Brighton Childcare Centre sold by CBRE for $17.5m adds to Australia’s list of largest ever childcare transactions

Contact

Brighton Childcare Centre sold by CBRE for $17.5m adds to Australia’s list of largest ever childcare transactions

Less than 6 months after the largest ever childcare investment sale in Victorian history another trophy early learning investment sold in the Victorian suburb of Brighton by CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Jimmy Tat and Marcello Caspani-Muto.

Less than 6 months after the largest ever childcare investment sale in Victorian history another trophy early learning investment has changed hands in the Victorian suburb of Brighton.

Adding to Australia’s ever-growing list of centre sales exceeding $10,000,000 (The full list of Australia’s Top 25 childcare centre sales at the bottom of this article)

The subject property (image above) at 46 Dendy Street, Brighton has sold for $17,500,000 reflecting a yield of 5.19%.

The transaction was handled by CBRE’s Australian Healthcare and Social Infrastructure team of Sandro Peluso, Jimmy Tat and Marcello Caspani-Muto.

The subject property located at 46 Dendy Street, Brighton sits within one of the areas most esteemed residential streets and is fully leased to ASX listed G8 Education, trading under their flagship banner The Learning Sanctuary. The centre which was developed in 2019 features a net operating income of $910,047pa. and was licensed for 171 places (one of the largest centres in Victoria).

The property was sold via an international expressions of interest campaign which saw interest generated from multiple high net worth private investors, both domestic and international.

Jimmy Tat said “We had notable interest from both private and institutional level investors. The reality is private capital is leading the way by notable margins in most of our transactions between $15,000,000-$50,000,000. This is across both domestic and international capital. There was notable international investment interest in the property with most capital coming from either Singapore or Taiwan. Both underbidders were international groups however in this instance the eventual buyer was a local investor.”

Sandro Peluso added “When selling both childcare and healthcare investments at these price points the focus of both our team and broader investment market is moving away from returns and is more focused on replacement cost. This is no revelation, however astute investors are well aware the buyside opportunity being witnessed will end in short order and may not be seen again for a long period of time. Yields will again sharpen as supply reduces which will be further catalysed by the eventual shift in the rate environment when this occurs. The simple fact is the cost of buying and developing a new centre all inclusive if often resulting in the same or an inferior yield to what can be achieved buying a passing and land rich investment like the subject property today.”

The full list of Australia’s Top 25 childcare centre sales below, please note CBRE sales denoted in Green. (Source CBRE)

