Brisbane CBD office vacancy predicted to fall until mid 2024 - Knight Frank Brisbane CBD Office Market Report

Contact

Brisbane CBD office vacancy predicted to fall until mid 2024 - Knight Frank Brisbane CBD Office Market Report

Report author and Knight Frank Partner, Research and Consulting Queensland Jennelle Wilson said with no new supply until late 2024, the vacancy rate had the ability to make meaningful reductions as ‘new product’ would be limited to refurbished space.

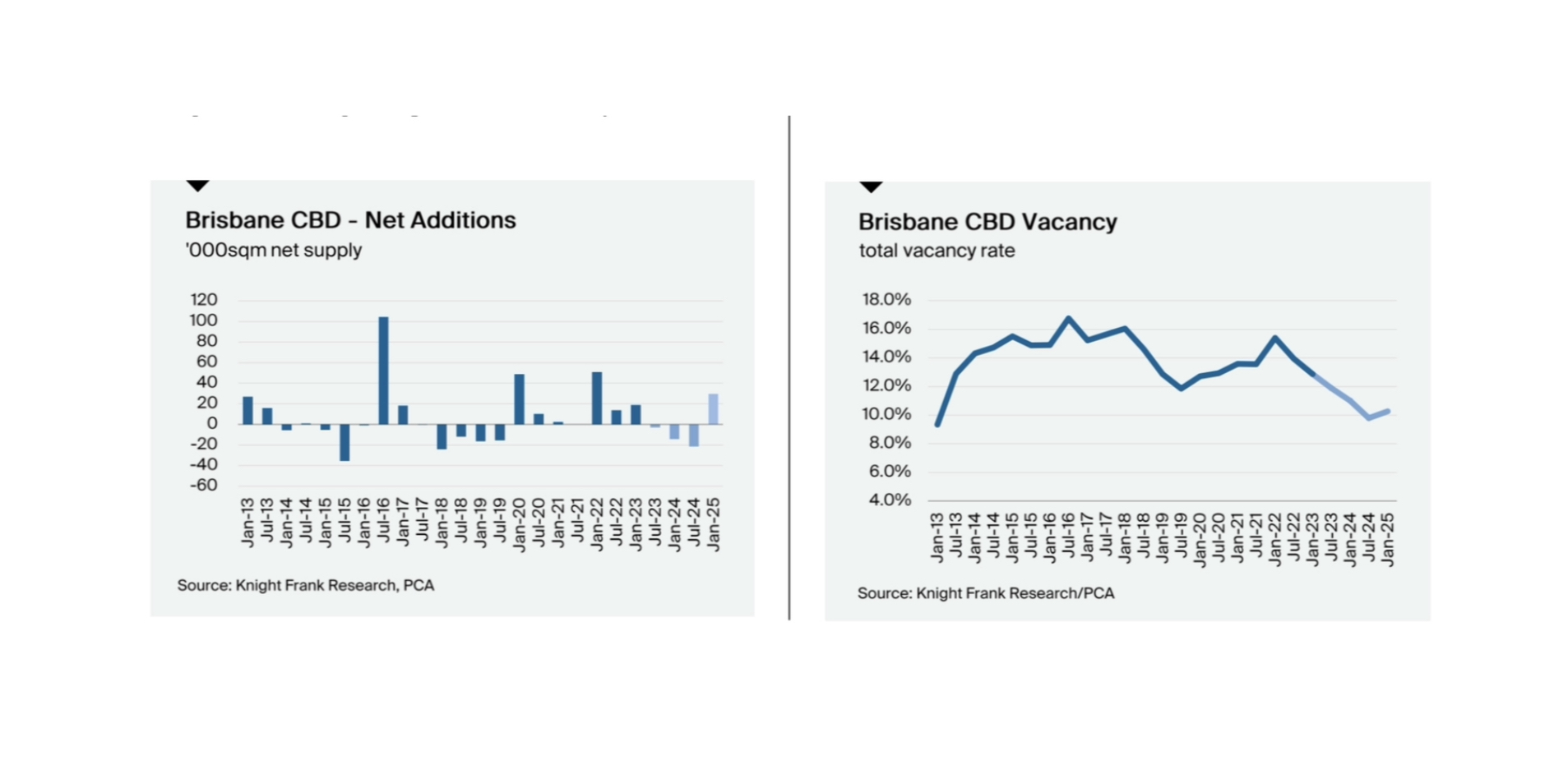

Vacancy in Brisbane’s CBD office market is expected to keep falling until the middle of 2024 due to robust tenant demand and a lack of new supply, according to the latest research from Knight Frank.

