National Childcare Portfolio for sale poised To Start 2024 With A Bang - CBRE

Contact

National Childcare Portfolio for sale poised To Start 2024 With A Bang - CBRE

CBRE’s Australian Healthcare and Social Infrastructure team have continued where they left off at the conclusion of 2023 with the listing of a national child care portfolio across Western Australia / South Australia and Victoria offered to market by KM Funds Management (Previously Korda Mentha) by Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat on a national platform with CBRE local offices including Harry Einerson and Rhyce Scott in South Australia and Chloe Mason in Western Australia.

CBRE’s Australian Healthcare and Social Infrastructure team have continued where they left off at the conclusion of 2023 with the listing of a national child care portfolio across Western Australia / South Australia and Victoria.

The portfolio which comprises four trophy early learning investments is being offered to market by KM Funds Management (Previously Korda Mentha). The assets which sit within their community and social infrastructure fund are all modern and near new with a portfolio WALE of 17.6* years. The properties will be marketed by Sandro Peluso, Marcello Caspani-Muto and Jimmy Tat on a national platform with CBRE local offices including Harry Einerson and Rhyce Scott in South Australia and Chloe Mason in Western Australia.

Marcello Caspani-Muto said “These really are likely to be the last in a wave of new high quality childcare investment for a period of time. Our team have been touting the rapid decline in new development pipeline across the sector for over a year now. We see this decline in development activity from a leasing perspective and so have a very clear line of site as to what’s coming to market. In most cases, development of new metropolitan centre is not feasible, even with the positive rental growth we have seen across the sector. There really is a notable buyside opportunity as we expect limited supply in the coming 12-24 months to once again compress cap rates across the space and some of the returns being achieved are likely not to be seen again. And this is before we factor in the forecast rate cuts over the coming 12 months.”

Sandro Peluso added “ All centres withing the portfolio were selected with a strategic and research driven process to establish them for long-term success. Demand ratios are strong across the board and strong barriers to entry for competition via either planning or underlying land costs will limit future competing development. The lease terms on offer are also amongst the most favourable in market, with buyers having demonstrated an affinity for Nido Leases centres due to their triple net structure.”

The portfolio which offers a combined net income of $1,535,684 is being offered individually or in one line and will be sold via Expressions of Interest closing on February 15th 2024.

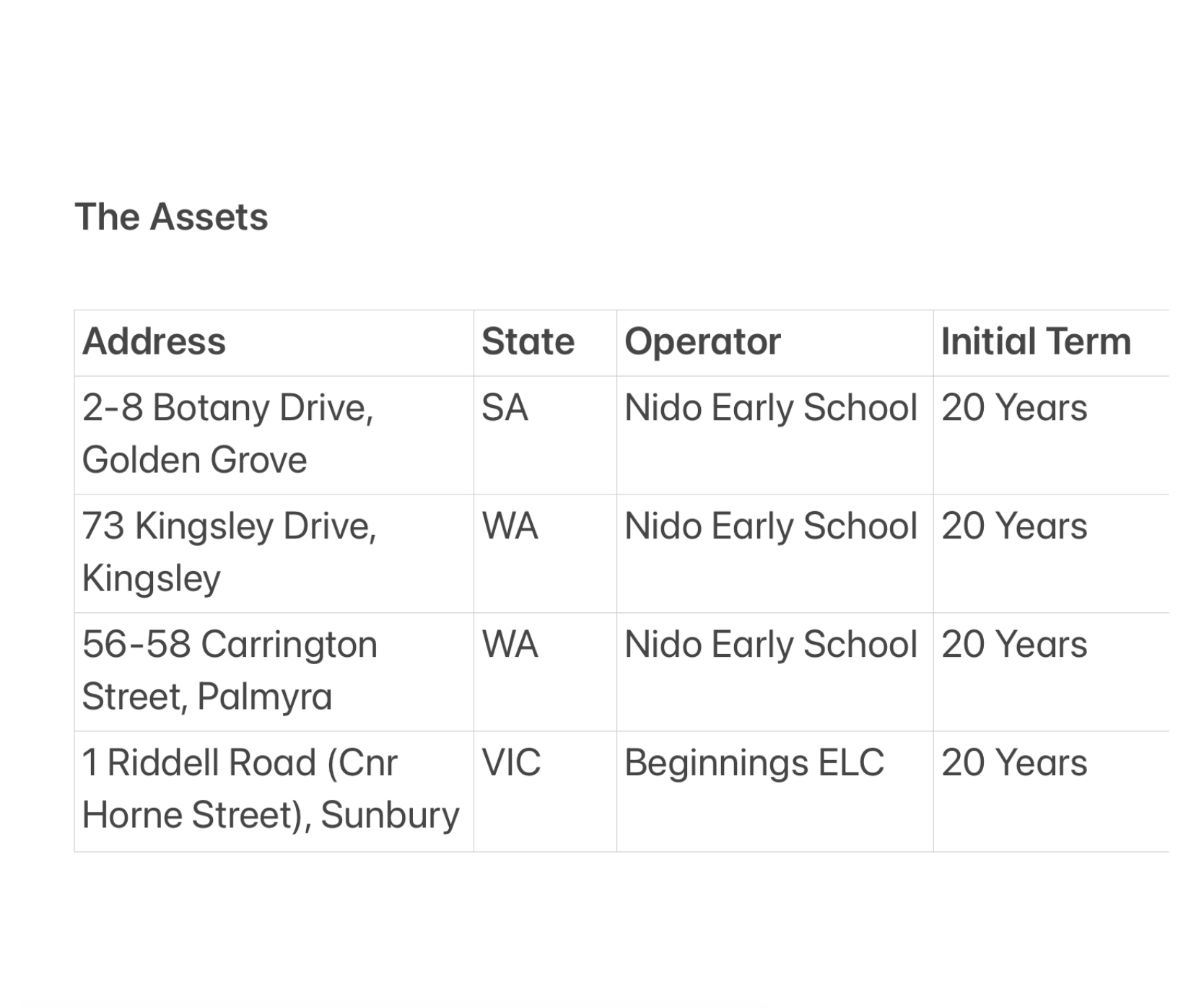

Above table of the assets with the majority of centres leased to the recently ASX Listed Nido Early School on a triple net basis.

Related Reading:

Generational Doncaster Childcare Centre investment for sale in thriving Eastern Melbourne - CBRE

Mildura childcare development leased to Country Bunch Early Learning by CBRE

Vacant aged home care facility sold to offshore investor - CBRE