t have the resources to compete with the extended hours and increased GPs large centers offer.

Regardless of whether a new centre is opening or an existing one is expanding, there are plenty of highly advantageous depreciation deductions available. BMT Tax Depreciation would like to remind commercial investors why they should be claiming depreciation.

What is depreciation?

Depreciation is the natural wear and tear of a building and the assets within it over time. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim this a tax deduction.

There are two types of deductions available to be claimed. Capital works deductions (Division 43) are claimable on the building’s structure and assets permanently fixed to the property. Plant and equipment depreciation (Division 40) is claimable on assets which are easily removable from the property or mechanical in nature.

Depreciation in a medical centre

Depreciation in commercial property can be complex. Capital works is generally quite standard across the board. It’s mostly depreciated at a rate of 2.5% or 4.0% depending on construction date, type of capital works and what they’re used for. Some capital works that can be depreciated in a medical centre include car parks, flooring, and ducting for air-conditioning.

Because a medical centre requires a significant fit out there are lucrative plant and equipment depreciation deductions available. Plant and equipment assets are depreciated over their effective lives, which is dependent on what industry the asset is used in and type and frequency of use. Some commonly found depreciable assets within a medical centre include autoclaves, defibrillators, photocopiers, reception furniture, medical examination beds, medical refrigerators and many more.

Case study: Depreciation available in a medical centre

‘Smith Medical Centre’ is a private general practice medical centre operating in Sydney. It has six consulting rooms and provides a variety of medical services. Smith Medical Centre is owner- operated and was purchased in 2018 for $2,800,00.

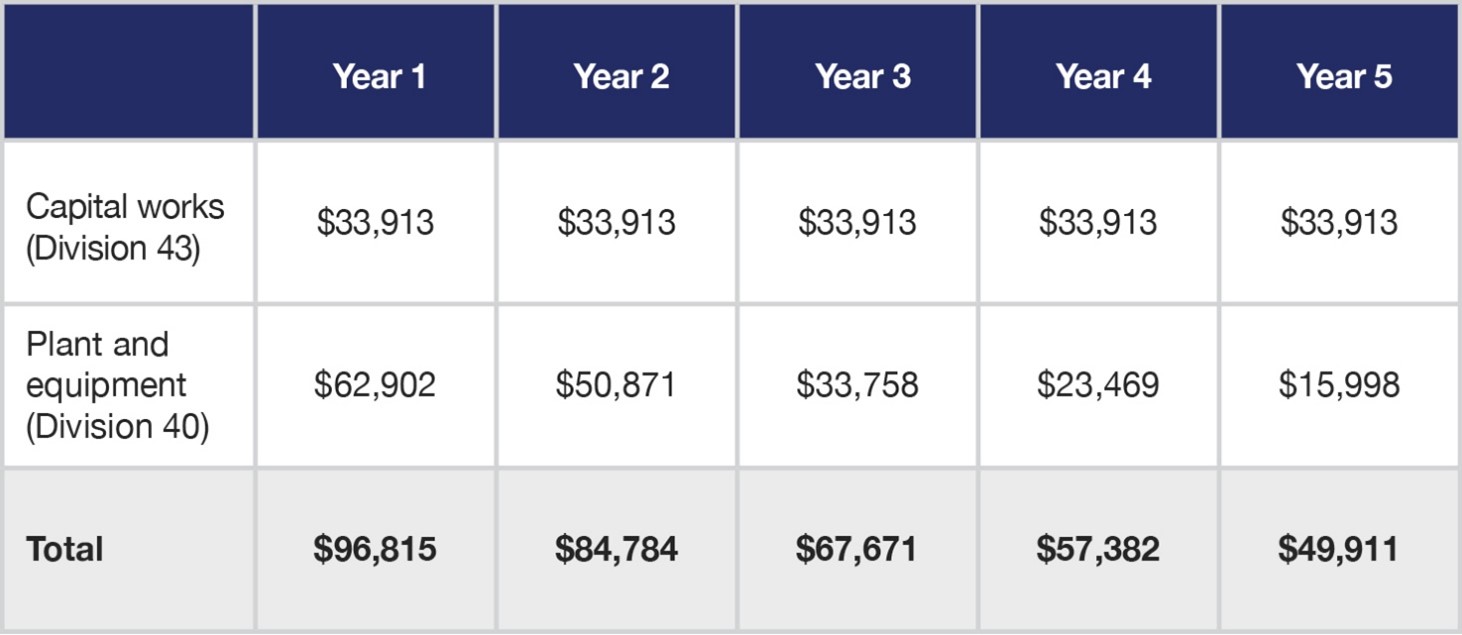

The table reveals the available depreciation deductions for capital works and plant and equipment deductions in the first five years. Because the business owns the building, they are entitled to claim both capitals works and plant and equipment deductions.

The owners of Smith Medical Centre claimed depreciation on these commonly found assets and received significant deductions in the first five years.

- The five-year total depreciation found for an autoclave purchased for $5,995 is $4,572.

- The five-year total depreciation found for a medical examination bed purchased for $3,936 is $3,448.

- The five-year total depreciation found for reception furniture purchased for $16,936 is $14,837.

- The five-year total depreciation found for a telephone system purchased for $13,869 is $11,895.

If Smith Medical Centre failed to claim depreciation they would have missed out on over $350,000 in deductions in the first five years alone, not to mention what could have been lost throughout the life of the property.

Deprecation allows investors to recoup some of the costs associated with running a business and property investment by boosting cash flow.

A BMT Tax Depreciation Schedule ensures commercial depreciation deductions are claimed to their full potential and compliantly by applying all industry-specific legislation.

To learn more about medical centre depreciation call the experts at BMT on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

Similar to this:

A healthy boost to cash flow for office owners and tenants - BMT

How can scrapping affect your business? - BMT

Commercial owners and tenants can maximise cash in time for their spring clean - BMT