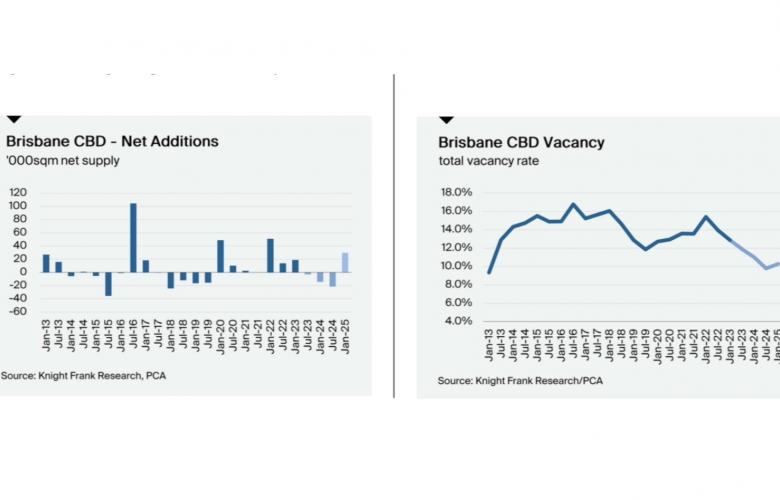

The firm’s Brisbane CBD Office Market Report noted that the Brisbane CBD office market had been devoid of new construction since the completion of 80 Ann Street in early 2022, and this pause would continue through to late 2024 with the anticipated completion of 205 North Quay.

Report author and Knight Frank Partner, Research and Consulting Queensland Jennelle Wilson said with no new supply until late 2024, the vacancy rate had the ability to make meaningful reductions as ‘new product’ would be limited to refurbished space.

“The lack of supply means that net absorption directly translates into a fall in the vacancy rate with sustained reduction expected through to mid 2024,” she said.

“There are also likely to be withdrawals of smaller buildings for refurbishment or potential redevelopment, with likely candidates including 41 George Street in 2023, and 150 Charlotte Street and 140 Elizabeth Street in the second half of 2024.

“We expect the vacancy rate to dip under 10 per cent for the first time in more than a decade during 2024, and from there the upswing of new supply and refurbished space is expected to keep the vacancy rate just into double digits through to 2027.”

The Knight Frank report found there was increasing disparity in the vacancy rate across the different grades with premium clearly the tightest at 5.9 per cent, triggering higher rental growth in these assets.

By contrast, A grade vacancy currently sits at 17.9 per cent, which will take time to work through but tenant upgrading will assist to erode this vacancy, as will withdrawal of tranches for refurbishment.

The B-grade vacancy has fallen below 10 per cent for the first time since mid 2012 as investments in assets and speculative suites, along with steady SME demand, has benefitted that sector.

