Vacant Burwood aged care and seniors living home sold to international operator sets new benchmark - CBRE

Contact

Vacant Burwood aged care and seniors living home sold to international operator sets new benchmark - CBRE

A vacant Burwood aged care home sold to an international owner occupier for $12,588,888, setting a new pricing benchmark for the asset class. 8-18 Edward Street property sold at a rate per bed of $280,000 by CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat.

A vacant Burwood aged care home has sold to an international owner occupier for $12,588,888, setting a new pricing benchmark for the asset class.

The 8-18 Edward Street property occupies a 5,614sqm landholding and was previously operating as Trinity Aged Care with 45 beds and two adjoining residential properties. The sale price represents a rate per bed of $280,000.

The property has an existing Development Approval for a new 110 bed aged care facility; however, the international buyer plans to utilise the existing improvements for a supported residential services facility focusing on NDIS participants.

CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat brokered the deal.

“International investment activity is once again surging across Australia, despite commentary surrounding funding challenges,” Mr Tat said.

“Since China’s borders re-opened, we have seen high demand for larger commercial investments, with our team handling a number of highly liquid Asian investment mandates.”

The property attracted numerous buyer profiles and while the purchaser is focused on both NDIS and supported residential services, underbidders were linked to healthcare and day hospitals, other NDIS services and aged care.

Mr Caspani Muto added, “The transaction was made slightly more complex by the inclusion and transfer of the existing aged care company via a share sale arrangement. As the company was an approved provider and held 45 active bed licenses, this added an additional value to the property.”

