Co-location of services sees the emergence of early education superstores - Burgess Rawson

Contact

Co-location of services sees the emergence of early education superstores - Burgess Rawson

Co-location has led to the creation of early education superstores, as innovation sees operators partner with complementary services, such as swim schools and horse riding clubs - coinciding with increased rents.

Co-location has led to the creation of early education superstores, as innovation sees operators partner with complementary services, such as swim schools and horse riding clubs - coinciding with increased rents.

Burgess Rawson’s eagerly awaited, Early Education Industry Insights report has found these innovative centres are attracting some of the strongest rents in the country.

Burgess Rawson Partner and Managing Director, Queensland, Adam Thomas said early education rents continue to soar with the 2023 March quarter showing Australian rents per place rose by almost 15 per cent since early 2022, to now average $3,518 per place, per annum.

According to Mr Thomas, early education is undergoing a major transformation with this industry proving a true pioneer in creating and leading the way with new trends.

“Such innovation has attracted a new ‘super centre’ with these centres set to receive stronger rental growth in the future.

“Operators are taking a more holistic approach to the services they offer, adopting complementary services that add value to their curriculum, and ultimately, to families.

“New centres, such as the recently opened Officer Childcare Centre and Swim School in Victoria, are now incorporating swimming pools in their designs to provide a holistic learning environment. Another example is the new Bluebird Early Education Centre and Little Snappers Swim School at Berrinba Place in Queensland, developed by renowned De Luca Corporation.

“The industry will continue to innovate with the co-location of complementary tenants, creating a one-stop shop offering additional services and hugely benefiting parents as they become more time poor.

“Responding to the increasing demand for expanded services, we believe both federal and state governments may introduce policies to facilitate parents’ access to these offerings. Core activities in early education will potentially receive funding from the Australian Government, and childcare operators could play a pivotal role in providing NDIS services, such as ADHD support. Such collaborations would benefit the government by optimising their investment” he said.

The Burgess Rawson report shows that over the past decade, early education rents have grown by 87 per cent, and by 27 per cent since 2020 alone.

Mr Thomas said rents have also grown in line with increased government funding, rising land values and construction costs.

“Rents in NSW increased by 46 per cent over the same period taking the cost to average $3,696 per place.”

Mr Thomas said that the increased rents coincided with strong demand to buy early education assets with investors lured to the longevity and security of the ‘set and forget’ leases.

“Over the six months to the end of June this year, we’ve transacted $134 million in early education centres, which is up on the same period last year.