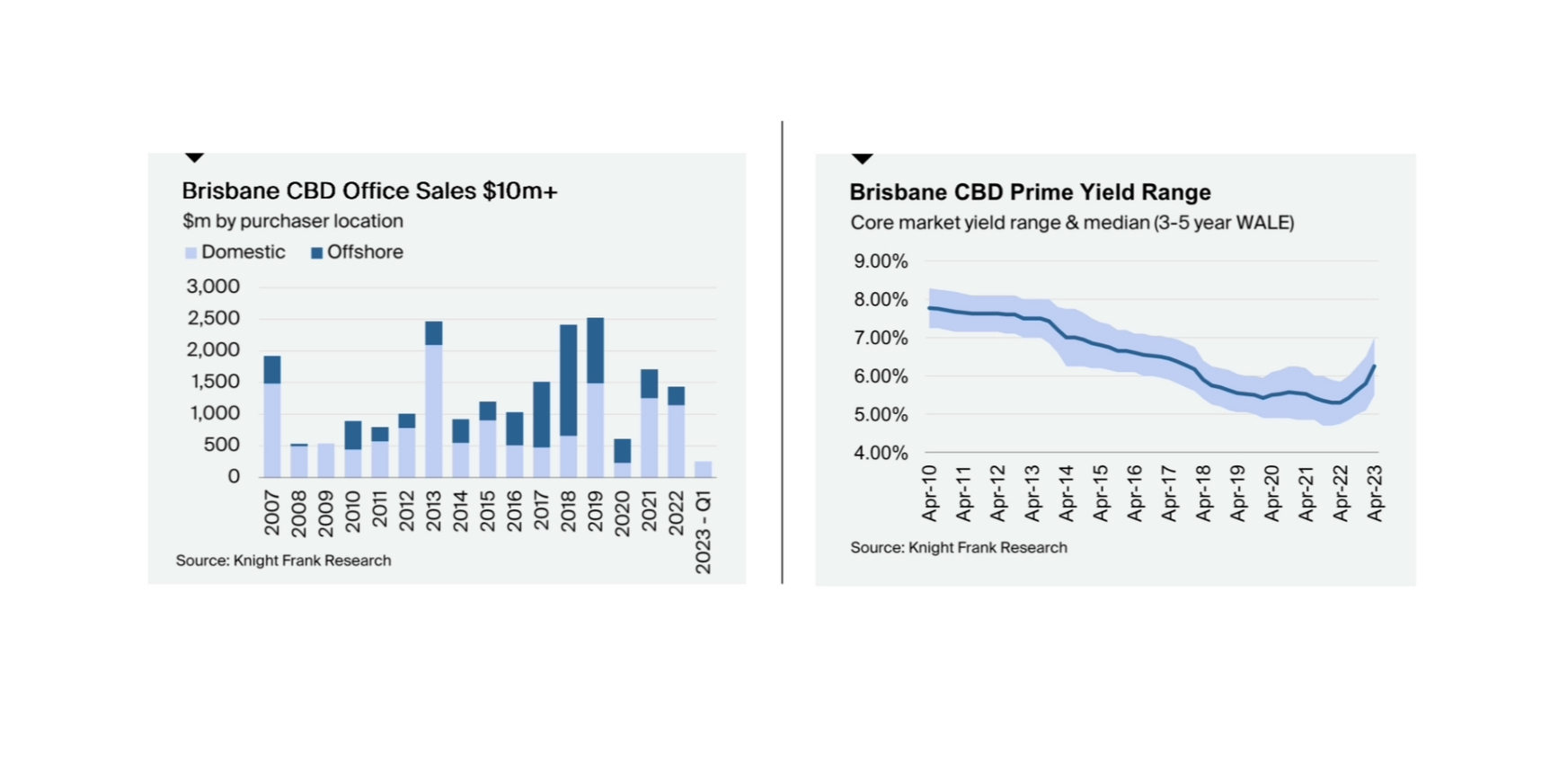

Prime gross face rents increased by 7.2 per cent to $853/sq m in the 12 months to April 2023.

Incentives moderated slightly to average 41 per cent in line with the levels of a year ago, but remain necessary to induce tenants to relocate.

Face rents are expected to continue to grow strongly in 2023, up by 4.9 per cent over the calendar year.

Ms Wilson said growth momentum will remain with a forecast average uplift of gross face rents of circa three per cent over the coming five years.

“Incentives are expected to remain a significant part of the market, but there may be some falls from the current 41 per cent average to 39 per cent in 2025 and 2026.”

Knight Frank Head of Office Leasing Queensland Mark McCann said best in class assets were seeing the strongest rental growth due to tenant competition for this space.

