Perth’s CBD office market a standout performer nationally - Knight Frank

Contact

Perth’s CBD office market a standout performer nationally - Knight Frank

The Perth office market is a standout performer in Australia, with positivity in the resources sector underpinning tenant demand and market activity, according to the latest research from Knight Frank.

The Perth office market is a standout performer in Australia, with positivity in the resources sector underpinning tenant demand and market activity, according to the latest research from Knight Frank.

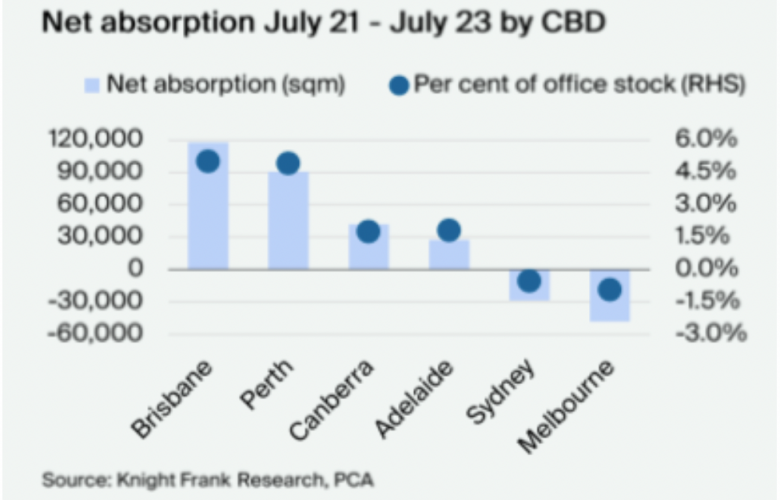

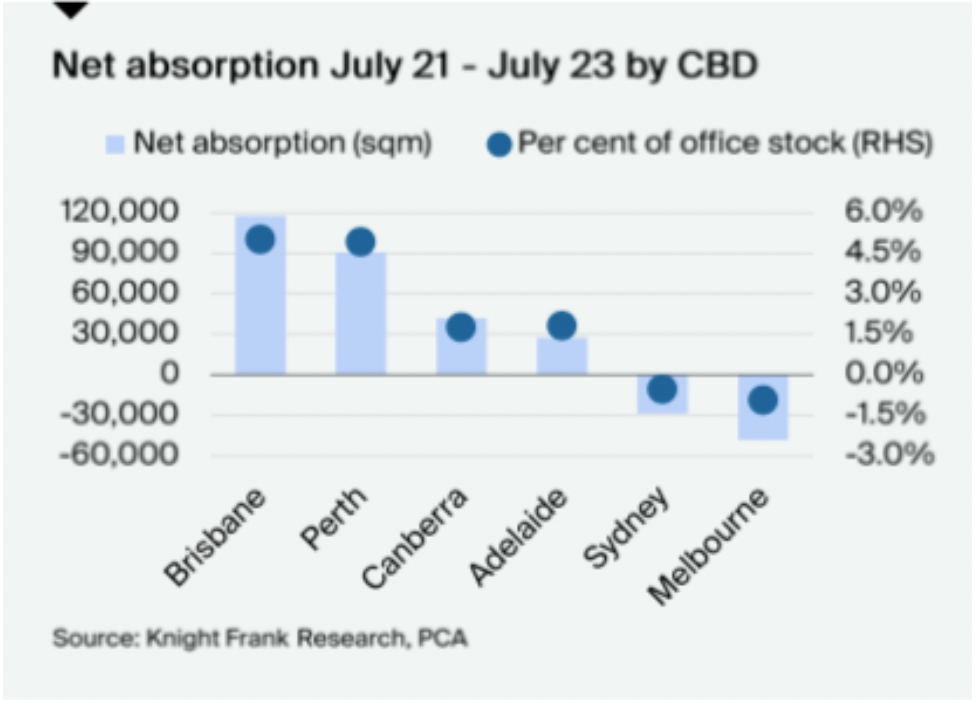

The Perth CBD Office Market Report found the Perth CBD has recorded a high level of net absorption over the past two years at 90,534sq m, with 23,950sqm recorded in H1 2023.

This reflected 4.9% of total stock, the second highest of any major CBD over the past two years, trailing Brisbane by only 0.1%.

Over this two year period, net absorption of B Grade (26,181sq m) has remained positive and net absorption of A-grade (36,539sq m) has been particularly strong, contrasting with other major cities which have seen a more pronounced concentration of absorption in premium-grade assets.

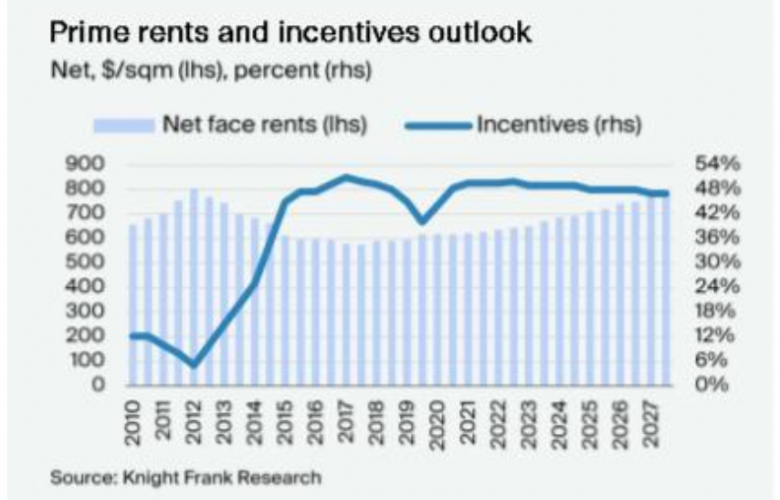

The research found prime and secondary rents in Perth’s CBD office market also both increased in H1 2023, with incentives remaining stable.