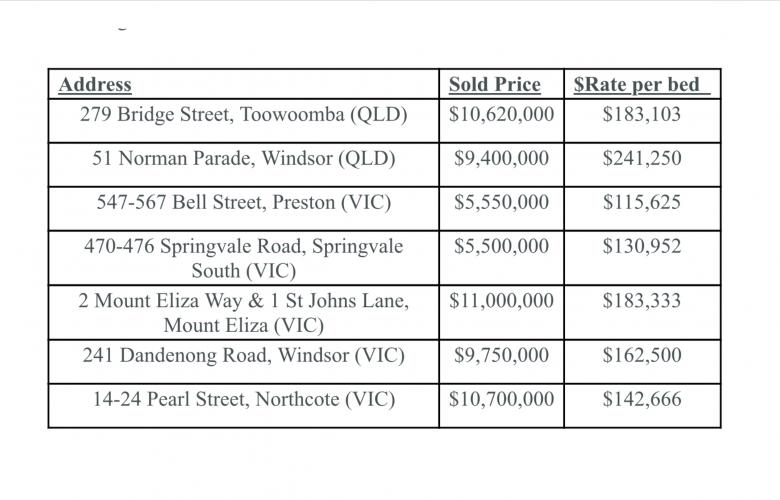

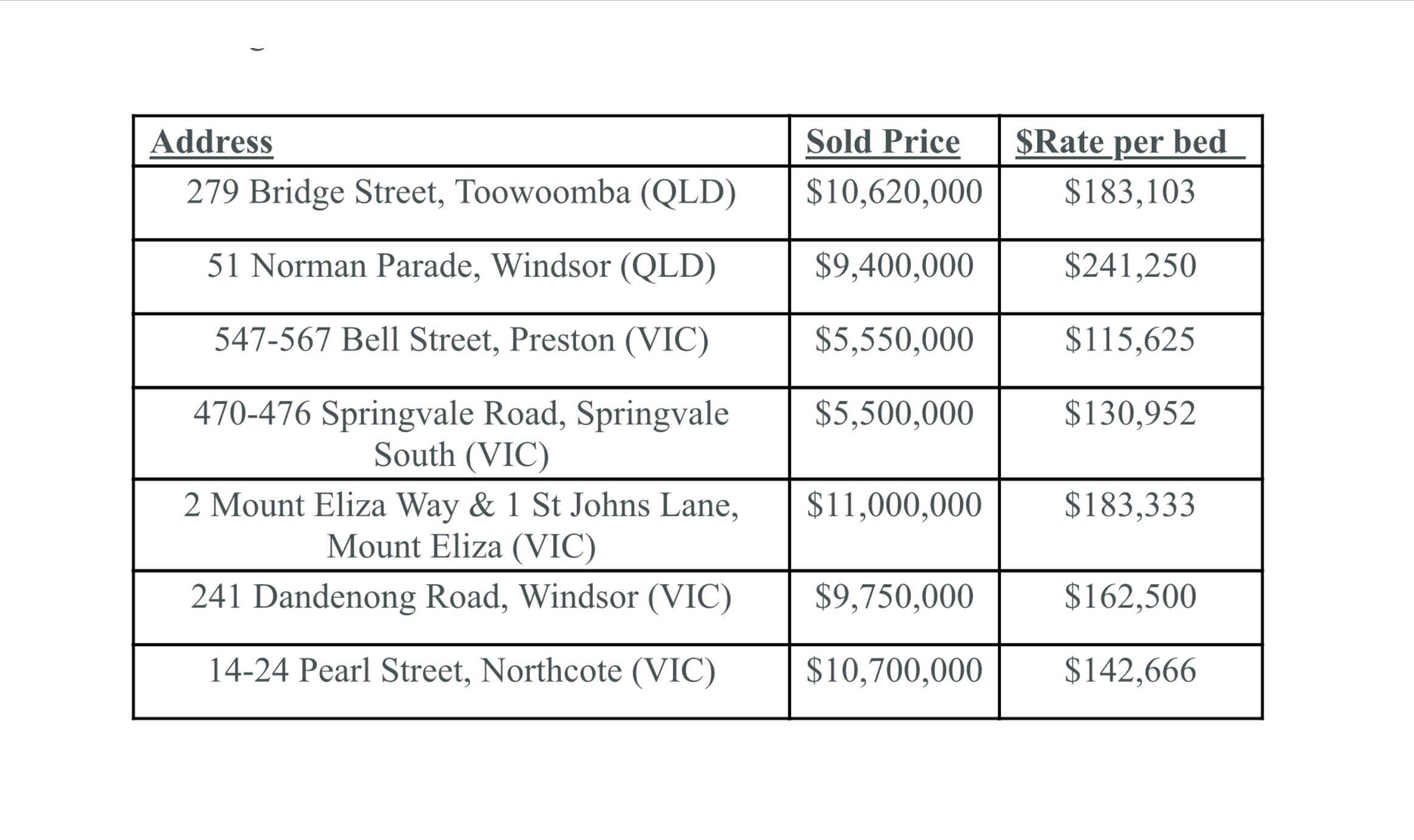

In addition to the 8-18 Edward Street transaction, CBRE has been involved in a range of other recent vacant aged care sales:

To request a sales analysis please contact the selling agents CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat brokered the deal via the below contact details.

Strong Investor and Occupier Demand Drives Growth of Life Sciences Asia Pacific Hubs - CBRE

Click here to read article on Retalk Asia: Life sciences real estate reaches 100 million sq. ft. with major hubs like Shanghai, Beijing, Tokyo, Singapore, and Melbourne; US$18 billion of funds has been raised to invest in life sciences real estate.

Sign up here to receive COMMO newsletters and breaking news sent straight to your inbox.

Related Reading:

Click here to read other Medical Real Estate News

Childcare dominates new year with CBRE brokering 7 deals in 30 days

Highly rated AMIGA Montessori Centre business for sale by CBRE

Brand-new Medical Centre for lease in Victoria’s Highest Growth Municipality by CBRE

Two WA childcare centres sold to Australian Unity $13.495 m through LJ Hooker Commercial Perth

Vacant Burwood aged care and seniors living home sold to international operator sets new benchmark - CBRE

A vacant Burwood aged care home sold to an international owner occupier for $12,588,888, setting a new pricing benchmark for the asset class. 8-18 Edward Street property sold at a rate per bed of $280,000 by CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat.