Dan Murphy’s Butter Factory Shepparton for sale by Colliers and Savills

Contact

Dan Murphy’s Butter Factory Shepparton for sale by Colliers and Savills

Dan Murphy’s Butter Factory for sale expected to attract significant investor interest via Colliers’ Mike Crittenden and Tim McIntosh, in conjunction with Savills’ Rick Silberman and Steven Lerche.

Dan Murphy’s Butter Factory in Shepparton is expected to attract significant investor interest when it hits the market with Colliers and Savills this month.

Colliers’ Mike Crittenden and Tim McIntosh, in conjunction with Savills’ Rick Silberman and Steven Lerche, have been appointed to sell the prominent 6,366sqm site at 440-452 Wyndham Street, on the Goulburn Valley Highway, by Expressions of Interest closing Thursday, 23 June 2022.

The property comprises a fully leased 2,732 sqm (GLA) centre with 91 on-grade car spaces, returning an annual net income of $763,628.

“This represents the first Dan Murphy’s property nationally to be publicly marketed since November 2021,” Mr McIntosh said. “Investors will be attracted to the strong trading performance of the Dan Murphy’s Butter Factory in Shepparton, which has seen 7.00% average YoY MAT growth since opening late 2009, along with the guaranteed rental growth across all specialty tenants, who are secured on net leases with fixed annual increases.”

Shepparton, often known as ‘Food Bowl of Australia’, is Victoria’s fifth largest regional city located approximately 190km north of the Melbourne CBD. Shepparton is a thriving regional economy underpinned by the agricultural and tourism industry.

Mr Crittenden said Dan Murphy’s Butter Factory was strategically located in Shepparton CBD’s core retail and commercial precinct, surrounded by national retailers including Coles, Kmart, Chemist Warehouse and JB HiFi, which all draw shoppers from a wider catchment area.

“Dan Murphy’s is one of Australia’s most trusted brands, leading bulky liquor retailer with only 250 stores across Australia and gross sales of $11.6 billion in FY21,” Mr Crittenden said. “The defensive nature of this retail sub-sector has seen the assets become even more highly sought after by investors, who are seeking income security through non-discretionary specialty tenants and built-in rental growth, all underpinned by robust demographic characteristics and population growth.’’

Mr Silberman said the property was likely to attract significant interest given the continued demand for regionally located retail investments, driven by an improved outlook on population growth, as well as the current 50% stamp duty savings.

Mr McIntosh said Dan Murphy’s was one of the best performing retailers in Australia and one of the most sought after by investors.

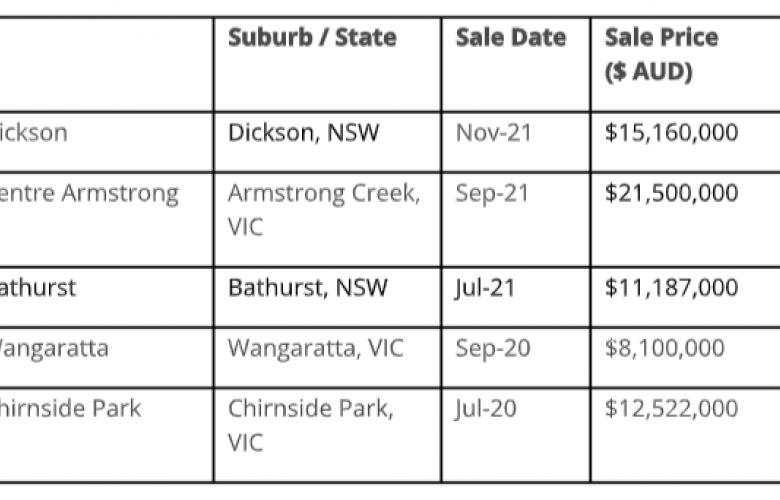

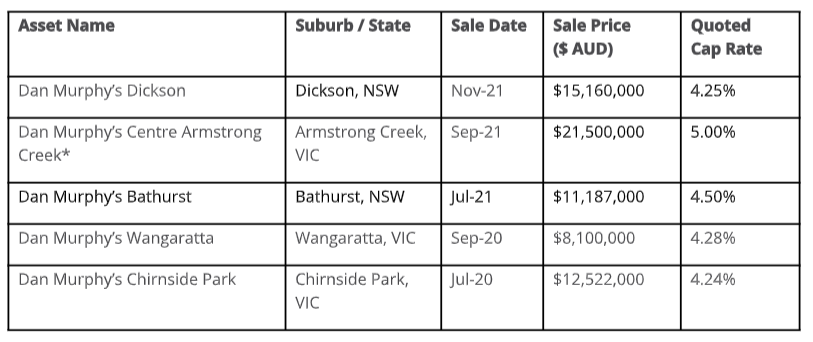

“In the last two years, there have only been seven Dan Murphy’s transactions nationally with only four trading in Victoria over that time,” he said.

Recent Dan Murphy’s transactions include Dan Murphy’s Dickson (ACT), selling November last year on a yield of 4.25%, while Dan Murphy’s Bathurst sold in July for $11.2 million, showing 4.50%.

To request a copy of the Information Memorandum please contact one of the marketing agents via the contact details below.