2023 winners and losers: which asset came out on top?

Contact

2023 winners and losers: which asset came out on top?

According to Vanessa Rader, Head of research at Ray White Commercial, some asset classes have managed to weather the storm better than others.

The latest MSCI returns data for the year to September 2023 has recently been released, highlighting a downward turn in market conditions in the last quarter, with continued increases in interest rates sure to hinder results for the remaining months of 2023. However, some asset classes have managed to weather the storm better than others.

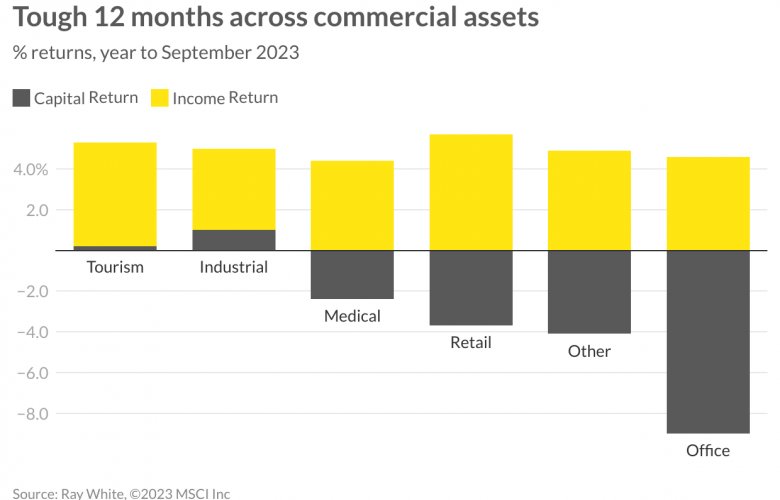

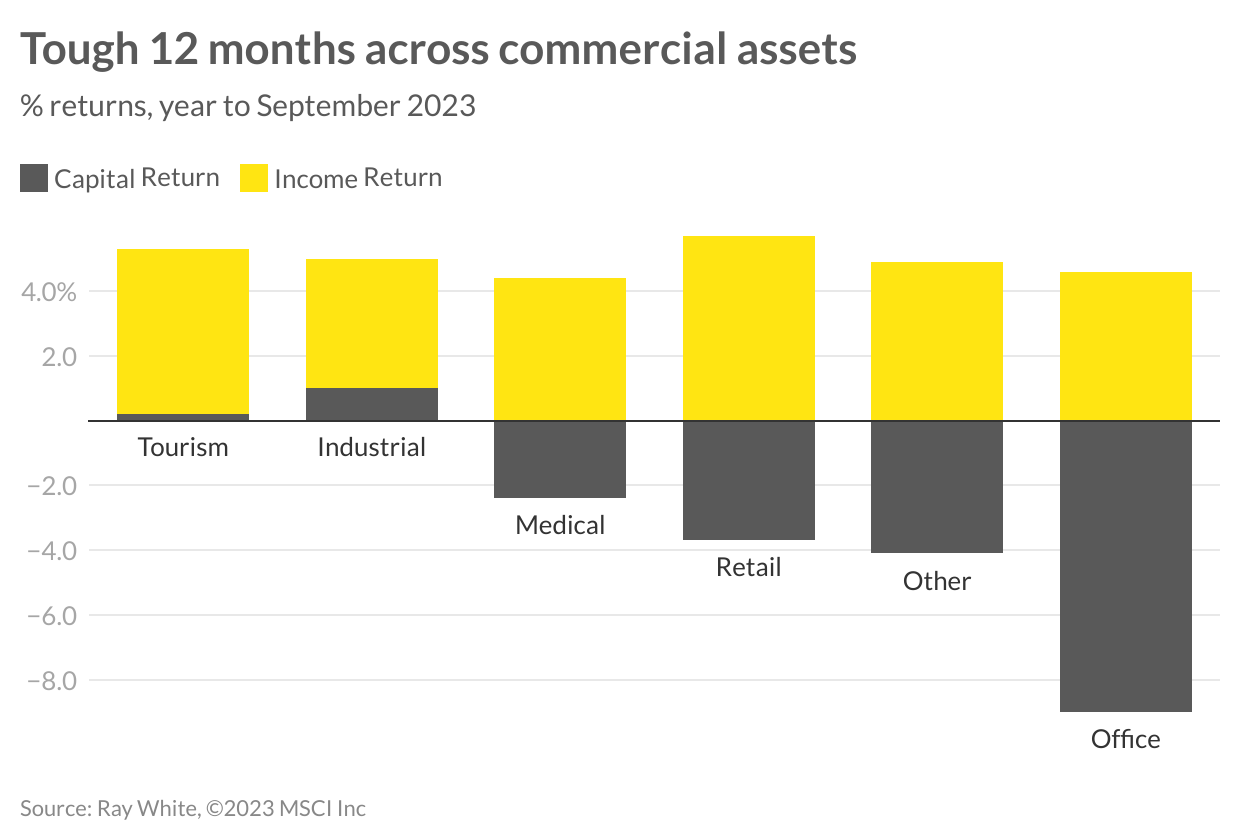

Encouragingly, income returns continue to maintain, albeit slightly behind last year results, highlighting stable occupancy across many asset classes within the portfolios included. Capital returns, however, have seen the greatest change impacting the total return results for most asset classes this year.

Remaining in positive territory have been the tourism and industrial sectors. These national results highlight continued growth in value despite the changing cost of finance. This is heavily influenced by rising rents which are factored into the long-term total return of these assets. Industrial has been the star performer in this regard, showing at 1 per cent increase, to bring total returns to 5 per cent this year, just behind tourism which has yielded total returns of 5.3 per cent. However, looking at total returns alone, the tourism sector and our uptick in occupancy and daily room rates for accommodation, coupled with increased domestic and international visitor nights, has seen this asset class reign supreme for 2023.

Medical has been a key area of investment interest this year, however, underlying pricing has seen capital growth in negative bringing total returns to 2 per cent, the same rate as retail, having them tie for third place. The challenges of the office market since COVID-19 have not improved, impacting vacancies, effective rents, incentives and yields making it the loser of 2023, recording declines in capital value of -9 per cent over the last 12 months. These results are indicative of national averages, with some office markets outperforming the average, including Brisbane CBD, which saw total returns remaining in positive territory for this period, followed by Perth CBD which recorded -0.8 per cent total returns.