“Overall tenant confidence and activity in the market has continued to surge with high net absorption in the past year,” he said.

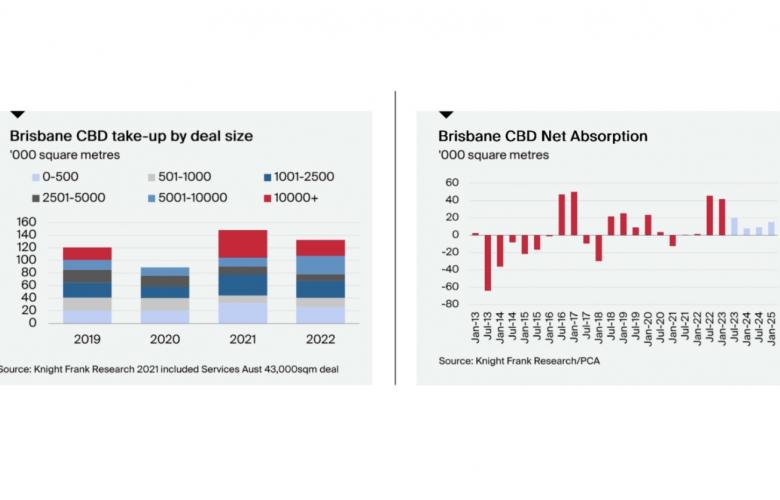

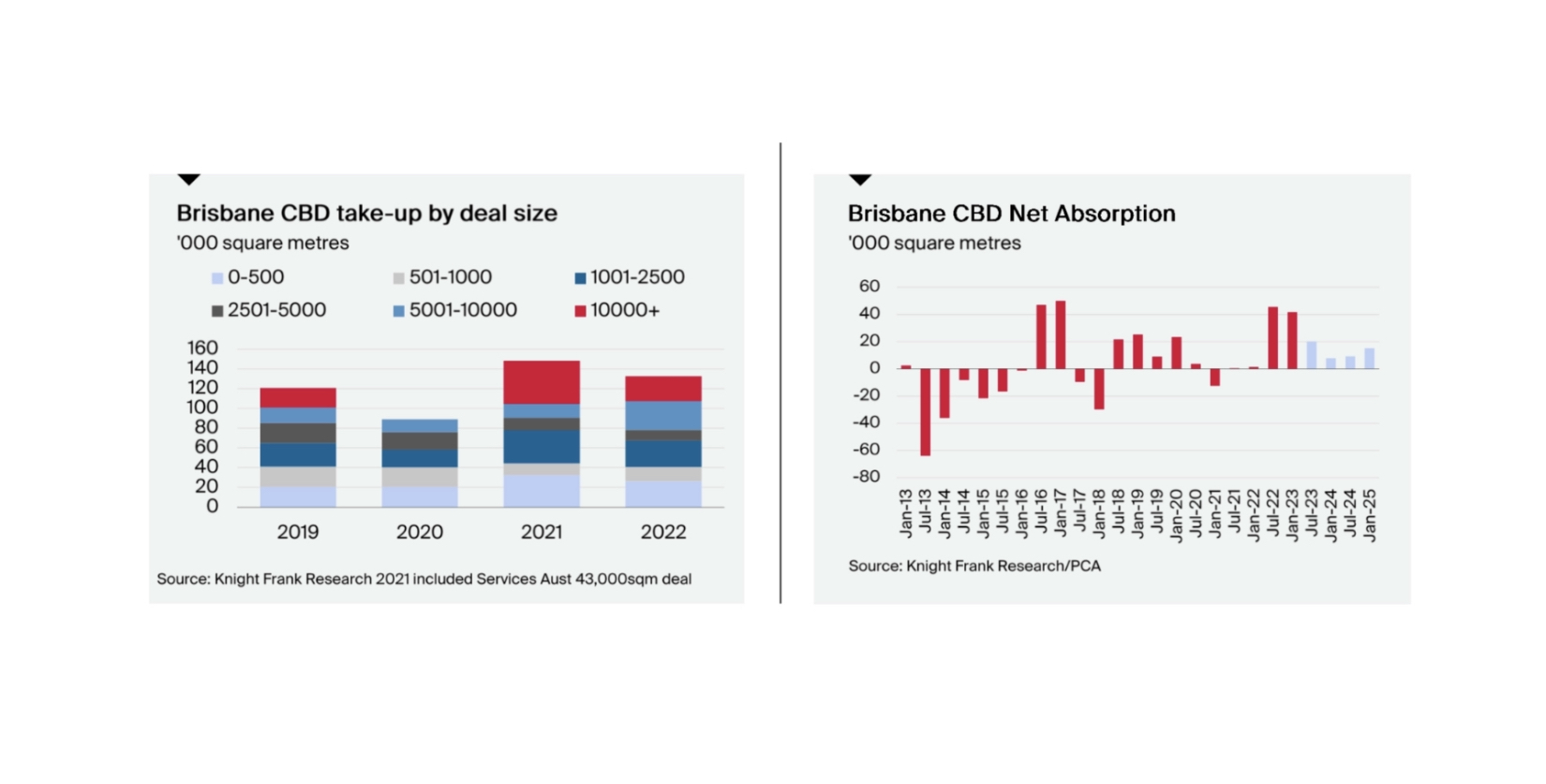

“We saw positive net absorption of 87,000 square metres-plus in 2022, which was the highest annual net absorption for six years; the result of growth across corporate tenants plus continued strong growth amongst small to medium enterprise tenants.

“This strength was in contrast to the major southern capitals where exposure to financial and TMT tenants saw more muted results.

“The changing economic environment could moderate net absorption in Brisbane’s CBD office market this year however the underlying general growth story in Brisbane is expected to maintain positive momentum.

“Queensland’s economy is strong and Brisbane is thriving, bolstered by the significant infrastructure investment, inwards migration and 2032 Olympics.

“The extent of the existing infrastructure spend, in addition to the Olympics 2032 capital works program provides an exciting platform to the Brisbane office market to outperform other states over the next 10 years.”

Mr McCann said so far this year tenant activity in Brisbane’s CBD office market had risen sharply, demonstrating the level of confidence despite wider economic conditions, with leasing briefs rising steadily since January.

“March saw a significant increase in market activity, with 22 briefs released, the highest level recorded in the past 12 months and almost double the 12 for March last year.

“The number of tenant briefs for Q1 this year totalled 45, compared to 37 in Q1 2022.

