Australian commercial property volume shaping up to be 'lowest since 2012' - Urban Property Australia

Contact

Australian commercial property volume shaping up to be 'lowest since 2012' - Urban Property Australia

Investors are becoming increasingly cautious of Australia's commercial property market, Urban Property Australia Founder and Managing Director Sam Tamblyn says.

A sense of caution is emerging around Australia's retail and office sectors as investors and occupiers monitor economic headwinds and consumer concerns, Urban Property Development says.

Research conducted through UPA indicates a substantial slowing of transactional activity in the commercial market, with yields of most sectors below previous benchmark lows.

Founder and Managing Director, Sam Tamblyn, said despite an initial confidence bounce provided by the re-election of the Morrison government, the volume of Australian commercial property is shaping up to be the lowest since 2012 as investors grow increasingly cautious.

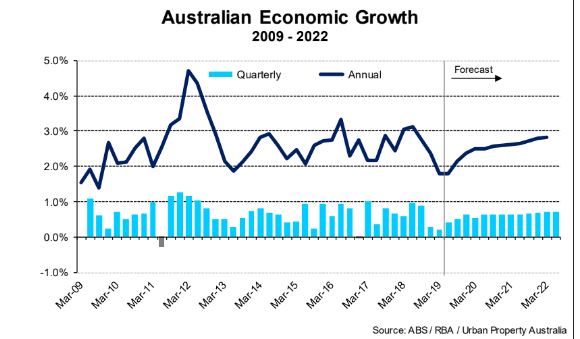

“The Australian economy has slowed to the weakest annual expansion since 2009 with consumers concerned by modest income growth and a decreased wealth effect from falling home prices, albeit with emerging signs that prices have stabilised," he said.

"Looking ahead, growth momentum is unlikely to accelerate significantly through the rest of this year with the Australian economy is forecast to grow by 1.7 per cent this year."

At a glance:

- Research from Urban Property Australia suggests investors a growing increasingly cautious of Australia's commercial market.

- Boosted by strong tenant demand and continued rental growth, the Australian office sector is the only commercial property sector on track to record annual sales volumes above average.

- Retail rental levels continue to be under downward pressure as many retailers prefer consolidation rather than expansion strategies.

Australia’s economy has been buffeted by global economic challenges that have included the intensified US-China trade war and the prolonged uncertainty on the Brexit decision.

In the US, the Federal Reserve cut the US interest rates for the first time in 11 years while China’s GDP grew at its slowest rate since 2008.

Mr Tamblyn said despite the slowdown in the housing market and weak consumption growth, the labour market remained healthy, as shown in the decrease of Australian office vacancies in the first half of 2019.

"Boosted by strong tenant demand and continued rental growth, the Australian office sector is the only commercial property sector on track to record annual sales volumes above average," he said.

Australia’s total office vacancy rate has fallen to 8.3 per cent as at July 2019, its lowest level since July 2012 with falls recorded in the majority of CBD office markets.

Melbourne and Sydney remain Australia’s strongest and best performing CBD markets with total vacancy rates of 3.3 per cent and 3.7 per cent respectively.

Over 2019 to date, UPA has recorded more than $8 billion of office properties transacted boosted by a number of major sales.

The news isn't as good for the retail sector, with rental levels under downward pressure from retailers opting for consolidation rather than expansion strategies.

Source: Urban Property Australia

According to UPA, these soft occupier and consumer sentiment conditions have also hindered investment activity with transactional activity to date indicating that the 2019 annual volume will be the lowest Australian annual total since 2011.

Reflecting the easing investor demand for retail assets, UPA estimates that yields have expanded for all Australian retail property types over the year to July 2019 with the exception of regional shopping centres.

Mr Tamblyn said the retail sector continued to face the greatest challenges with changing consumer preferences and technological changes impacting sales activity, values and rents.

"Australian retail trade has trended down over the past five years which has led to retailers adopting a cautious approach to expansion," he said.

Similar to this:

Brisbane office transactions reach highest level in 10 years - Colliers

Office market expected to be more even in 2019

'Solid' investment expected to continue this year, says Urban Property Australia