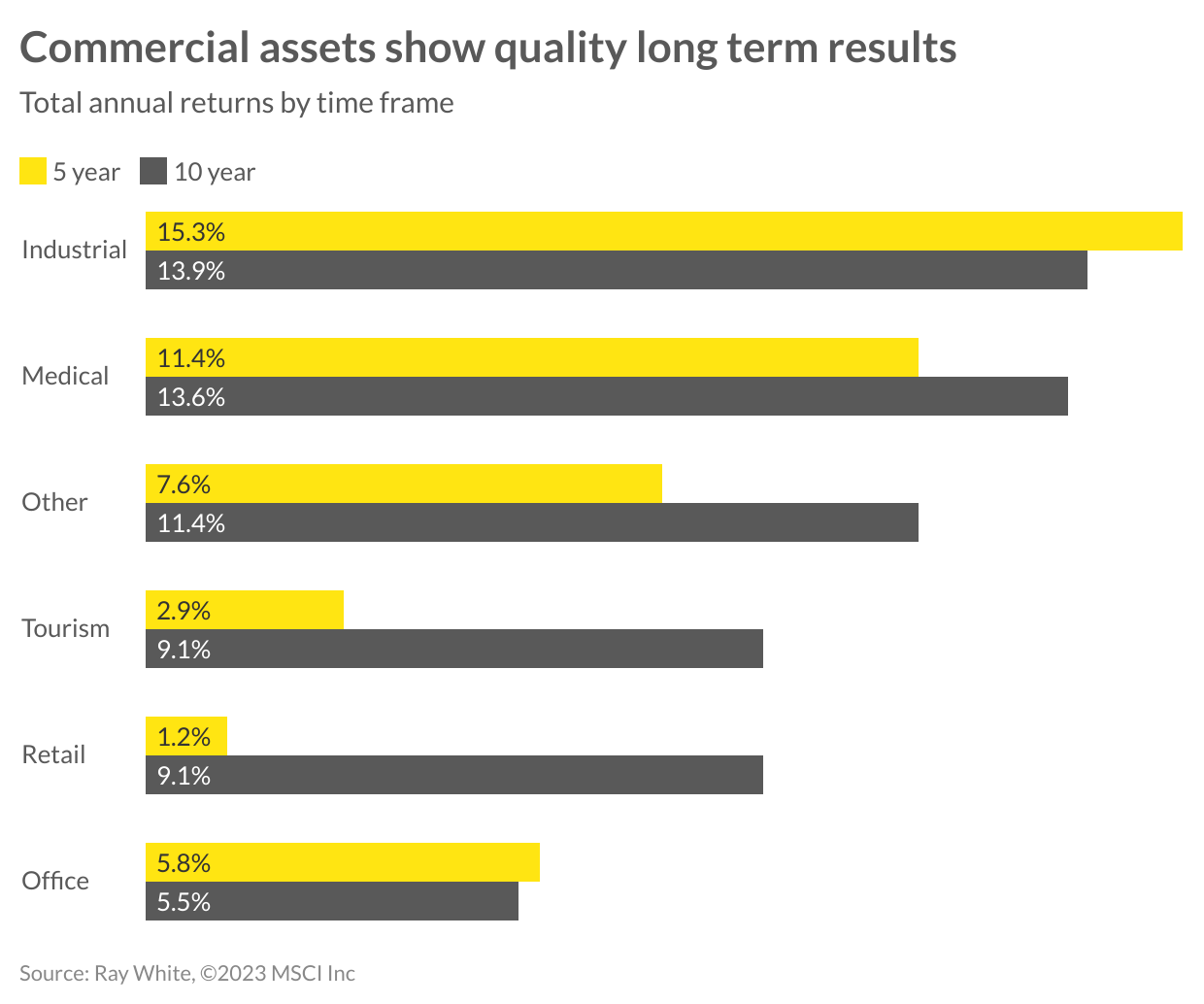

Despite the woes of the last 12 months, commercial assets historically have been considered quality long term investment options. The rapid rate of escalation over the last few years; spurred on by inexpensive and available finance together with the desire for large institutions, funds, and smaller private buyers to diversify their portfolios; is all part of the volatility that these assets recorded. Considering the longer term trends, industrial has cemented its number one position with both 5 and 10 year average returns outstripping all other asset types at 15.3 per cent and 13.9 per cent respectively. Over this longer term, the evolution of the industrial asset class has been outstanding. Previously considered a “dirty” asset, which held a discount to other asset classes, industrial assets have grown in sophistication and our demand to occupy, outpacing the supply of stock.

Hot on the tail of industrial has been the medical sector. Over the last 10 years this asset class has enjoyed 13.6 per cent annual growth and will continue to perform well given our growing needs in this space, high population appreciation and an undersupply of quality offerings, ensuring medical as an institutional asset class is here to stay. While tourism has had a strong 12 months, this asset class has had to bear the negative results seen during COVID-19, and over the last five years growth has sat at just 2.9 per cent per annum. Although, over the longer term, tourism has outperformed other asset types with a 10-year average of 9.1 per cent which is inline with retail. Retail similarly had greater difficulty during the pandemic period, resulting in a five-year average growth of just 1.2 per cent.

Coming in last has been the office market, even over the longer term. The difficulty over the last few years, regarding limited demand and high supply in some markets, has hindered the returns for this historically attractive commercial asset class. Both five and 10-year returns sit at a similar level of 5.8 per cent and 5.5 per cent respectively. Unfortunately, future expectations surrounding occupancy and investment demand may see further short term declines in total returns making the historic long term prospects for offices more difficult. Encouragingly we may see a resurgence in offshore, institutional and private activity capitalising revalued assets, while a strong movement by the private sector to bring staff back into our office assets could improve fundamentals in 2025 and beyond.