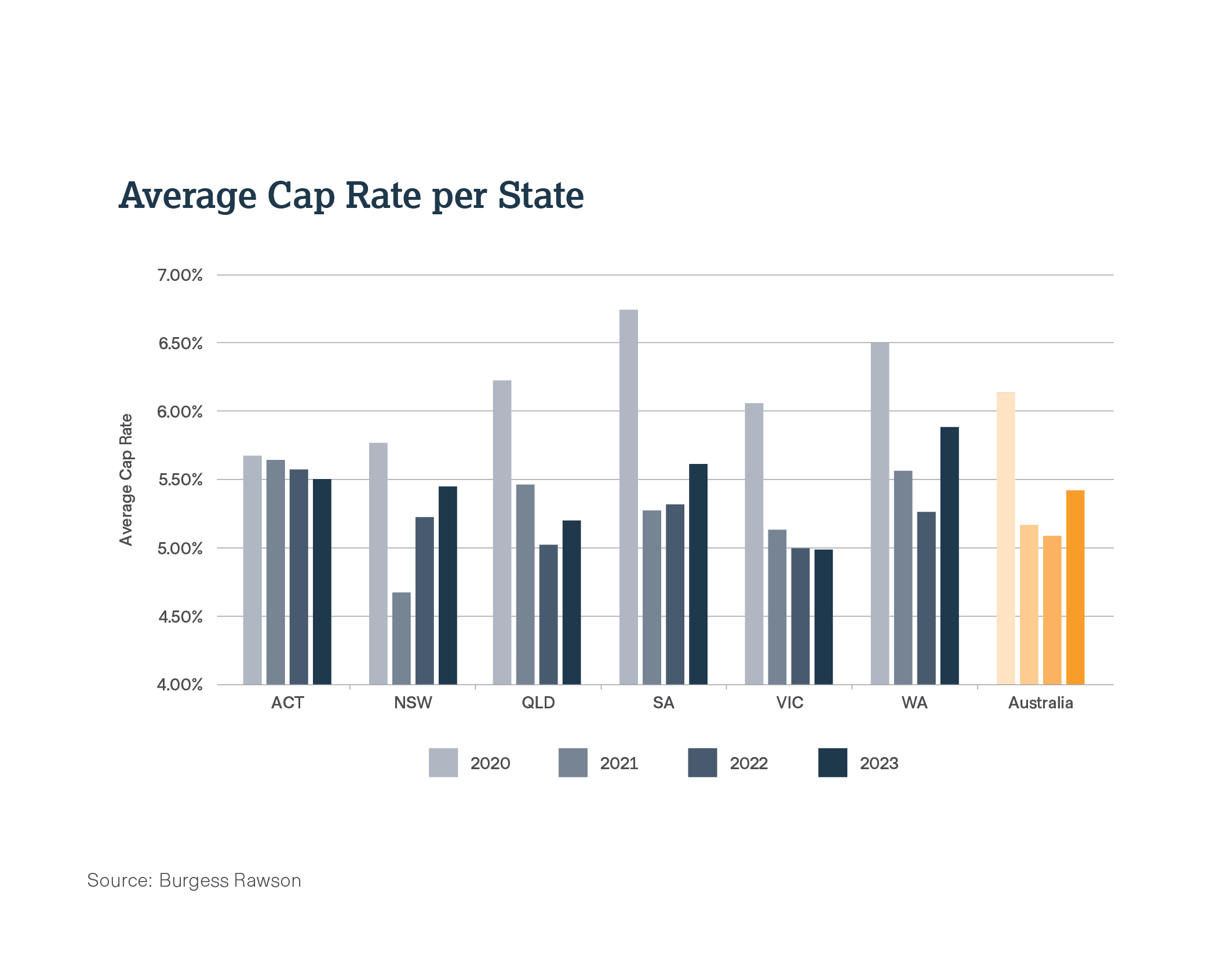

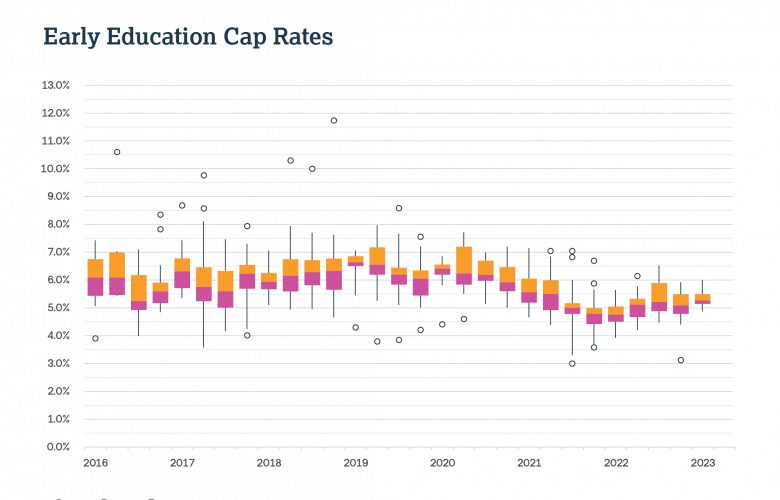

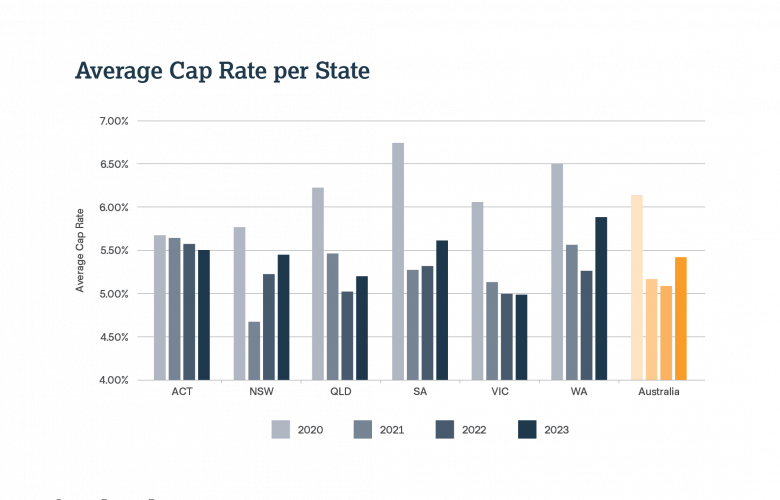

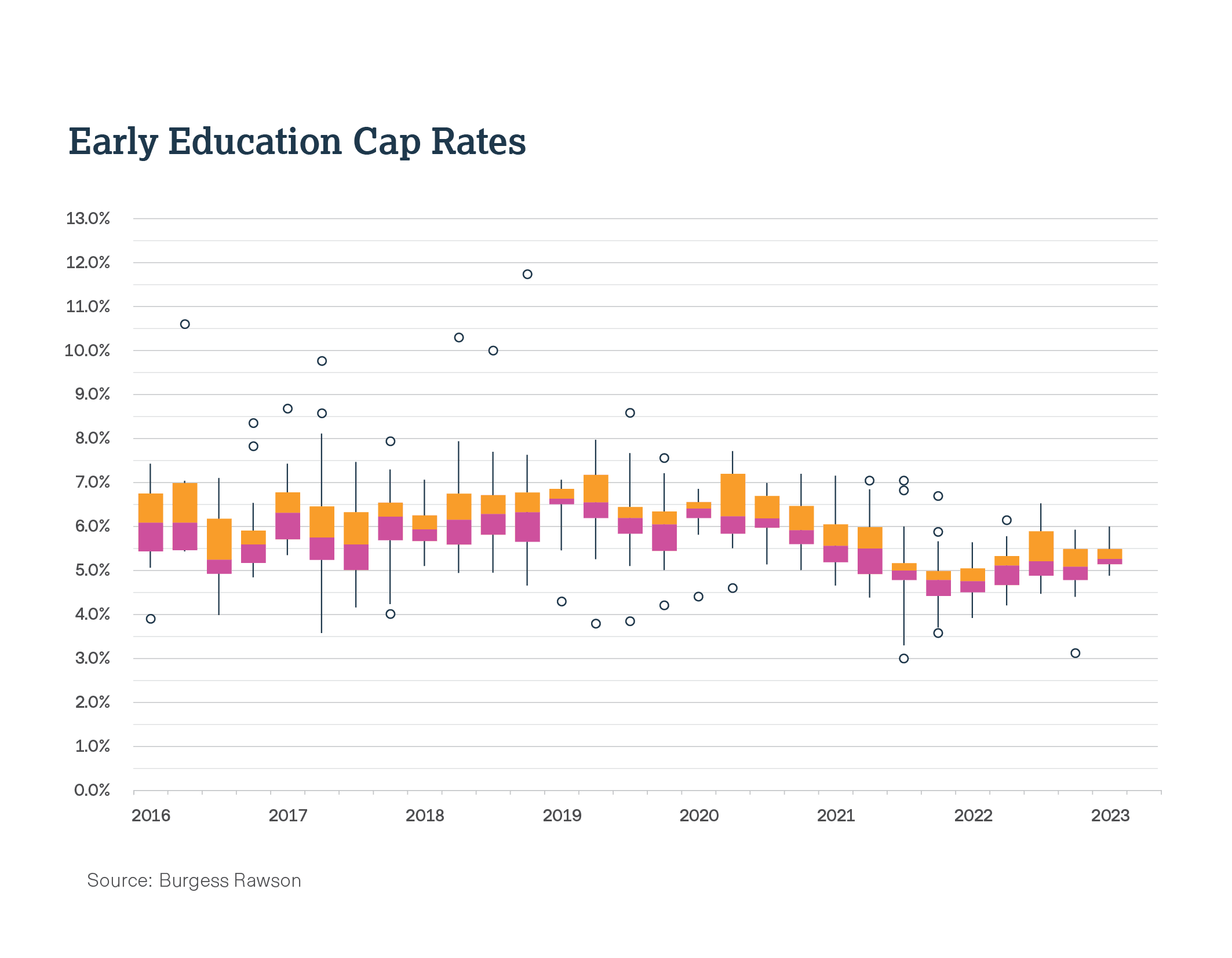

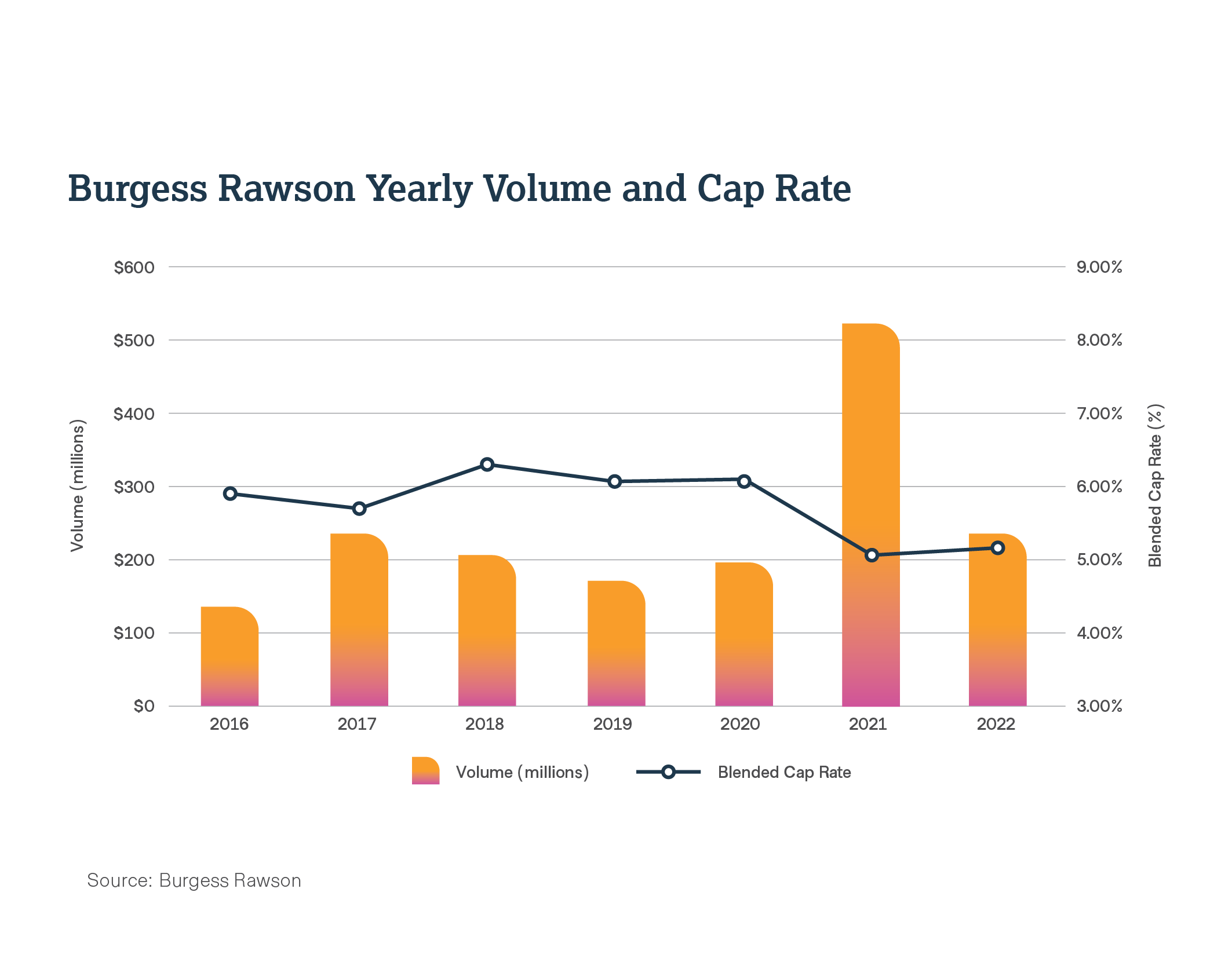

“We’ve seen that while early education cap rates have grown marginally, they still sit at historically low levels, despite 12 cash rate rises. Australian early education cap rates averaged 4.94 per cent last year, before a modest rise in 2023 to an average of 5.0 per cent. This reflects a firm return when compared to 2018 where the average cap rate was 6.3 per cent.

“We’re seeing strong results and record yields achieved including the Goodstart Early Learning Centre in Mosman which sold for $4.41 million on a return of just 2.75 per cent - the lowest ever recorded for this asset class,” he said.

Mr Thomas said environmental and sustainability are reaching new levels which is being demanded by the key players and investors alike. In future, banks will have to assess their loan book and their carbon output footprint which will be offset by lending more to green initiatives.

“Banks will have to assess their clients on their carbon output since sustainability is becoming such a strong consideration. If you’re buying a new facility with a 15 year lease, you should be paying a premium price for a green asset knowing it will be more attractive as an investment,” he added.