“The continued increase in construction costs is stifling the prospect of new developments in the CBD, providing an opportunity for existing assets to leverage market conditions with capital upgrades to accommodate future demand.

“Amid a strong preference for fitted spaces, landlords are adopting strategies such as refurbishing existing fitouts to offset high construction costs and promote sustainable building practices.”

The Knight Frank report found tenant demand had broadened in the past year with greater activity from larger tenants, particularly as the top and mid-tier professional firms announced their longer-term premises decisions.

For 2022, 41 per cent of leasing activity by area was in tenancies of 5,000sq m-plus, higher than the 39 per cent in 2021 and representative of more widespread decision making from tenants of scale and greater pre-commitment activity.

At the same time smaller tenants have remained the backbone of leasing activity in the Brisbane market, with 31 per cent of leases by area coming from sub-1,000sq m tenants.

Take up by tenant type showed the continued strength of the professional services sector in Brisbane, with 48 per cent of take up by area.

The Government sector at 13 per cent was down from a particularly active 2021 when they accounted for 33 per cent of leasing activity, however a number of briefs in the market indicate that the State and Federal Governments will be active during 2023.

Report author and Knight Frank Partner, Research and Consulting Queensland Jennelle Wilson

Related Reading:

Click here to view the Knight Frank - Brisbane CBD Office Market Report 2023

Click here to view the Knight Frank - Melbourne CBD Office Market Report 2023

Click here to view the Knight Frank - Sydney CBD Office Market Report 2023