Melbourne CBD office vacancy remains at national low: Property Council

Contact

Melbourne CBD office vacancy remains at national low: Property Council

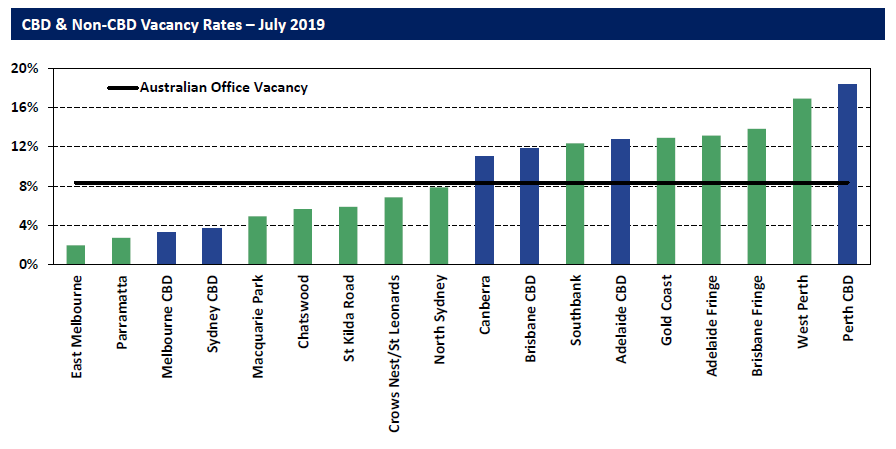

Melbourne has recorded a CBD vacancy rate of 3.3 per cent - the lowest CBD vacancy rate in the nation, according to the Property Council of Australia Office Market Report released today.

A combination of demand, some stock withdrawal and steady population growth are driving low vacancy rates in Victoria's capital, the Property Council of Australia says.

According to Cressida Wall, Victorian Executive Director for the Property Council of Australia, the looming question for Melbourne’s office supply is where will workers go when the office supply pipeline dries up in 2023?

“To 2023, Melbourne CBD will supply approximately 650,000 sqm of new commercial stock," she said.

However, half of that stock is pre-committed and there is little to no, new office space in the pipeline beyond 2023.”

At a glance:

- New research from the Property Council of Australia has revealed that Melbourne's CBD has the lowest office vacancy rate in the nation at 3.3 per cent.

- To 2023, Melbourne CBD will supply approximately 650,000 sqm of new commercial stock, but there is no new office space in the pipeline beyond that.

- According to JLL, the first half of 2019 suggested that centralisation will remain a key theme in the market this year.

Changes to the C270 planning controls introduced in 2016 saw approvals of commercial developments in the CBD plummet, leading to significant concerns about the pipeline of supply beyond the current cycle.

“With Melbourne’s population set to match that of Sydney by 2028, immediate action is required to ensure that Melbourne’s CBD is able to accommodate its growing workforce,” said Ms Wall.

“We welcome the State Government’s announcement that changes to C270 are imminent.

“However, until changes are implemented, CBD approvals remain at a standstill.

"This position is untenable and changes to C270 to support commercial development are the release valve Melbourne urgently needs if it is to continue to develop as a thriving global commercial hub.”

According to an Urbis report, commissioned by the Property Council in late 2018, at least ten iconic Melbourne buildings that have either been built or that are currently under construction could not have been approved under the existing C270 controls.

Source: Property Council of Australia

Centralisation to be a key theme

JLL's Head of Office Leasing for Victoria Stuart Colquhoun said while market speculation about decentralisation continued, the first half of 2019 suggested that centralisation will remain a key theme this year.

"Australian Unity (15,600 sqm, 271 Spring Street) and the Australian Computer Society (1,980 sqm, 839 Collins Street) have opted to centralise to CBD locations from existing locations in Melbourne’s Fringe," he said.

“It is likely that co-working space operators have also played a role in ongoing centralisation.

“Melbourne has been leading the Australian market with the strongest take-up of flexi-space, accounting for 19.7 per cent of CBD office leases in 2018.

"Operators of co-working space in Melbourne’s CDB are leasing up to 50 per cent of their floor area to large enterprises as the ‘on-demand’ workforce expands and vacancy remains constrained."

JLL's Head of Office Leasing for Victoria Stuart Colquhoun. Source: JLL

Mr Colquhoun said pre-commitment levels and withdrawals continued to dampen the impact of the accelerating supply cycle.

"A total of nine projects are under construction in the Melbourne CBD which will deliver 433,738 sqm of new office space to the market between 4Q19 and 1Q22," he said.

"Of this, 74 per cent is already pre-committed," he said.

Four new pre-commitments were confirmed in 2Q19, absorbing an additional 13,100 sqm across three buildings.

1. 80 Collins Street South Tower

- Ashurst (4,400 sqm) – relocating from 181 William Street.

- Queensland Investment Corporation (1,200 sqm) – relocating from its offices in the existing north tower.

2. Collins Arch – 447 Collins Street.

- Work Club Global (2,800 sqm) – co-working group will open their second Melbourne location.

3. Two Melbourne Quarter – 697 Collins Street

- Spaces (4,700 sqm) – co-working group will open an additional location in Docklands.

Mr Colquhoun said population and economic growth drivers remained strong within the city.

"Melbourne is increasing by over 100,000 people per year," he said.

"The market is expected to continue to reflect this buoyancy in the second half of 2019."

Click here to view the Office Market Report.

Similar to this:

Dexus working on deal for 80 Collins Street

Record start to the year for Sydney office sales as investors spend $4.4 billion