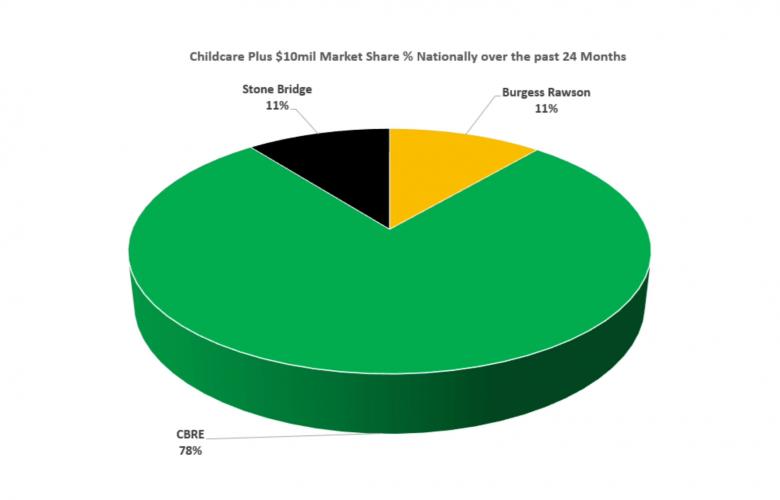

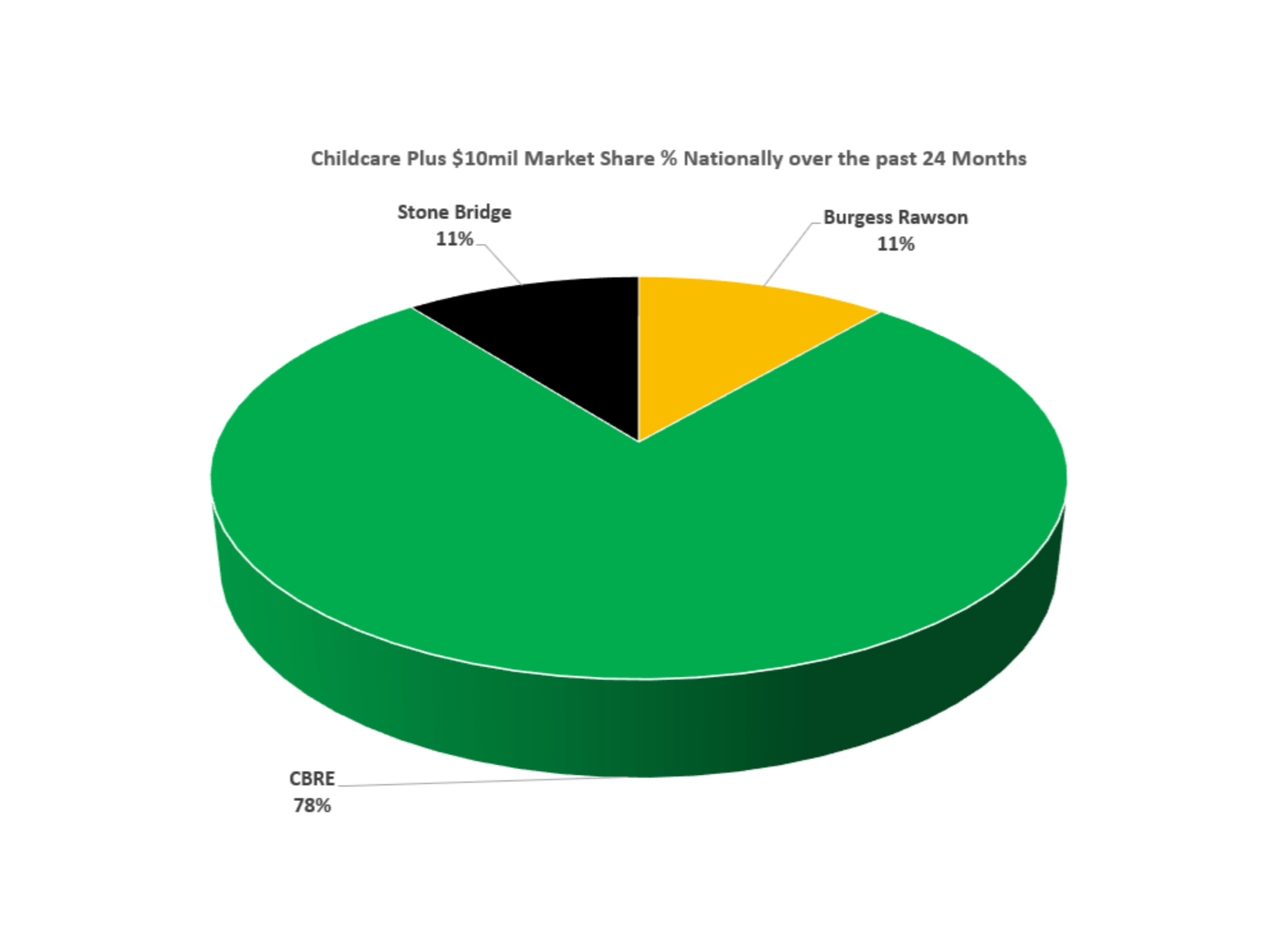

The Brighton Childcare Centre transaction continues CBRE’s run of dominance in the childcare sales industry with the team having now transacted the lions share of childcare assets exceeding $10,000,000 since February 2022.

(Below) CBRE hold a market share of 78% during the aforementioned category (Source CBRE)

(Below) CBRE Market Share - February 2022-February 2024 ($10,000,000+ Centres) (Source CBRE)

Related Reading:

CBRE launch rooftop Inner West Melbourne child care space for lease Moonee Ponds CBD | Commo.

CBRE lease city rooftop childcare centre along the famed St Kilda Road corridor | Commo.

Generational Brighton Childcare Centre Continues Run Of Trophy Childcare Sales For CBRE | Commo.

National Childcare Portfolio Poised To Start 2024 With A Bang

Generational Doncaster Childcare Centre investment for sale in thriving Eastern Melbourne - CBRE

Mildura childcare development leased to Country Bunch Early Learning by CBRE

NSW medical centre marks the first healthcare transaction of 2024 - CBRE | Commo.

Brighton Childcare Centre sold by CBRE for $17.5m adds to Australia’s list of largest ever childcare transactions