Prime net face rents in the Perth CBD rose by 1.5% over the six months to July 2023 to average $678/sq m, 5.3% higher over the last 12 months and among the fastest growing markets nationally.

Knight Frank Associate Director Research and Consulting and report author Dr Theo Connell- Variy said the sustained positive absorption in the Perth CBD reflected the sustained strength of economic and employment growth in the city.

“Amid economic headwinds nationally, Western Australia is outperforming, benefitting from commodity exports, particularly the increasingly sought-after rare earths and critical minerals, which are vital to renewable energy technologies,” he said.

“The state’s tight labour market, with an unemployment rate of 3.8% in August and a 0.7% increase in the participation rate to 69.3% both augur well for continued office demand in Perth.”

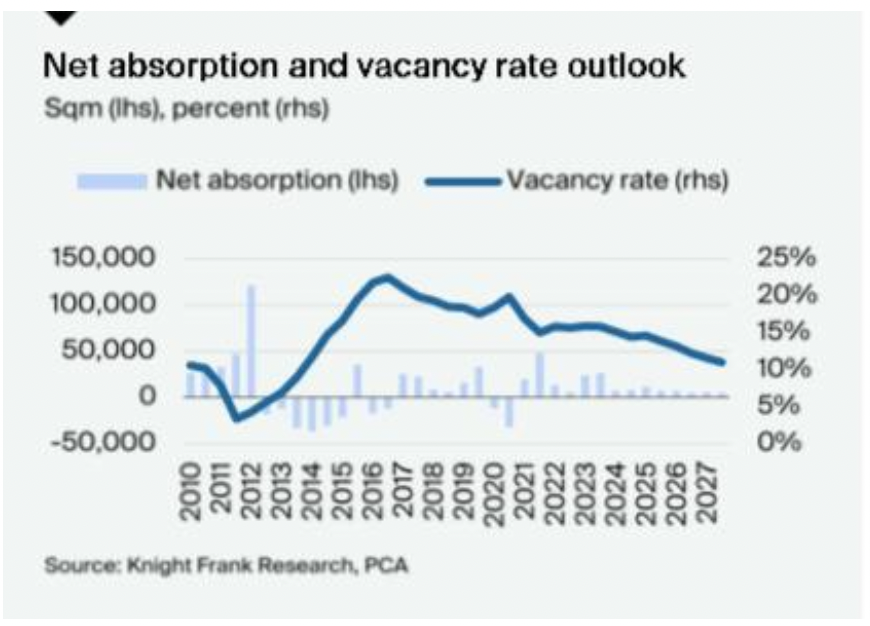

Knight Frank’s research found the overall vacancy rate for the Perth CBD moved out slightly in H1, increasing by 0.2% to stand at 15.9%, due to high supply additions, but premium grade vacancy reduced to 6.3%, second only to Brisbane nationally.

It found that while many markets around Australia are battling higher sublease vacancy rates, led by major tenants seeking to downsize, this is not occurring in Perth, where sublease vacancy has declined again to sit at only 0.5%, reflective of high occupancy rates and the performance of the local economy.

Knight Frank Head of Office Leasing WA Rick McKenzie said tenant demand in Perth’s CBD office market was the strongest for premium assets in line with the national flight to quality.

“While the premium vacancy rate will increase as a consequence of backfill and further completions, demand here remains the strongest of all grades,” he said.

“This is driven by the growing importance placed on quality of accommodation, precinct amenity and ESG from larger occupiers.”

Knight Frank’s Perth CBD Office Market Report found the limited development pipeline and increased number of project requirements in Perth was also expected to aid short-term demand for existing A- grade space.

The completion of Capital Square Tower 3 (13,681sq m) and the 9,529sq m at Westralia Square 2 ends the 2023 pipeline.

There is a further 32,000sq m at 9 The Esplanade due for completion in H1 2025 and further out, site works have commenced at Lot 4 The Esplanade, which is anticipated to deliver 60,000sq m in 2027.

However, there are no completions due in 2024, and it is unlikely there will be substantial supply additions in 2025 or 2026 without a significant pre-commitment due to elevated construction and funding costs impacting project viability.

Dr Theo Connell-Variy said with such limited supply, it is very likely that there will be a reduction in overall vacant space in 2024 through to 2026 and beyond.

“We expect the overall vacancy rate will fall from its current level of 15.9% to around 10% by 2027,” he said.

“Given sustained tenant demand and a modest supply outlook beyond 2023, prime rents are also expected to continue to rise.

“Perth’s history and ongoing demand suggest that it has the potential to outperform other markets.

“The strength of the premium market in particular positions Perth well relative to other cities, with tight supply driving stronger rental growth, and the recent experience of rapid growth in 2019 illustrates the potential to surprise on the upside.

“Moving forward, the market will be aided by the limited supply pipeline to help reduce vacancy rates.”